Top 50 Companies in Insurance Market: Market Research Report (2024–2035)

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

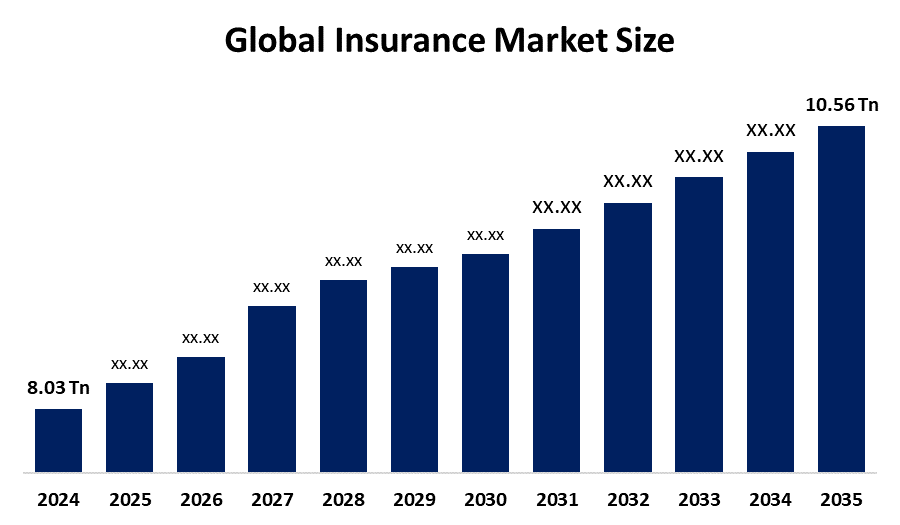

According to a research report published by Spherical Insights & Consulting, The Global Insurance Market Size is projected to grow from USD 8.03 Trillion in 2024 to USD 10.56 Trillion by 2035, at a CAGR of 2.52% during the forecast period 2025–2035. The importance of insurance as a fashion accessory is growing. Digital transformation, AI-driven analytics, and a greater emphasis on sustainability and climate-related concerns are some of the major themes influencing the market. While insurers are investigating alternative investments and cross-border reinsurance methods, regulatory agencies are placing a greater emphasis on transparency, risk management, and consumer protection.

Introduction

The global insurance market is still resilient and flexible in the face of changing risk environments, inflationary pressures, and economic ups and downs. With the help of solid underwriting and excellent financial market performance, insurers are seeing consistent increases in both assets and premiums. Insurers maintain steady liquidity and solvency positions by using liquid investments and premium income to cover commitments such as funding requirements, surrender values, and claims.

Growing government rules requiring insurance coverage in developing nations and the incorporation of wearables into consumer engagement measures for life insurance software are driving major changes in the market. These patterns demonstrate the increased focus on risk reduction and customized client experiences. The regulatory landscape for insurance companies is becoming more stringent at the same time, which calls for strong compliance plans. Mandating insurance coverage in emerging nations through government programs offers significant development potential, especially in areas like health and auto insurance. An approach to risk management that is more proactive is promoted by insurers offering personalized plans based on personal health data, due to the incorporation of wearable technology into life insurance software. In 2024, the global insurance market remained resilient amid steady economic growth, despite inflationary pressures in several regions. Total assets of insurers rose by 2.7% to USD 40 trillion, fueled by strong financial market performance, while liabilities increased by 2.4% to USD 34 trillion, driven by premium growth.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Insurance Market.

Insurance Market Size & Statistics

- The Market for insurance was Estimated to be worth USD 8.03 Trillion in 2024.

- The Market is going to expand at a CAGR of 2.52% between 2025 and 2035.

- The Global Insurance Market Size is anticipated to reach USD 10.56 Trillion by 2035.

- North America is expected to generate the highest demand during the forecast period in the insurance Market

- Asia Pacific is expected to grow the fastest during the forecast period in the insurance Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the insurance market. The expansion of the middle class in countries such as China, India, and Indonesia increased demand for goods and services, which in turn stimulated demand in the technology, automotive, and retail sectors. Due to the area's fast urbanization, there is a greater need for housing, infrastructure, and urban services. Consequently, associated industries such as construction, real estate, and utilities are expanding. The digital economy is expanding rapidly, and technologies like 5G, the cloud, AI, and the Internet of Things have huge growth potential. Significant investments are being made by local businesses in digital infrastructure and capabilities.

North America is expected to generate the highest demand during the forecast period in the insurance market. The region's strong per capita income makes life insurance plans more accessible to more people. This discretionary money is used to purchase supplemental and essential financial products, including life insurance. In the case of an insured person's death, life insurance is often regarded as an essential financial tool for protecting families and ensuring financial stability. The ongoing demand for life insurance products is strengthened by this cultural awareness. The Guardian Life Insurance Company of America, one of the biggest life insurers and employee benefit providers in the United States, announced a strategic alliance with the international fund manager Janus Henderson Group in April 2025.

Top 10 trends in Insurance Market

- AI-driven underwriting and claims automation

- Embedded insurance and API-based distribution

- Cybersecurity and cyber insurance expansion

- Climate risk modeling and parametric coverage

- Personalized and usage-based insurance

- InsurTech partnerships and digital ecosystems

- Blockchain and smart contracts

- Microinsurance and financial inclusion

- Omnichannel customer engagement

- Regulatory modernization and data transparency

- AI-driven underwriting and claims automation

Artificial intelligence is streamlining underwriting and claims processes by analyzing vast datasets in real time. This reduces manual errors, speeds up decision-making, and enhances risk assessment accuracy. Insurers are using generative AI to automate documentation, fraud detection, and customer service, improving both efficiency and customer satisfaction.

- Embedded insurance and API-based distribution

Insurance is increasingly being bundled into everyday purchases like travel bookings, e-commerce checkouts, or ride-sharing apps via APIs. This seamless integration expands reach, reduces distribution costs, and meets customers where they are. It’s transforming insurance from a standalone product into an invisible, value-added service.

- Cybersecurity and cyber insurance expansion

With rising digital threats, cyber insurance is becoming essential. Insurers are offering tailored policies that cover ransomware, data breaches, and business interruption. Underwriting now includes assessments of a company’s cyber hygiene, and some carriers are partnering with cybersecurity firms to offer bundled protection and response services.

- Climate risk modeling and parametric coverage

Climate-related events are pushing insurers to adopt advanced modeling tools and parametric insurance. These policies trigger payouts based on measurable events like rainfall or wind speed rather than traditional claims processes. It enables faster relief and better alignment with real-world risks, especially in agriculture and disaster-prone regions.

- Personalized and usage-based insurance

Consumers expect tailored coverage based on lifestyle, behavior, and preferences. Usage-based models like pay-per-mile auto insurance or health plans linked to fitness data are gaining traction. AI and IoT devices help insurers track usage and offer dynamic pricing, making insurance more relevant and cost-effective.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the insurance market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 20 Companies Leading the Insurance Market

- Allianz

- Ping An Insurance

- Berkshire Hathaway

- China Life Insurance

- AXA

- Prudential

- MetLife

- Nippon Life Insurance

- Manulife Financial

- Legal & General Group

- Assicurazioni Generali

- Life Insurance Corporation of India

- American International Group

- Great-West Lifeco

- CNP Assurances

- Japan Post Insurance

- Dai-ichi Life Holdings

- National Mutual Insurance Federation of Agricultural Cooperatives

- Crédit Agricole Assurances

- Aegon

- New York Life Group

- Aviva

- Zurich Insurance Group

- Meiji Yasuda Life

- TIAA Group

- Allianz

Headquarters - Munich, Germany

Allianz is a global powerhouse in the insurance market, offering life, health, property, and casualty coverage across more than 70 countries. With a strong focus on digital transformation, Allianz integrates AI and data analytics to enhance underwriting and claims efficiency. Its asset management arm, Allianz Global Investors, adds depth to its financial services portfolio. The company’s resilience and scale make it a benchmark in global insurance, especially in Europe. Allianz continues to lead in climate risk modeling and sustainability-driven insurance solutions, reinforcing its position as a forward-thinking insurer in the global insurance market.

- Ping An Insurance

Headquarters - Shenzhen, China

Ping An is China’s largest composite insurer and a major player in the global insurance market. It offers life, property, casualty, and health insurance, along with banking and asset management services. Known for its tech-first approach, Ping An uses AI, blockchain, and cloud platforms to deliver smart insurance solutions. Its “One Ping An” strategy integrates services across verticals, creating a seamless customer experience. With over 200 million clients, Ping An is redefining digital insurance distribution and embedded coverage models, making it a leader in innovation and scale.

- Berkshire Hathaway

Headquarters - Omaha, USA

Berkshire Hathaway, led by Warren Buffett, is a diversified conglomerate with a strong footprint in the global insurance market. Its subsidiaries, GEICO, National Indemnity, and Berkshire Hathaway Reinsurance cover auto, specialty, and large-scale risk segments. The company’s disciplined underwriting and long-term investment philosophy set it apart. Berkshire’s insurance operations generate significant float, which is reinvested to fuel growth across its portfolio. While categorized broadly under investment and services, its insurance arm remains a cornerstone of its financial strength and global influence.

- China Life Insurance

Headquarters - Beijing, China

China Life is one of the world’s largest life insurers and a key player in the global insurance market. It serves over 300 million policyholders and offers a wide range of protection and savings products. The company is expanding its digital capabilities through mobile platforms and AI-powered customer service. China Life plays a vital role in China’s social security system and is increasingly focused on sustainable investing and climate resilience. Its scale, government backing, and strategic reforms position it as a dominant force in Asia’s insurance landscape.

- AXA

Headquarters - Paris, France

AXA is a global leader in composite insurance, serving over 100 million clients across life, health, and property/casualty lines. Headquartered in Paris, AXA is known for its strong ESG commitments and digital innovation. The company has invested heavily in cybersecurity, parametric insurance, and AI-driven risk assessment. AXA’s acquisition of XL Group strengthened its commercial insurance capabilities, making it a top-tier provider in the global insurance market. Its omnichannel strategy and focus on customer-centric solutions continue to drive growth and relevance in a competitive landscape.

Are you ready to discover more about the insurance market?

The report provides an in-depth analysis of the leading companies operating in the global insurance market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Allianz

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Ping An Insurance

- Berkshire Hathaway

- China Life Insurance

- AXA

- Prudential

- MetLife

- Nippon Life Insurance

- Manulife Financial

- Others.

Conclusion

The global insurance market is entering a transformative era, shaped by digital innovation, evolving consumer expectations, and heightened regulatory focus. With steady growth projected, insurers are leveraging AI, embedded solutions, and climate modeling to offer more personalized and resilient coverage. Regional dynamics, especially in Asia Pacific and North America, are driving demand and diversification. As competition intensifies, strategic agility and customer-centric models will define success. The future of insurance lies in proactive risk management and inclusive, tech-enabled ecosystems.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?