Tamaño, participación y tendencias del mercado mundial de seguros de cultivos, informe de análisis del impacto de COVID-19, por tipo (seguro de cultivos contra riesgos múltiples, historial de producción real y cobertura de ingresos por cultivos), por cobertura (calamidades localizadas, riesgo de siembra/plantación/germinación, pérdida de cultivos en pie y pérdidas poscosecha) y por región (Norteamérica, Europa, Asia-Pacífico, América Latina, Oriente Medio y África), análisis y pronóstico 2021 - 2030

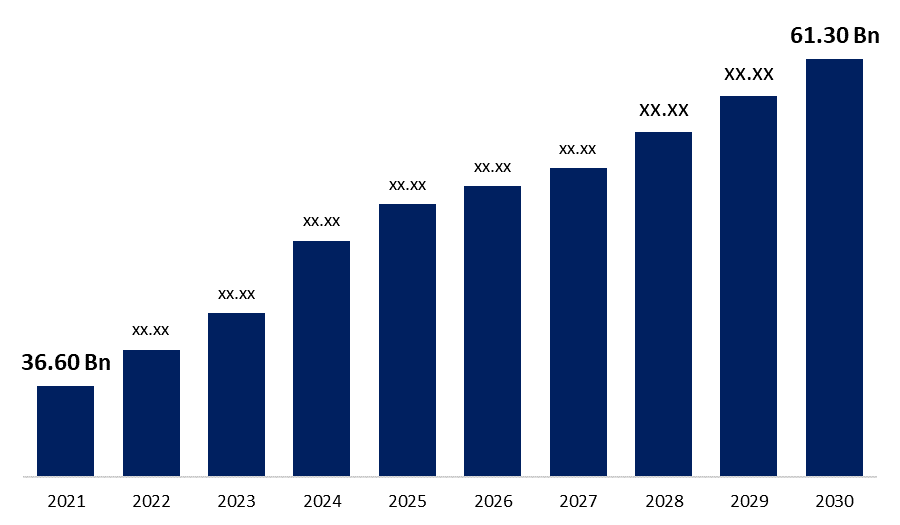

Industria: Banking & FinancialMercado mundial de seguros de cosechas Size To Exceed USD 61.30 Billion by 2030

According to a research report published by Spherical Insights & Consulting, the Mercado mundial de seguros de cosechas Size is to grow from USD 36.7 Billion in 2021 to USD 61.30 Billion by 2030, at a Compound Annual Growth Rate (CAGR) of 5.90% during the projected period.

Obtener más detalles sobre este informe -

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Mercado mundial de seguros de cosechas Size, Share & Trends, COVID-19 Impact Analysis Report, By Type (Multiple Peril Crop Insurance, Actual Production History, and Crop Revenue Coverage), By Coverage (Localized Calamities, Sowing/Planting/Germination Risk, Standing Crop Loss, and Post-harvest Losses), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030.

The crop insurance is also called agriculture insurance, it is a risk management tool for farmers and industrialized economics, the policy paths towards the sustainability is different from the many countries. Private companies that are providing insurance work with tandem with government- run insurance corporation. Farming is a risky business because there are unpredictable and severe weather to the mix make things even more challenging. The farmers are aware that a major hailstorm, fire or unforeseen calamity of the crop. Furthermore, the climate index insurance is also called as parametric, weather index or index- based insurance they pay the policyholders. The climate index insurance has a lower rate than the other insurance. Its potential benefits, considerable basis risk, and lack of technical ability, expertise and prevent climate index insurance products which are the gaining attentions from the industry, policymakers and scientists. In addition, the developing nations governments supporting the commercial crop insurance market are widely adopted in the global market. However, the insurance for a crop is scarce since the lack of understanding and lack of knowledge as well as cost of the product, and the there are premiums plans also available for the payment claims for the profitable opportunities such factors are expanding the market growth in the forecast period.

Mercado mundial de seguros de cosechas Cobertura del informe

| Cobertura del informe | Details |

|---|---|

| Año base: | 2021 |

| Tamaño del mercado en 2021: | 36,7 millones de dólares |

| Período de pronóstico: | 2021-2030 |

| CAGR del período de pronóstico 2021-2030 : | 5.90 %. |

| Datos históricos de: | 2017-2020 |

| Nº de páginas: | 230 |

| Tablas, gráficos y figuras: | 110 |

| Segmentos cubiertos: | Por tipo, por cobertura, por región, COVID-19 Análisis de impacto |

| Empresas cubiertas:: | Agricultural Insurance Company of India Limited (AIC), American Financial Group, Inc, Chubb, Fairfax Financial Holdings Limited, ICICI Lombard General Insurance Company Limited, PICC, QBE Insurance Group Limited, Sompo International Holdings Ltd, Tokio Marine HCC, Zurich |

| Impulsores de crecimiento: | 1) Aumento de los subsidios gubernamentales para el seguro climático agrícola 2) Falta de conciencia en el crecimiento de los mercados de los países en desarrollo |

| Errores y desafíos: | COVID-19 tiene el potencial de afectar al mercado mundial |

Obtener más detalles sobre este informe -

The multiple peril crop insurance segment dominates the market with the largest revenue share over the forecast period.

Based on the type, the Mercado mundial de seguros de cosechas is segmented into multiple peril crop insurance, actual production history, and crop revenue coverage. Among these, the multiple peril crop insurance segment is dominating the market with the largest revenue share over the forecast period. Multi-peril crop insurance dominates the market because it protects against a wide range of perils such as adverse weather, pests, diseases, and other unanticipated events. Farmers looking for a comprehensive risk management solution will also find resonance with this extensive coverage.

The standing crop loss segment is witnessing significant CAGR growth through the forecast period

On the basis of coverage, the Mercado mundial de seguros de cosechas is segmented into localized calamities, sowing/planting/germination risk, standing crop loss, and post-harvest losses. Among these, the standing crop loss segment is witnessing significant CAGR growth over the forecast period. In order to mitigate the effects of wind erosion and blowing dust from agricultural lands, land managers must establish the protection of the soil surface provided by standing crop residue.

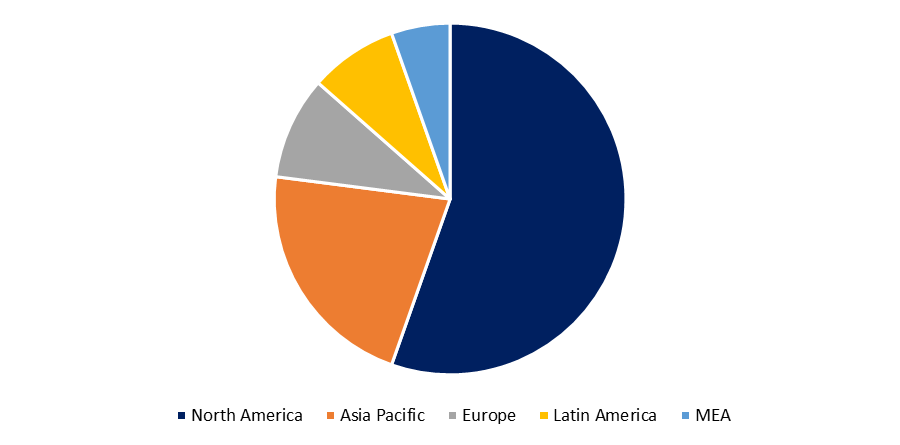

North America dominates the market with the largest market share over the forecast period.

Obtener más detalles sobre este informe -

North America dominates the market with the largest market share over the forecast period. The cropped land has increased in North America. The farmers and ranchers in the United States are developing the maintain the profitable crop production. The governments are focusing the educating the agriculture producers to ensure the safety of crop for consumption in North America.

Asia Pacific is expected to grow the fastest during the forecast period. Our analysis indicates that during the forecast period, the region will contribute 35% of the growth in the global market. China and India hold a dominant position in the APAC crop insurance market. Large areas of agricultural land and ideal weather conditions will fuel the growth of the crop insurance market in Asia Pacific over the forecast period.

Major vendors in the Mercado mundial de seguros de cosechas are Agriculture Insurance Company of India Limited (AIC), American Financial Group, Inc., Chubb, Fairfax Financial Holdings Limited, ICICI Lombard General Insurance Company Limited, PICC, QBE Insurance Group Limited, Sompo International Holdings Ltd., Tokio Marine HCC, Zurich, and Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2020, DCIS Diversified Crop Insurance Services, a division of CGB Enterprises, Inc. (CGB), has been acquired by Sompo International Holdings Ltd. (SIH), a Bermuda-based specialty provider of property and casualty insurance and reinsurance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2030. Spherical Insights has segmented the Mercado mundial de seguros de cosechas based on the below-mentioned segments:

Mercado mundial de seguros de cosechas, By Type

- Multiple Peril Crop Insurance

- Actual Production History

- Crop Revenue Coverage

Mercado mundial de seguros de cosechas, By Coverage

- Localized Calamities

- Sowing/Planting/Germination Risk

- Standing Crop Loss

- Post-harvest Losses

Mercado mundial de seguros de cosechas, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

¿Necesita ayuda para comprar este informe?