United States Airline Industry Market 2025: Market Share, Passenger Demand, and Top Airlines Overview

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Introduction

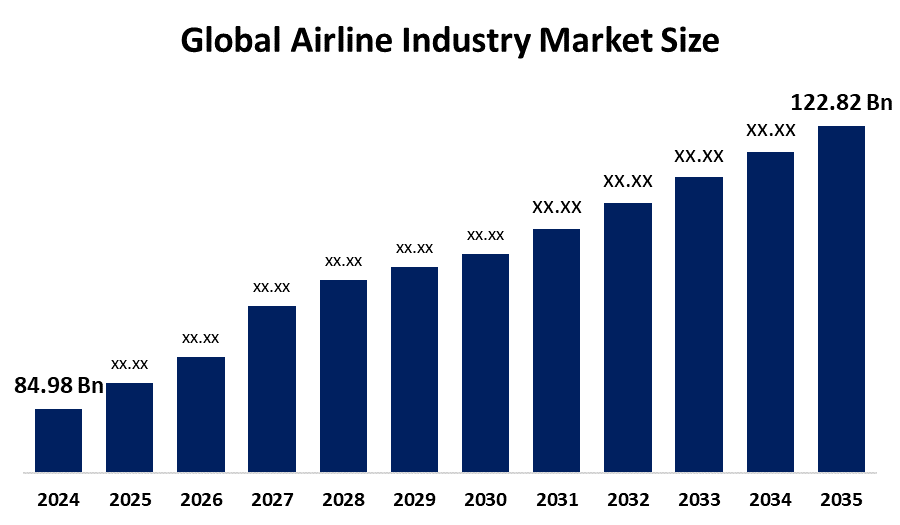

The United States Airline Industry Market Size stands as one of the largest and most dynamic aviation markets worldwide. According to Spherical Insights, The US aviation market size is projected to grow from USD 84.98 Billion in 2024 to USD 122.82 Billion by 2035, at a CAGR of 3.75% during the forecast period 2025–2035. Serving millions of passengers each year, US airlines play a pivotal role in both domestic and international travel. Over the years, the industry has undergone significant shifts driven by technological advancements, economic factors, and evolving customer preferences. In 2025, the competitive landscape is characterized by consolidation among a few dominant players accounting for the majority of the market share, creating a highly concentrated and competitive environment.

US Airline Industry Market Concentration and Passenger Demand.

The US airline business is still quite profitable; in 2025, the top airlines will have earned over 60 billion a year, with a passenger base of over 700 million seats available during peak travel seasons. Four big airlines have almost 74% of the domestic capacity, indicating a considerable concentration of market share. The demand for domestic travel is stable, even though the volume of foreign air travel has somewhat decreased due to global uncertainty. Additionally, by offering flexible booking options and inexpensive costs, low-cost carriers are greatly impacting traveler choice and escalating competition. With airlines increasingly utilizing digital platforms for customer involvement and refining frequent flyer programs to increase loyalty in a competitive market, scheduled domestic capacity has maintained its supremacy, according to recent data.

Market Share Overview and Capacity Trends of Leading US Airlines in 2025

- American Airlines led the US market in September 2025 with approximately 20% market share, offering around 20 million seats to passengers. It remains the largest US carrier by fleet size and passenger capacity, serving a broad domestic and global network.

- Delta Air Lines closely follows, holding about 19% market share with 18.9 million seats available. Delta operates extensively out of Atlanta, focusing on operational efficiency and premium service.

- Southwest Airlines commands roughly 18% of the market with 17.9 million seats, making it the largest low-cost carrier. Its extensive point-to-point network and customer-friendly policies underpin this strong position.

- United Airlines, part of the Big Four, contributes to the collective 75% market share held by these dominant carriers. United is steadily growing its capacity, adding 814,500 seats compared to last September, reflecting expansion efforts.

- Other airlines show capacity shifts: Delta Air Lines increased seats by 282,100, while Spirit Airlines cut back by 22%, losing 863,500 seats from the previous year. Frontier Airlines also reduced capacity by 12% in September 2025.

Top US Airlines and Market Shares (2025)

The US airline industry is dominated by a few key players that control the majority of the domestic market share. These airlines operate extensive networks connecting millions of passengers annually and collectively capture around 75% of US domestic capacity. The following are the top five US airlines by market share in 2025, along with their passenger volumes, revenue estimates, and strategic highlights.

1. American Airlines (21% Market Share)

American Airlines leads the US airline market with a 21% share, operating the largest fleet and serving over 200 million passengers annually. Its major hubs at Dallas–Fort Worth and Miami bolster both domestic and international routes. In 2025, American Airlines is projected to generate revenues above $50 billion, driven by a large business traveler base and premium service offerings. The airline continuously invests in digital innovations and strategic partnerships to improve customer experience and sustain its market dominance, reinforcing its leadership in a competitive landscape.

2. Delta Air Lines (19% Market Share)

Delta Air Lines holds a 19% share of the US airline market, with its headquarters and primary hub in Atlanta. Known for exceptional reliability, Delta serves over 180 million passengers yearly and has annual revenues exceeding $45 billion. The carrier focuses heavily on operational efficiency and leverages advanced technology to optimize service quality. Its robust loyalty programs and diversified offerings across domestic and international flights maintain Delta’s position as a strong market contender catering to varied passenger demographics.

3. Southwest Airlines (18% Market Share)

Southwest Airlines commands 18% of the US market as the largest low-cost carrier, boasting a network connecting over 100 destinations. It flew approximately 150 million passengers in 2025 and reported revenues near $25 billion. Southwest’s customer-centric policies, such as no change fees and free checked bags, along with frequent flight schedules, sustain its market appeal. Its point-to-point route system effectively serves leisure travelers, helping Southwest maintain strong brand loyalty and reshape price competition in the US aviation industry.

4. United Airlines (16% Market Share)

United Airlines captures 16% of domestic airline capacity, with major hubs at Chicago O’Hare and Newark. Serving around 140 million passengers annually, United's 2025 revenues are estimated around $40 billion. The airline emphasizes fleet modernization with fuel-efficient aircraft and invests in technology to enhance digital engagement. United’s strategic mix of premium and economy services across domestic and long-haul routes strengthens its competitive position in a dynamic and evolving market alongside other major carriers.

5. Alaska Airlines (5% Market Share)

Alaska Airlines holds a 5% market share, focusing on West Coast connectivity through hubs in Seattle and Portland. In 2025, it served over 40 million passengers, generating revenues exceeding $8 billion. Known for exceptional customer service, Alaska has gained strong loyalty by upgrading its fleet and expanding its frequent flyer program. Its focus on regional and leisure routes positions it for steady growth, even as competition intensifies, making Alaska a significant niche player in the US airline landscape.

Conclusion

The US Airline Industry Market Size is highly concentrated in 2025, with the leading airlines controlling a sizable portion of the domestic travel market. Domestic demand is resilient despite challenges to international travel volumes, supported by low-cost carriers that are innovating in accessibility and price. Continued technological adoption, improved customer service, and growing sustainability considerations will all influence the industry's future. All of these elements work together to propel the US airline industry's development and maintain its competitiveness in the ever-changing global aviation market.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?