Top 50 Global Companies in Micro Server IC Market 2025: Strategic Overview and Future Trends (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

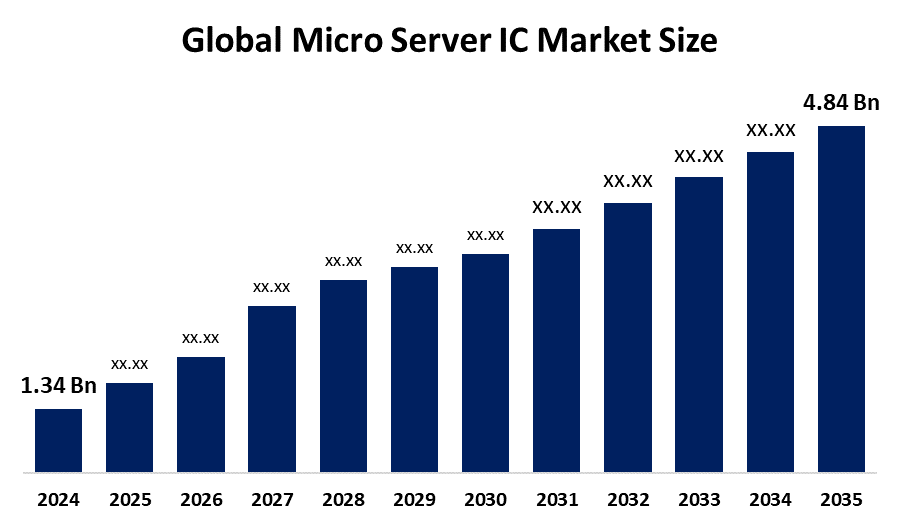

According to a research report published by Spherical Insights & Consulting, The Global Micro Server IC Market Size is projected to Grow from USD 1.34 Billion in 2024 to USD 4.84 Billion by 2035, at a CAGR of 12.38% during the forecast period 2025–2035. The market is presently growing dynamically fueled by several key trends and drivers including demand for energy efficiency, the uptake of Cloud services and growing adoption of IoT devices.

Introduction

The global micro server integrated circuit market covers designing and deploying integrated circuits specifically for micro servers or small, energy efficient servers optimized for lightweight, distributed computing tasks. These integrated circuits include all processing, memory, and connectivity functionality to support applications such as edge computing, web hosting, and real-time data analytics. The market will grow because of the rising demand for infrastructure that can operate at low power levels and can scale in cloud services, IoT ecosystems, and hyperscale data centers. Additionally, the opportunity in this area is still very ripe, and companies are looking to upgrade their computing capability without having to build a traditional server room by using micro servers. Companies can take advantage of the growing need for hybrid cloud environments and edge-computing. Another good opportunity is the meteorically growing interest of developing new ICs that have advanced features focusing on micro machine learning and data analytics. With such evolution, companies will meet the demand for reliability with high processing power.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights-Download the Brochure now and dive deeper into the future of the Micro Server IC Market.

Micro Server IC Market Size & Statistics

- The Market Size for Micro Server IC Was Estimated to be Worth USD 1.34 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 12.38% Between 2025 and 2035.

- The Global Micro Server IC Market Size is Anticipated to Reach USD 4.84 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Micro Server IC Market.

- Asia Pacific is expected to grow the fastest during the forecast period in the Micro Server IC Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the micro server IC market. Dominated by fast-paced industrialization, growing IT infrastructure, and huge expenditures on data center infrastructure. Countries like China, Japan, South Korea, and India are leading the way for new technologies with the global demand for highly efficient server solutions fuelled by the continued adoption of IoT, AI, and cloud computing technologies. With a large population base and an expanding digital economy, the demand for micro server ICs is expected to rapidly increase in the region.

North America is expected to generate the highest demand during the forecast period in the micro server IC market. Spurred by the presence of advanced technology companies, established IT infrastructure, and an immense prioritization of innovation. North America Micro Server IC Market was valued at USD 1,328.79 Million in 2022 and is anticipated to surpass USD 4573.46 Million in 2032, growing at CAGR of 13.2% from 2022 to 2032. Advancements in the high-performance computing category are primarily spurred by the increased industries like technology, telecommunications, and finance that rely on micro server ICs, and ultimately demand begets demand to the availability of micro server ICs. This demand is further accelerated by the rapid growth of cloud computing and edge computing. The U.S. has been at the forefront because of its existing data center infrastructures, and a plethora of leading technology companies that continue to heavily invest in advanced server technologies.

Top 10 Micro Server IC Trends

1.Minimal Power Draw

2.AI and ML Integration

3.Modularity and Scalability

4.Edge Computing Acceleration

5.Adoption of ARM Processors

6.Development of Hyperscale data centers

7.Convergence of Storage and Networking

8.Demand Explosion due to the IoT

9.Onshoring and supply chain diversification

10.Investment in R&D

1. Minimal Power Draw

In the context of micro server ICs, the increase in demand for ultra-low power consumption is a product of rapid growth in edge computing and IoT ecosystems, which often utilize devices in power-constrained applications like remote sensors, smart infrastructure, or mobile equipment. These devices are designed principally to be efficient in processing while consuming very little power, promoting longer device life and less cooling requirement and total cost of operation.

2. AI and ML Integration

The integration of AI and ML within micro server ICs is revolutionizing edge computing. These ICs provide the means for real-time workloads, which allow data to be processed, patterns to be recognized, and decisions to be made solely at the data source. Using specialized cores, accelerators, and memory diagrams, micro server ICs can be designed to accept inference workloads and lightweight training models leveraging edge technology, without requiring centralized, cloud-managed infrastructures. This represents a shift toward edge-based workloads that can lower latency, preserve privacy, and affect mission-critical applications across industries such as smart manufacturing, autonomous vehicles, and predictive maintenance.

3. Modularity and Scalability

The introduction of modular and scalable architectures in micro server integrated circuits (ICs) are changing deployment flexibility. With modular ICs, configurations can be designed, upgraded, or exchanged based on application requirements. The alleged plug-and-play design is ideal for integrating into a variety of settings that demand quick adaptation (such as smart cities, driverless cars, and industrial automation). More importantly, modular ICs have the ability to provide customized performance for less downtime and reduced effort, enabling organizations to scale infrastructure while continuing to accommodate existing and future computational requirements with a lower total cost of ownership.

4. Edge Computing Acceleration

The acceleration of edge computing is driving ultra-responsive and latency optimized micro server ICs, powered for real-time processing at the point of collection. In autonomous vehicles, smart factories, robotics, and other environments where milliseconds matter (and centralized cloud processing is not practical for local time-sensitive operations), these types of ICs are enabling applications that offer increased bandwidth, parallel processing, and decision-making logic reside locally (at the point of operational context), often with local identities, and contribute to mission-critical processing that cannot be delayed.

5. Adoption of ARM Processors

Adoption of ARM-based processors in the micro server IC segment is speeding up as industries shift towards energy efficiency, scalability and cost-effective performance. Because of their reduced instruction set computing (RISC) architecture, ARM processors provide a high degree of computational throughput while drawing low amounts of power, making them suitable for hyperscale data centers, cloud computing platforms and edge hosts. ARM processors provide modular flexibility for their installation and can interchange workloads from web hosting to AI inference. That's why ARM processors are poised for large-scale deployments within distributed computing.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the micro server IC market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 16 Companies Leading the Micro Server IC Market

1.Intel Corporation

2.Advanced Micro Devices (AMD)

3.Marvell Technology Group

4.Qualcomm Incorporated

5.NVIDIA Corporation

6.Broadcom Inc.

7.Ampere Computing

8.Huawei Technologies Co., Ltd.

9.Texas Instruments Incorporated

10.Fujitsu Limited

11.IBM Corporation

12.MediaTek Inc.

13.Samsung Electronics Co., Ltd.

14.Toshiba Corporation

15.Microchip Technology Inc.

16.STMicroelectronics N.V.

17.Others

1. Intel Corporation

Headquarters - Santa Clara, California, the US.

Intel Corp (Intel) is engaged in the design and development of technology products and components. The company's product offerings include microprocessors, chipsets, embedded processors and microcontrollers, Ethernet products. In addition, the Company provides technologies and solutions that enable, Cyber Security, 5G connectivity, Artificial Intelligence, Cloud Computing, Data Centers Solutions, Internet of Things, Robotics. The company markets processors as Core, Atom, Celeron, Pentium, Xeon, and Movidius. Intel sells products and solutions to original equipment manufacturers, industrial and communications manufacturers and original design manufacturers. The Company serves customers in Media (Broadcasting), Financial Services, Health and Life Sciences, Government, and public services, Manufacturing, Retail and Education, Industrial and Transportation Sectors.

2. Advanced Micro Devices (AMD)

Headquarters - Santa Clara, California, the US.

Advanced Micro Devices Inc (AMD) designs, develops, manufactures, and sells high-performance computing, graphics and visualization technologies. AMD's portfolio includes desktop graphics, desktop processors, laptop graphics, laptop processors, chipsets, memory products, professional graphics, and server processors. AMD sells products under the AMD, Athlon, FreeSync, EPYC, FirePro, Geode, Opteron, Ryzen, Radeon, Virtex, Kintex, Zynq, Versal, UltraScale, and Threadripper brands. AMD's products are applied in multiple sectors including automotive; aerospace and defense; healthcare and sciences; education; industrial and vision; consumer electronics; media and entertainment; and supercomputing and research.

3. Marvell Technology Group

Headquarters - Wilmington, Delaware, the US.

Marvell Technology Inc. is a fabless semiconductor company producing application specific standard products. Marvell's product portfolio contains complex system-on-chip devices, as well as devices designed for data storage and switches. The company has wireless baseband infrastructure, security processors, wireless network devices, storage controllers (hard and solid-state disk drivers), storage accelerators, host bus adapters, printers, receivers (set-top), video surveillance and other products. Marvell sells products under the brand name Alaska, AQUANTIA, Armada, AUTHENTIK, BRITGHTLANE, BRAVERA and CAVIUM.

4. Qualcomm Incorporated

Headquarters - San Diego, California, the US.

Qualcomm Inc (Qualcomm) creates and develops wireless telecommunication products and services. The company provides integrated circuits and system software for mobile devices and other wireless products. The company's product offerings include system processors, audio components, wireless networking, radio frequency components, sensors, wired networking, and wireless connectivity. The company's products are generally used in mobile devices, laptops, tablets, cellular networks, cameras, headsets, enterprise networks, home security, smart homes, auto connectivity, warbles, and small cells.

5. NVIDIA Corporation

Headquarters - Santa Clara, California, the US.

NVIDIA Corp (NVIDIA) is a designer and manufacturer of graphics processing units, central processing units, and system on a chip unit. The company sells products in the gaming, professional visualization, data center, and automotive markets. The company also provides solutions for artificial intelligence and data science, data center and cloud computing, design and visualization, edge computing, high-performance computing, and autonomous driving. NVIDIA sells products under their GeForce NOW, Quadro, GeForce, SHIELD, vGPU, DOCA, JETSON, and Bluefield product names. The company operates across a wide range of industries, including architecture, engineering, and construction, cybersecurity, energy, financial services, healthcare and life sciences, education, gaming, manufacturing, media and entertainment, retail, robotics, telecommunications, and transportation.

Are you ready to discover more about the micro server IC market?

The report provides an in-depth analysis of the leading companies operating in the global micro server IC market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

1.Intel Corporation

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

2.Advanced Micro Devices (AMD)

3.Marvell Technology Group

4.Qualcomm Incorporated

5.NVIDIA Corporation

6.Broadcom Inc.

7.Ampere Computing

8.Huawei Technologies Co., Ltd.

9.Texas Instruments Incorporated

10.Fujitsu Limited

11.IBM Corporation

12.MediaTek Inc.

13.Samsung Electronics Co., Ltd.

14.Toshiba Corporation

15.Microchip Technology Inc.

16.STMicroelectronics N.V.

17.Others

Conclusion

The Global Micro Server IC Market Size is going through rapid change around the world due to the growing emphasis on energy-efficient, scalable computational solutions through cloud, edge, and IoT ecosystems. Key trends that have driven both product development and configuration changes include AI adoption, modular architectures, and a marketing shift toward ARM processors. The regional growth is primarily driven by industrial growth in the Asia Pacific and tech-based infrastructure in North America. With strategically placed investments in Research and Development and a diversified supply chain, leading firms are placed to meet dynamic market needs. With the acceleration of hybrid cloud and edge computing, micro server ICs will become instrumental in supporting next-generation digital infrastructure.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?