Top 50 Companies in Hydrometallurgical Electrodes (2025–2035): Competitive Analysis And Forecast

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

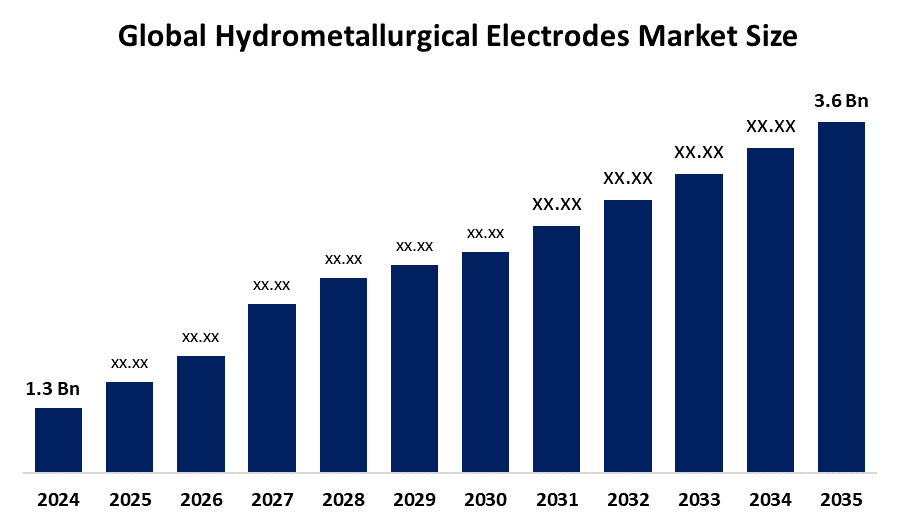

According to a research report published by Spherical Insights & Consulting, The Global Hydrometallurgical Electrodes Market Size is projected to Grow from USD 1.3 Billion in 2024 to USD 3.6 Billion by 2035, at a CAGR of 9.7% during the forecast period 2025–2035. The market for hydrometallurgical electrodes is in greater demand as a growing reliance on effective metal extraction techniques is driven by the increasing demand for metals such as copper, nickel, cobalt, and zinc, which is being fueled by the expansion of electronics, electric vehicles, and renewable energy. Compared to conventional pyrometallurgical processes, hydrometallurgical procedures have environmental benefits like lower emissions and less energy consumption, which is in line with more stringent environmental laws and sustainability objectives.

Introduction

Hydrometallurgical electrodes are conductive parts used in hydrometallurgy, which is the process of using aqueous chemical solutions to extract metals from ores or recyclable materials. Hydrometallurgical electrodes are crucial for enabling the electrochemical extraction of metals from aqueous solutions rather than high-heat procedures. Their spectrum of materials includes lead, graphite, carbon, and metallic oxides; each has trade-offs in terms of longevity, corrosion resistance, and conductivity. Additionally, electrode design is crucial the best electrodes have a wide effective surface area to facilitate effective reactions, resist chemical degradation, and preserve dimensional stability. In many configurations, coated or dimensionally stable types of anodes, cathodes are favoured in order to lower maintenance costs and enhance performance. They have several uses, including the extraction of copper, nickel, gold, and other metals, recycling of electronic waste, and purification and refinement electrowinning, electrorefining). Reducing harmful materials, moving away from lead, creating closed-loop systems, and enhancing electrode recyclability are all examples of increased emphasis on sustainable practices.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Hydrometallurgical Electrodes Market.

Hydrometallurgical Electrodes Market Size & Statistics

- The Market Size for Hydrometallurgical Electrodes Was Estimated to be worth USD 1.3 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 9.7% between 2025 and 2035.

- The Global Hydrometallurgical Electrodes Market Size is anticipated to reach USD 3.6 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Hydrometallurgical Electrodes Market

- Asia Pacific is expected to grow the fastest during the forecast period in the Hydrometallurgical Electrodes Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the hydrometallurgical electrodes market. The market for hydrometallurgical electrodes is now growing in the Asia Pacific due to the strong mining and metallurgical sectors in nations like China, India, and Australia. The growing need for hydrometallurgical processes is a result of China's substantial production and consumption of metals like copper and zinc, as well as India's developing industrial base. The Asia-Pacific market for hydrometallurgical electrodes is expected to increase due to the region's quick industrialisation, raw material availability, reduced manufacturing costs, and encouraging government regulations.

North America is expected to generate the highest demand during the forecast period in the hydrometallurgical electrodes market. The hydrometallurgical electrodes market with the quickest rate of growth throughout the study period is anticipated to be in North America, due to developments in technology and a strong emphasis on sustainability. Due to their established mining and metallurgical industries, the United States and Canada are major contributors. The region's use of hydrometallurgical processes is growing as a result of the growing need for high-purity metals for a range of industrial uses, such as electronics, automotive, and aerospace. Furthermore, the need for sophisticated hydrometallurgical electrodes in North America is being driven by strict environmental restrictions as well as the drive for cleaner and greener technology.

Top 10 trends in the Hydrometallurgical Electrodes Market

- Surge in Electric Vehicle Battery Demand

- Advancements in Electrode Materials

- Integration with Industry

- Focus on Sustainability

- Recycling and Circular Economy Initiatives

- Technological Convergence with IoT and Industry

- Emergence of High-Power Electrodes

- Advancements in Electrode Materials

- Integration with Industry

- Focus on Sustainability

1. Surge in Electric Vehicle Battery Demand

The market for hydrometallurgical electrodes is being greatly impacted by the increase in demand for electric vehicle batteries. The need for metals like lithium, nickel, and cobalt is growing as EV adoption speeds up globally, which fuels the need for effective extraction techniques. These metals are increasingly being recovered from ores and recyclable materials using hydrometallurgical techniques, such as electrowinning. This trend supports the expanding EV sector by highlighting the significance of innovative electrode technologies in improving the sustainability and efficiency of metal recovery processes.

2. Advancements in Electrode Materials

The performance, durability, and environmental requirements of hydrometallurgy are driving a rapid evolution in electrode materials. Graphite, carbon, and metallic oxide materials are replacing or enhancing traditional materials like lead because they provide superior longevity, electrical conductivity, and corrosion resistance. Surface area, stability in extreme chemical environments, and metal recovery selectivity are all being improved by the introduction of nanomaterials and modified composites. In order to preserve shape and performance during extended operations, dimensionally stable anodes and cathodes are also becoming more prevalent. Higher purities and efficiency are produced by enhanced electrowinning and electrorefining processes made possible by these materials. Newer, less hazardous, and more recyclable materials are becoming more popular as companies strive for sustainability.

3. Integration with Industry

Integration with Industry technology is growing in popularity as hydrometallurgy modernises. Operators can now continually monitor parameters like pH, temperature, current density, and reagent flow thanks to the integration of smart sensors and real-time monitoring systems into extraction and electrowinning settings. Before making adjustments in the field, extraction and purification processes are simulated and optimised using digital twins, which are virtual representations of processing circuits. In order to minimise downtime, machine learning algorithms are used to schedule preventative maintenance, identify abnormalities, and forecast equipment wear. Process automation enhances the quality and consistency of metal recovery in solvent extraction, leaching, and electrode regeneration. In hydrometallurgical electrode applications, the combination of digital tools and operational technologies is improving process control, allowing for more accurate material consumption, increased yield, and greater environmental compliance.

4. Focus on Sustainability

In the market for hydrometallurgical electrodes, sustainability is becoming more and more important as attempts are made to lessen the environmental impact of electrode life cycles. In place of more environmentally friendly and corrosion-resistant alternatives like graphite, carbon, and metallic oxides, traditional hazardous elements like lead are gradually being phased out. In line with the ideas of the circular economy, electrode component recycling and reuse are growing in popularity. In order to recover metals, particularly from battery trash, research is also looking into ecologically friendly acids and green leaching agents, which will lower emissions and chemical residues. Life-cycle assessments and regulatory pressure are forcing manufacturers to implement procedures that reduce energy use and toxic byproducts.

5. Recycling and Circular Economy Initiatives

In the market for hydrometallurgical electrodes, recycling and circular economy activities are becoming more popular, particularly since sources such as wasted lithium-ion batteries, electronic trash, and industrial by-products are seen as valuable raw material streams. High-purity metals can be recovered, and cathode materials can be resynthesised thanks to improved processes that use organic acids or hydrometallurgical pathways to leach metals like lithium, nickel, cobalt, and copper from spent batteries.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the hydrometallurgical electrodes market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Hydrometallurgical Electrodes Market

- Umicore

- BASF SE

- Johnson Matthey

- Sumitomo Metal Mining Co., Ltd.

- Glencore International AG

- Norilsk Nickel

- Freeport-McMoRan Inc.

- Vale S.A.

- Anglo American plc

- China Molybdenum Co., Ltd.

- Jinchuan Group International Resources Co. Ltd.

- Sherritt International Corporation

- First Quantum Minerals Ltd.

- Southern Copper Corporation

- Eramet Group

- Sibanye Stillwater Limited

- Nornickel

- KGHM Polska Mied? S.A.

- Boliden Group

- Hindustan Zinc Limited

- Others

1. Umicore

Headquarters: Brussels, Belgium

Material science, metallurgy, and recycling are the areas of expertise for Umicore SA, a circular materials technology firm based in Belgium. It offers goods like battery materials, electroplating, precious metal refining, and pollution control catalysts through its several business segments, which include Catalysis, Energy & Surface Technologies, and Recycling. With a closed-loop business model that recovers and repurposes metals from end-of-life products, Umicore places a strong emphasis on sustainability. Its worldwide activities encompass research and development facilities in North and South America, Asia-Pacific, and Europe.

2. BASF SE

Headquarters: Rhein, Germany

Leading the chemical industry globally, BASF SE provides a broad range of products, including chemicals, materials, surface technologies, industrial solutions, nutrition & care, and agricultural solutions. Automotive, electronics, agriculture, construction, and coatings are just a few of the industries in which their goods are used. By fusing economic success with social and ecological responsibility, the company hopes to produce chemistry for a sustainable future. Sustainability and environmental protection are important to it.

3. Johnson Matthey

Headquarters: England, United Kingdom

A multinational corporation based in the United Kingdom, Johnson Matthey plc specialises in precious metals, sustainable technology, and specialty chemicals. Its activities include process technology, fine chemicals, fuel cell technologies, battery materials, and pollution control catalysts for industrial and automotive applications. Additionally, it is actively involved in the recycling and refinement of platinum-group metals as well as the development of technology to lower emissions into the environment. The headquarters of Johnson Matthey are located in London, England, in the United Kingdom.

4. Sumitomo Metal Mining Co., Ltd.

Headquarters: Tokyo, Japan

Sumitomo Metal Mining Co., Ltd. is a Japanese firm that mines, smelts, refines, and produces innovative materials from non-ferrous metals. Smelting & Refining, which produces metals like copper, nickel, zinc, lead, and precious metals; Materials, which produces products like batteries and crystal materials, fine powders, and electronic components and Mineral Resources, which purchases and develops metal ores, comprise its three primary business segments. In addition, it engages in recycling and environmental projects, such as water treatment and precious metal recovery. The company operates in a number of nations, including the US, Australia, China, Peru, and the Philippines.

5. Glencore International AG

Headquarters: Zug, Switzerland

Mining, smelting, refining, and selling metals, minerals, energy, and agricultural products are the areas of expertise for Glencore plc, a significant international commodities corporation. Copper, cobalt, nickel, zinc, lead, coal, oil, and ferroalloys are among the commodities in its portfolio. The business provides services to industrial clients in industries like energy, steel, power generation, automotive, and battery production. In addition, Glencore is dedicated to sustainability, controlling its effects on the environment and society and aiming to lower greenhouse gas emissions throughout its business.

Are you ready to discover more about the hydrometallurgical electrodes market?

The report provides an in-depth analysis of the leading companies operating in the global hydrometallurgical electrodes market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Umicore

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- BASF SE

- JOHNSON MATTHEY

- Sumitomo Metal Mining Co., Ltd.

- Glencore International AG

- JDA Software

- Epicor Software Corporation

- TECSYS

- Made4net

- Others

Conclusion

The hydrometallurgical electrodes market is accelerating due to rising demand for effective and environmentally friendly metal extraction techniques. Hydrometallurgical processes, which use aqueous solutions to extract metal. The efficiency of these procedures is being increased by technological developments in electrode materials, such as enhanced conductivity and resistance to corrosion. The need for efficient hydrometallurgical processes is further fuelled by the growing demand for metals worldwide, especially in industries like electronics and electric cars. The market is anticipated to grow as more businesses embrace hydrometallurgical processes as environmental sustainability continues to be a top priority.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?