World's Top 15 Companies in Regtech In 2025 Watch List; Statistics Report (2024–2035)

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

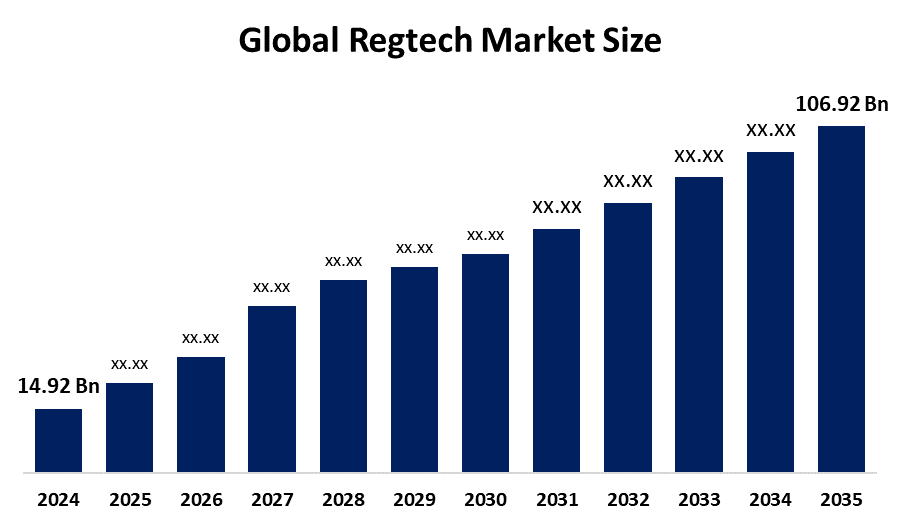

According to a research report published by Spherical Insights & Consulting, The Global Regtech Market Size is projected to grow from USD 14.94 Billion in 2024 to USD 106.92 Billion by 2035, at a CAGR of 19.59% during the forecast period 2025–2035. The increasing regulatory complexity, the need for advanced fraud detection and prevention, and the growing adoption of cloud-based solutions. Technological advancements, particularly in AI, big data, and blockchain.

Introduction

The worldwide Regulatory Technology (RegTech) sector has developed as a crucial part of financial as well as compliance digitalization. RegTech is the application of technology, in the form of artificial intelligence (AI), machine learning (ML), big data, and cloud computing, toward speeding up regulatory processes and automation enhancement. They consist of compliance monitoring, risk management, anti-money laundering (AML), fraud detection, know-your-customer (KYC) verification, and regulatory reporting.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Regtech Market.

Regtech Market Size & Statistics

The Market for Regtech was estimated to be worth USD 14.92 Billion in 2024.

The Market is going to expand at a CAGR of 19.59% between 2025 and 2035.

The Global Regtech Market Size is anticipated to reach USD 106.92 Billion by 2035.

North America is expected to generate the highest demand during the forecast period in the regtech Market.

Asia Pacific is expected to grow the fastest during the forecast period in the regtech Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the regtech market. The fast-paced Growth is fueled by nascent digitalization, regulatory reinforcement, and enhanced government initiatives in Singapore, India, China, Japan, and Australia. The sound fintech culture in the region, along with requirements to avert financial crimes and international compliance standards, is expediting the use of RegTech solutions. Regulatory sandboxes, electronic KYC norms, and enhanced cross-border digital payments are compelling financial institutions to invest in real-time risk surveillance and data analysis.

North America is expected to generate the highest demand during the forecast period in the regtech market. Regional leadership comes as a result of the existence of a tightly regulated banking system with intricate systems like the Dodd-Frank Act, the Sarbanes-Oxley Act, and the Bank Secrecy Act. Regulators like the SEC, FINRA, and the CFPB consistently increase compliance levels, which cause banks and fintech companies to invest in sophisticated RegTech solutions. The initial adoption of cloud-based software, artificial intelligence-driven compliance automation, and real-time monitoring solutions has continued to spur market growth. Further, North America has a number of the globe's leading RegTech innovators and service providers, further reinforcing the region's dominance via a mature and competitive ecosystem.

Top 10 Regtech Trends

- AI and Machine Learning for Predictive Compliance

- Real-Time Regulatory Reporting

- Rise of Cloud-Based Compliance Platforms

- KYC and Identity Verification Automation

- Growth in Anti-Money Laundering (AML) Solutions

- Blockchain Integration in RegTech

- Expansion of Regulatory Sandboxes

- RegTech-as-a-Service (RaaS) Models

- Integration of RegTech in Cryptocurrency Compliance

- Increasing Adoption Across Non-Financial Sectors

1. AI and Machine Learning for Predictive Compliance

Machine learning (ML) and artificial intelligence (AI) are revolutionizing the monitoring, reaction, and analysis of regulatory information. AI and ML can identify anomalies, foretell non-compliance incidents, and respond to emerging regulations. Banks are increasingly employing AI-driven models to forecast risk exposure prior to it happening, computerize audits, and eliminate manual surveillance. Transitioning from reactive to predictive compliance is enabling organizations to better deal with regulatory pressure.

2. Real-Time Regulatory Reporting

Legacy batch-based regulatory reporting is being substituted with real-time regulatory reporting solutions. Firms can report to regulators automatically with structured formats and timely data using these solutions. This becomes increasingly important in high-frequency trading, insurance, and digital banking, where delays or mistakes can result in humongous fines. Real-time systems enable timely compliance, increased transparency in data, and levels of regulator confidence.

3. Rise of Cloud-Based Compliance Platforms

Cloud computing is the foundation of the majority of contemporary RegTech implementations. Cloud-based compliance platforms offer scalability, cost-effectiveness, and quicker deployment compared to on-prem systems. They also offer effortless software upgrades and integrate very well with other business applications, including CRMs and ERPs. With more remote work and digitalization, cloud-first RegTech solutions are increasingly at the forefront in all firm sizes.

4. KYC and Identity Verification Automation

Know-Your-Customer (KYC) compliance is significant to banks, and automated identity verification software is gaining traction. The software employs facial recognition, biometrics, document verification, and AI-driven screening to authenticate customers rapidly and securely. Automated KYC solution reduces onboarding time, enhances user experience, and minimizes the risk of onboarding rogue clients while keeping pace with global compliance standards.

5. Growth in Anti-Money Laundering (AML) Solutions

AML solutions are one of the biggest RegTech segments. Global regulatory attention on money laundering has been increasing, driving demand for smart transactional monitoring, suspicious activity reporting, and composite risk scoring. Existing AML platforms leverage AI to identify anomalous patterns, conduct more robust due diligence, and provide audit-ready logs, enabling institutions to escape costly fines.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the regtech market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 10 Companies Leading the Regtech Market

- 3M

- PwC

- NICE Actimize

- Accuity

- IBM

- ACTICO GmbH

- BWise

- London Stock Exchange Group plc.

- Deloitte

- Broadridge Financial Solutions Inc.

- Others

1. 3M

Headquarters – USA

3M, although primarily associated with manufacturing and industrial solutions, has a solid footing in the healthcare and data protection sectors. Through patient safety and compliance technologies, the company operates in the RegTech segment by enabling healthcare organizations to remain compliant with changing data privacy and regulations. Its technologies automate compliance reports, risk analysis, and identity safeguard within safe environments.

2. PwC

Headquarters – United Kingdom

PwC is a worldwide leader in professional and consulting services and has a comprehensive line of RegTech solutions for banks, insurers, and fintech entities. PwC's product lines vary from regulatory transformation management to digital transformation of compliance, AML automation, and KYC solutions. PwC also works with start-ups as well as technology companies to deliver bespoke RegTech frameworks for real-time compliance with regulations.

3. NICE Actimize

Headquarters – Israel

NICE Actimize is a leader in the RegTech sector, skilled in risk management, financial crime prevention, and compliance analytics. Its offerings include real-time AML detection, fraud prevention, market surveillance, and conduct risk management. NICE Actimize is utilized by global financial institutions to maintain ongoing compliance with changing regulatory needs and maximize the efficiency of investigations.

4. Accuity

Headquarters – United States

Accuity is a LexisNexi Risk Solutions subsidiary which provides global payment screening, anti-money laundering, and financial crime compliance solutions. Accuity equips banks and corporates with solutions for authenticating transactions, customer risk management, and compliance with global sanctions and AML rules. Its data-intensive platform is regularly employed to fight financial crime and facilitate secure cross-border payments.

5. IBM

Headquarters – United States

IBM cemented its leadership among RegTech vendors through its Watson AI and cloud-based regulation offerings. IBM's platforms provide automated monitoring of compliance, improve KYC, and provide predictive analytics for risk scoring. IBM's solutions find application in the financial services industry, healthcare, and government to enhance audit trails and ensure stringent compliance requirements.

Are you ready to discover more about the Regtech market?

The report provides an in-depth analysis of the leading companies operating in the global regtech market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- 3M

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- PwC

- NICE Actimize

- Accuity

- IBM

- ACTICO GmbH

- BWise

- London Stock Exchange Group plc.

- Deloitte

- Broadridge Financial Solutions Inc.

- Others

Conclusion

The global RegTech industry is evolving rapidly as businesses come under more pressure to match complex and ever-evolving regulatory landscapes. For banking and insurance companies, healthcare facilities, or cryptocurrency exchanges, businesses are turning to RegTech to automate compliance, reduce the risk, and enhance operational efficiency. Use of AI, cloud platforms, real-time monitoring, and blockchain has transformed the way regulatory requirements are addressed. While North America leads the marketplace with a matured regulatory setting, the explosion in growth in Asia-Pacific is driven by digital adoption and policy creativity. Supported by deep commitment from tech pioneers and professional services providers, the RegTech market is not just serving as a compliance enabler but as a strategic investment in digital governance.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?