Marché du traitement de l’eau commerciale Analyse de la taille, de la part et de l’impact du COVID-19, par type (traitement biologique, traitement mécanique), par utilisateur final (bâtiments résidentiels, bâtiments commerciaux, produits chimiques et pétrochimiques, pétrole et gaz, mines et métaux, aliments et boissons, produits pharmaceutiques), et par région (Amérique du Nord, Europe, Asie-Pacifique, Amérique latine, Moyen-Orient et Afrique), analyse et prévisions 2023-2033

Industrie: Energy & PowerMarché mondial du traitement de l’eau commerciale Size is Expected to Hold a Significant Share by 2033

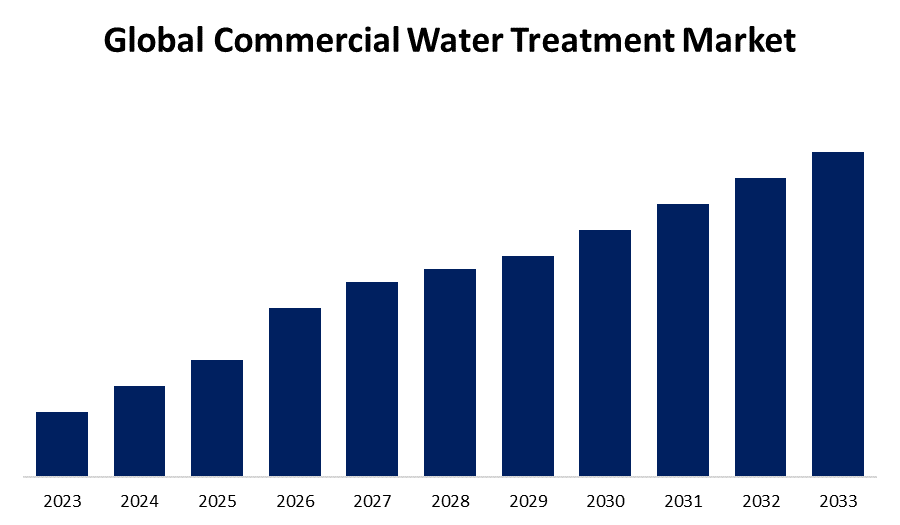

According to a research report published by Spherical Insights & Consulting, the Marché mondial du traitement de l’eau commerciale Size is to hold a substantial share by 2033, at a Compound Annual Growth Rate (CAGR) of 4.8% during the projected period.

Obtenez plus de détails sur ce rapport -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the Marché mondial du traitement de l’eau commerciale Size, Share, and COVID-19 Impact Analysis, By Type (Biological Treatment, Mechanical Treatment), By End User (Residential Buildings, Commercial Buildings, Chemical & Petrochemicals, Oil & Gas, Mining & Metals, Food & Beverage, Pharmaceuticals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Water treatment is a process that improves the quality of water so that it can be used for a specific purpose. The final application may include irrigation, river maintenance, drinking water, industrial water supply, recreational water, and a variety of other uses. Human health is dependent on this treatment, which allows people to reap the benefits of irrigation and drinking water. Recent research has emphasized the importance of sustainable and safe drinking water not only for daily operations but also as a preventative measure against several health issues such as cardiovascular health, cancer, and impacts on children's health. Furthermore, governments are enforcing stricter regulations to combat water pollution, boosting the commercial water treatment market. To comply with these regulations, which restrict pollutant discharge, industries must invest in cutting-edge wastewater treatment technologies. However, to reduce the use of chemicals in commercial water treatment, several nanotechnology-based technologies are available on the market. As a consequence, the commercial water treatment market's growth is hampered by these alternative technologies.

Marché du traitement de l’eau commerciale Couverture du rapport

| Couverture du rapport | Details |

|---|---|

| Année de base: | 2023 |

| Période de prévision: | 2023-2033 |

| TCAC de la période de prévision 2023-2033 : | 4,8 % |

| Données historiques pour: | 2019-2022 |

| Nombre de pages: | 200 |

| Tableaux, graphiques et figures: | 110 |

| Segments couverts: | Par type, par utilisateur final, par région et analyse d’impact du COVID-19. |

| Entreprises couvertes :: | DuPont Water Solutions, 3M, SUEZ - Water Technologies & Solutions, Veolia Water Technologies, Xylem Inc., United Utilities Group PLC, Evoqua Water Technologies, American Water, Aquatech International, Severn Trent Water, Kingspan Group, Ecolab et Organo (Asie) Sdn Bhd. et autres fournisseurs clés. |

| Pièges et défis: | Le COVID-19 a le potentiel d’avoir un impact sur le marché mondial |

Obtenez plus de détails sur ce rapport -

The biological treatment segment is expected to grow at the fastest pace in the Marché mondial du traitement de l’eau commerciale during the forecast period.

Based on the type, the commercial water treatment market has been segmented into biological treatment and mechanical treatment. Among these, the biological treatment segment is expected to grow at the fastest pace in the Marché mondial du traitement de l’eau commerciale during the forecast period. A biological water treatment system purifies water primarily using bacteria, protozoa, and possibly other specialized microbes. The organic matter settles out of the solution as a result of the flocculation effect caused by microorganisms adhering to one another while breaking down organic pollutants for food.

The commercial buildings segment is expected to grow at the largest pace in the Marché mondial du traitement de l’eau commerciale during the anticipated period.

Based on the end user, the Marché mondial du traitement de l’eau commerciale is divided into residential buildings, commercial buildings, chemical & petrochemicals, oil & gas, mining & metals, food & beverage, and pharmaceuticals. Among these, commercial buildings are expected to grow at the largest pace in the Marché mondial du traitement de l’eau commerciale during the forecast period. Bathing, toilet flushing, laundry, dishwashing, and other daily activities all produce wastewater. It is derived from domestic and residential sources.

North America dominates the market with the largest market share over the forecast period.

Obtenez plus de détails sur ce rapport -

North America is projected to hold the largest share of the Marché mondial du traitement de l’eau commerciale over the forecast period. The commercial water treatment market is growing slower than expected due to industries' reluctance to invest in water treatment plants, in addition to a lack of environmental awareness and apathy. The demand for sophisticated water treatment equipment and technologies raises costs.

Asia-Pacific is expected to grow the fastest in the Marché mondial du traitement de l’eau commerciale during the anticipated forecast period. Thailand, Vietnam, the Philippines, and Indonesia are at the forefront of water PPP development due to government legislative support for private sector engagement in wastewater management and urban infrastructure.

Major vendors in the Marché mondial du traitement de l’eau commerciale are DuPont Water Solutions, 3M, SUEZ - Water Technologies & Solutions, Veolia Water Technologies, Xylem Inc., United Utilities Group PLC, Evoqua Water Technologies, American Water, Aquatech International, Severn Trent Water, Kingspan Group, Ecolab, Organo (Asia) Sdn Bhd. & Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Recent Development

- In January 2022, Kurita Water Industries Ltd., a Tokyo-based leading manufacturer and provider of products and services in water treatment chemicals and water treatment facilities, announced that their KR-FM resin has recently been adopted in North America as part of their efforts to assist customers in improving production efficiency and product quality to advance industrial manufacturing technologies. The KR-FM resin is a functional material designed to produce high-purity ultrapure water while also improving yield in cutting-edge semiconductor manufacturing.

Market Segment

This study forecasts revenue at global commercial water treatment, regional, and country levels from 2023 to 2032. Spherical Insights has segmented the Marché mondial du traitement de l’eau commerciale based on the below-mentioned segments:

Marché mondial du traitement de l’eau commerciale, Type Analysis

- Biological Treatment

- Mechanical Treatment

Marché mondial du traitement de l’eau commerciale, End User Analysis

- Residential Buildings

- Commercial Buildings

- Chemical & Petrochemicals

- Oil & Gas

- Mining & Metals

- Food & Beverage

- Pharmaceuticals

Marché mondial du traitement de l’eau commerciale, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Besoin d'aide pour acheter ce rapport ?