World's Top 50 Companies in Satellite Communication (SATCOM) Equipment Market in 2025 Watch List: Statistics Report (2024-2035)

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

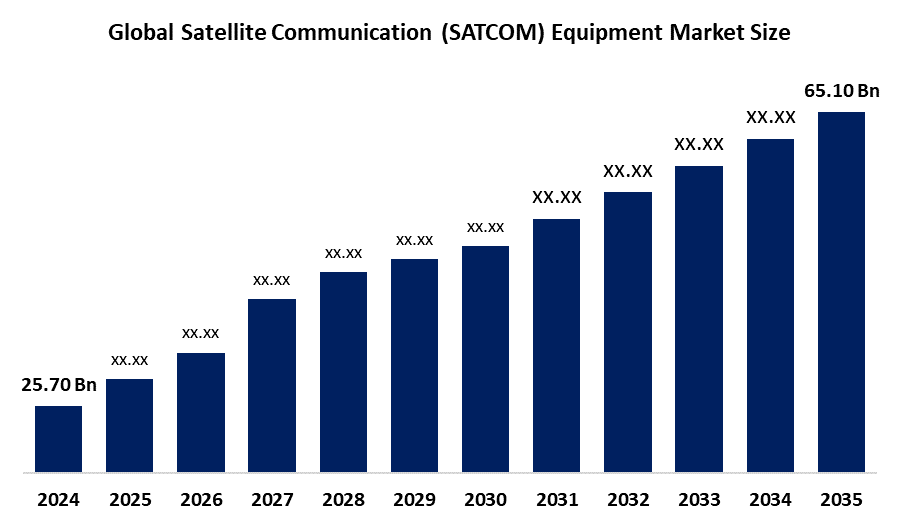

According to a research report published by Spherical Insights & Consulting, The Global Satellite Communication (SATCOM) Equipment Market Size is projected to grow from USD 25.70 Billion in 2024 to USD 65.10 Billion by 2035, at a CAGR of 9.74 % during the forecast period 2025–2035. Rising demand for global connectivity, defense modernization, remote sensing, and IoT integration are fueling SATCOM equipment advancements, creating opportunities in LEO satellites, mobile backhaul, 5G networks, and space-based internet services.

Introduction

Satellite Communication (SATCOM) equipment refers to the hardware used to establish, maintain, and enhance communication links via satellites orbiting the Earth. This includes transceivers, antennas, modems, amplifiers, and mobile terminals that support voice, data, and video transmission across vast distances, particularly in remote or underserved regions. The market is witnessing significant growth due to increasing demand for global broadband connectivity, defense and homeland security modernization, and the expansion of space-based communication networks. Key drivers include the proliferation of Low-Earth orbit (LEO) satellites, growing need for reliable communication in disaster recovery and maritime operations, and rising investments in 5G backhaul infrastructure.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Satellite Communication (SATCOM) Equipment market.

Satellite Communication (SATCOM) Equipment Market Size & Statistics

- The Market Size for Satellite Communication (SATCOM) Equipment Was Estimated To be Worth USD 25.70 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 9.74 % Between 2025 and 2035.

- The Global Satellite Communication (SATCOM) Equipment Market Size is Anticipated to Reach USD 65.10 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Satellite Communication (SATCOM) Equipment Market.

- Asia Pacific is expected to grow the fastest during the forecast period in the Satellite Communication (SATCOM) Equipment Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the Satellite Communication (SATCOM) Equipment market. The increasing need for launch and early orbit assistance, TT&C services, as well as data handling and processing services is a major factor propelling the Asia Pacific market. Throughout the forecast period, the Asia Pacific SATCOM equipment market is anticipated to expand as a result of rising demand for telecommunications and mobile broadband services.

North America is expected to generate the highest demand during the forecast period in the Satellite Communication (SATCOM) Equipment market. The rise in satellite launches for 5G is linked to the expansion of the SATCOM equipment sector in the United States. In Canada, boosting the proportion of small satellite launches for research and development purposes is anticipated to stimulate the market. North American governments are making significant investments in satellite communication infrastructure to close the digital gap and ensure dependable communication services in isolated regions.

Top 5 Satellite Communication Startups Impacting The Telecom Sector

1. Myriota – Satellite Connectivity

As the Internet of Things (IoT) and related technologies grow, startups are working on solutions that connect multiple devices in a single system. However, terrestrial connectivity solutions are limited in their range and are often inefficient for remote infrastructure. Satellite connectivity enables truly global coverage and expands the applications of IoT and machine-to-machine (M2M) in asset management. Myriota is an Australian startup that offers low-cost, low-power global connectivity for applications based on IoT. The startup’s ground modules transfer data directly to the cloud using a constellation of nanosatellites. Myriota also enables encrypted and secure access to data from anywhere in the world in a scalable manner.

2. Skyloom – Optical Communications

Satellites generally use radio frequencies (RF) to transmit data to the ground stations. However, their data-carrying capacity is quite restricted, allowing connectivity only at sparse times. To this end, developments in optical technologies enable high capacity and immediate data transfer. This opens up real-time and global applications powered by satellite communications. The US-based startup Skyloom develops a spaceborne network for optical communications. The startup’s low earth orbit (LEO) satellites and proprietary fiberless architecture enable fast and high capacity data plans. Further, the solution features immediacy and flexibility to help telecommunication companies offer real-time and location-agnostic solutions.

3. Hiber – Low Power Global Area Network

The growth of IoT technologies is marked by falling hardware and computing costs, as well as the development of longer-lasting batteries. However, the lack of global connectivity solutions remains a bottleneck for IoT-based applications. Telecom and space technology startups are working on solutions that empower low power and global connectivity to bridge this gap. Hiber is a Dutch startup that offers a global IoT network. Hiberband, a low power global area network that uses nanosatellites at a low orbit. Since this is a low power solution, companies are able to reduce costs compared to existing satellite connectivity options. The startup’s solution is also direct-to-satellite, eliminating the need for terrestrial networks. Hiber’s solution is available in two versions, Hiberband Direct and Hiberband Via, for scattered devices and high-density setups that require real-time monitoring, respectively.

4. Freefall Aerospace – Inflatable Antenna

Space antennas direct data to the right ground station or device on the ground. However, they are usually large and expensive to put into an orbit. Low mass and low power alternatives generally also have low data rates. Inflatable reflectors offer high data rates without the mass and complexity of traditional solutions, enabling modern applications such as fifth-generation (5G) wireless. The US-based startup Freefall Aerospace develops antenna technology for use in ground, air, and space. The startup’s inflatable antenna for spacecraft systems is ultra-low mass and volume. The antennas have spherical reflectors and large apertures for wide fields of view and high gain. The solution uses electronic beam steering to transmit big data from CubeSats and small spacecraft.

5. Clutch Space Systems – Ground Segment

Satellite communication infrastructure, including both ground stations and satellites in orbit, require massive upfront investment. Startups are working on solutions that reduce the infrastructure cost to promote growth in satellite-based applications, particularly satellite communication. Software-defined ground segments help achieve this by moving some functions of hardware elements to the software. Clutch Space Systems is a British startup that provides solutions for payload communications. CLUTCH-AnyBAND uses systems engineering techniques to serve S- and S-/X- bands. The solution provides high-performance communications for ground station network providers and satellite operators. It reduces the cost and complexity of satellite communications by lowering hardware costs and increasing the loading on current infrastructure.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Satellite Communication (SATCOM) Equipment market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 10 Companies Leading the Satellite Communication (SATCOM) Equipment Market

- EchoStar Corporation

- L3Harris Technologies

- Thales Group

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Honeywell International Inc.

- Cobham Satcom

- Viasat, Inc.

- Maxar Technologies

- Antwerp Space

- Oxford Space Systems

- Airbus SE

- Others

1. EchoStar Corporation

Headquartered in Englewood, Colorado, USA

EchoStar Corporation is a global leader in satellite communication solutions. It specializes in satellite operations, digital broadcasting, and internet services through its Hughes Network Systems subsidiary. The company provides advanced SATCOM equipment and network technologies for enterprise, government, and consumer markets. EchoStar’s focus on innovation in satellite broadband and space-based communications positions it strongly in the evolving SATCOM landscape. The company continues to invest in high-throughput satellites (HTS) and LEO constellations to expand connectivity worldwide, particularly in underserved regions, supporting applications in mobility, IoT, and remote enterprise communications.

2. L3Harris Technologies

Headquartered in Melbourne, Florida, USA

L3Harris Technologies is a global aerospace and defense technology company offering SATCOM systems that support secure communications for government and military clients. The company develops rugged and mission-critical SATCOM terminals, antennas, modems, and network systems. L3Harris is known for its innovation in tactical satellite communications and resilient network infrastructure, enabling rapid, secure data exchange in battlefield and emergency scenarios. Its SATCOM technologies are essential in space situational awareness, ISR (intelligence, surveillance, reconnaissance), and mobile connectivity. The company continues to enhance its SATCOM capabilities through R&D in protected waveforms, small form-factor terminals, and AI integration.

3. Thales Group

Headquartered in Paris, France

Thales Group, is a multinational technology company specializing in aerospace, defense, and digital identity. In the SATCOM sector, Thales designs and delivers high-performance terminals, modems, and satellite communication systems tailored for military, maritime, and aviation use. The company is known for its SATCOM-On-The-Move (SOTM) solutions and in-flight connectivity systems. Thales integrates cyber-secure communication frameworks and next-gen encryption protocols into its SATCOM offerings. Its commitment to seamless interoperability and network agility makes it a trusted partner for NATO and allied defense forces. Thales continues to drive innovation in Ka-band and HTS-compatible equipment and LEO satellite solutions.

4. Raytheon Technologies Corporation

Headquartered in Arlington, Virginia, USA

Raytheon Technologies Corporation is a key player in aerospace and defense, providing advanced SATCOM systems for secure, high-capacity communications. Through its Collins Aerospace and Raytheon divisions, the company offers terminals, modems, antennas, and integrated communication systems designed for military and government applications. Raytheon’s solutions emphasize secure, resilient communications in contested environments, with technologies supporting anti-jam capabilities and multi-band connectivity. The company actively supports programs like AEHF (Advanced Extremely High Frequency) and WGS (Wideband Global SATCOM). Raytheon’s expertise in defense-grade SATCOM infrastructure and its continued investments in space assets bolster its global presence.

5. General Dynamics Corporation

Headquartered in Reston, Virginia, USA

General Dynamics, is a major defense contractor and technology integrator with a strong portfolio in SATCOM systems. The company, through its General Dynamics Mission Systems division, delivers advanced satellite communication terminals, gateway solutions, and secure modems for military, government, and commercial applications. It is recognized for providing end-to-end SATCOM integration including fixed, transportable, and mobile platforms. General Dynamics focuses on delivering assured communications in denied or degraded environments, with a reputation for reliable, encrypted communications across various satellite constellations. Its innovations in SATCOM resilience, automation, and cloud-enabled platforms support future-forward global connectivity missions.

Are you ready to discover more about the Satellite Communication (SATCOM) Equipment market?

The report provides an in-depth analysis of the leading companies operating in the global Satellite Communication (SATCOM) Equipment market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- EchoStar Corporation.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- L3Harris Technologies

- Thales Group

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Honeywell International Inc.

- Cobham Satcom

- Viasat, Inc.

- Maxar Technologies

- Antwerp Space

- Oxford Space Systems

- Airbus SE

- Others

Conclusion

The Satellite Communication (SATCOM) Equipment market is witnessing significant transformation driven by growing global connectivity needs, defense modernization, and the rapid expansion of IoT and smart technologies. Technological advancements such as low-earth orbit satellite deployment, high-throughput satellite systems, and enhanced ground station infrastructure are accelerating market adoption across both commercial and military domains. With increasing investments in aerospace, maritime, aviation, and remote sensing applications, the SATCOM equipment landscape is poised for long-term growth. Strategic government initiatives, expanding telecom networks, and rising demand for uninterrupted, secure communication services are expected to solidify SATCOM’s role as a cornerstone of future global communications.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?