Top 50 Companies in Digital Banking Platform Market: Market Research Report (2024–2035)

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

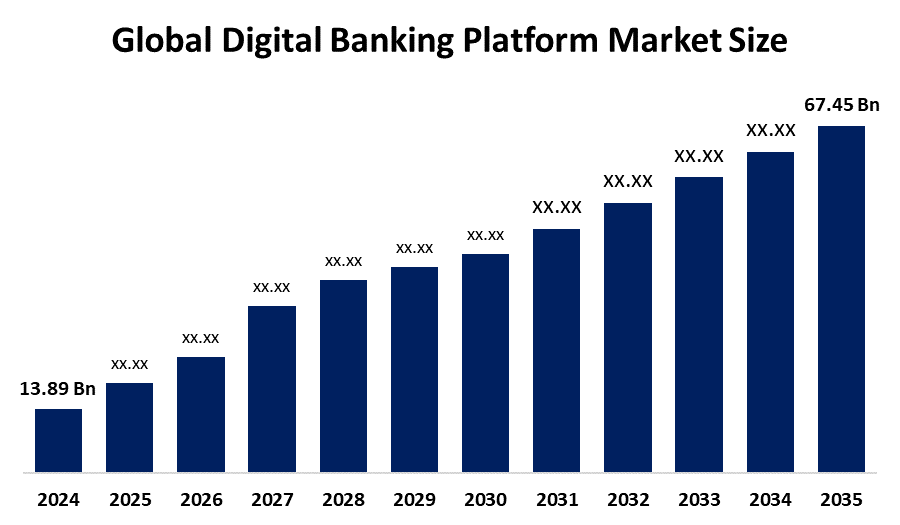

According to a research report published by Spherical Insights & Consulting, The Global Digital Banking Platform Market Size is projected to Grow from USD 13.89 Billion in 2024 to USD 67.45 Billion by 2035, at a CAGR of 15.45% during the forecast period 2025–2035. The primary drivers of the market's growth are the rise in Internet users and the trend toward online banking as opposed to traditional banking. Due to increased use of cloud platforms, which enhance scalability, the industry is expanding.

Introduction

The demand for digital banking platforms is fueled by consumers' increasing preference for digital banking services due to their ease, accessibility, and flexibility. Financial institutions are investing in digital transformation as a result of consumers' need for smooth and intuitive online and mobile banking experiences. Banks can offer their customers a digital banking experience that incorporates all of the typical banking services, such as online and mobile banking, with the aid of a digital banking platform. It also provides a number of banking functions, including loan management, financial product applications, savings account administration, bill payment, money transfers, bill deposits, and money withdrawals. It also provides omnichannel and multichannel banking services to its end users. Many banks also use this platform to decrease human error and do difficult jobs faster and more efficiently. To further reduce expenses and improve account security, numerous banks and financial institutions are developing state-of-the-art, intelligent banking platforms.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights-Download the Brochure now and dive deeper into the future of the Digital Banking Platform Market.

Digital Banking Platform Market Size & Statistics

The Market Size for Digital Banking Platform Was Estimated to be worth USD 13.89 Billion in 2024.

The Market Size is Going to Expand at a CAGR of 15.45% between 2025 and 2035.

The Global Digital Banking Platform Market Size is anticipated to Reach USD 67.45 Billion by 2035.

North America is Expected to Generate the highest demand during the forecast period in the digital banking platform Market

Asia Pacific is Expected to grow the fastest during the forecast period in the digital banking platform Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the digital banking platform market. The market is expanding due to a large user base that routinely uses digital banking, with a sizable share residing in rapidly developing nations like China and India, as well as the quick rise in internet access through computers, smartphones, and tablets. The market is further stimulated by the convenience that digital banking provides to customers. Furthermore, many small and medium-sized firms have benefited from favorable government programs to encourage start-ups, which have led to the creation of numerous retail and corporate accounts in over 33% of Asia-Pacific banks.

North America is expected to generate the highest demand during the forecast period in the digital banking platform market. The end-to-end credit journeys in North American nations have been digitally revolutionized, which has greatly aided in providing a uniquely individualized and user-friendly banking experience. It is clear that nations like the United States are already reaping significant financial services revenue benefits from technological advances and advancements, such as digital lending. Additionally, consumers' preferences for banking services have changed as a result of information technology advancements that have accelerated the creation of dynamic and user-friendly online and application user interfaces.

Top 10 trends in the Digital Banking Platform Market

- AI-driven automation and generative AI

- Cloud core banking migrations

- Real-time payments

- Open banking and API ecosystems

- Embedded finance integration

- Cybersecurity and fraud prevention

- Banking-as-a-Service (BaaS) expansion

- Rise of neobanks and challenger banks

- Hyper-personalization and customer data analytics

- Digital identities and biometric authentication

1. AI-driven automation and generative AI

Banks are accelerating the adoption of AI and generative AI to automate daily operations, customer service, credit scoring, fraud detection, and compliance. This not only increases efficiency and reduces costs, but also enables more personalized customer experiences and smarter, data-driven decision-making.

2. Cloud core banking migrations

The migration to cloud-based platforms is transforming traditional banking IT, allowing banks to scale rapidly, cut costs, improve disaster recovery, and accelerate product innovation. This supports flexible operations and seamless updates, keeping banks ahead in the digital era.

3. Real-time payments

Customers increasingly expect instant transfers and settlements. Real-time payment systems are being rapidly adopted to meet these demands, offering immediate fund movement and supporting new business models for both consumers and businesses.

4. Open banking and API ecosystems

Open banking, powered by secure APIs, enables banks to securely share data with third-party providers. This leads to a wider array of personalized financial services, greater customer choice, and stimulates industry-wide innovation and partnerships.

5. Embedded finance integration

Financial services are increasingly built into non-bank platforms, like e-commerce or travel apps, allowing users to access banking functions where they need them most. Banks collaborate with fintechs to embed banking in everyday digital experiences, driving convenience and deeper customer engagement.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the digital banking platform market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Digital Banking Platform Market

- Mambu

- Temenos

- Finastra

- Backbase

- nCino

- Oracle FLEXCUBE

- Finacle

- ebankIT

- SDK.finance

- FIS

- Ally Financial

- Nu (Nubank)

- Openbank

- Grasshopper Bank

- TymeBank

- Chime

- Revolut

- Cash App

- Mercado Pago

- Banco Itaú

- Capital One

- Rho

- Bluevine

- Wells Fargo

- JP Morgan Chase

1. Mambu

Headquarters: Amsterdam, Netherlands

Mambu is a global pioneer in cloud-native core banking platforms, empowering banks and fintechs to quickly launch digital products, embedded finance, and Banking-as-a-Service. With Mambu, clients benefit from API-first architecture and composable banking services, aligning with top trends such as cloud core banking migrations and embedded finance integration. Mambu’s agile software enables rapid product development and seamless scaling, used by over 250 financial institutions worldwide. Its flexible approach helps firms meet real-time payments demand, drive personalization, and transform legacy operations into modern, digital experience-driven systems—a hallmark of leading banking platform market solutions in 2025.

2. Temenos

Headquarters: Geneva, Switzerland

Temenos stands out as an industry leader in core and digital banking platforms, combining powerful AI-driven automation with cloud deployment. Their software supports over 950 banks globally, delivering real-time payments, open banking APIs, and hyper-personalized customer journeys, underscoring trends in AI-driven automation and open banking. Temenos Infinity and Transact suites redefine customer engagement, while robust cybersecurity and compliance solutions put it at the forefront of platform reliability and trustworthiness. The company enables established and challenger banks to adapt with speed to an evolving digital world, setting benchmarks in the banking platform market.

3. Finastra

Headquarters: London, United Kingdom

Finastra is a top-tier core banking software provider, formed from the merger of Misys and D+H, and leads in digital transformation for retail and corporate banking. With its open API ecosystem and multi-channel platforms, Finastra enables banks to rapidly innovate, optimize processes, and deliver comprehensive financial services. Its FusionFabric.cloud exemplifies cloud core banking migrations, while strong tools for embedded finance, real-time payments, and fraud management respond directly to major 2025 market trends. Finastra’s scalable and flexible architecture is trusted by thousands of financial institutions worldwide.

4. Backbase

Headquarters: Amsterdam, Netherlands

Backbase specializes in engagement banking platforms that enable banks to deliver seamless omnichannel experiences, personalize customer interactions, and rapidly integrate with fintech ecosystems. Their Digital Engagement Platform leverages predictive analytics, supporting hyper-personalization and real-time payments—both top market trends. By empowering banks with modern API-based tools, Backbase also leads in open banking ecosystems and the transition to digital-first operations, securing its place among the foremost banking platform providers globally in 2025.

5. nCino

Headquarters: Wilmington, North Carolina, USA

nCino delivers a robust cloud-based banking platform built on Salesforce, serving commercial, small business, and retail banking segments. Renowned for streamlining loan origination, portfolio management, and compliance via automation, nCino’s solutions embody AI-driven operations and cloud core banking migrations. The platform fosters real-time data analytics, allows seamless integration with third-party fintechs through open APIs, and drives digital transformation for over 1,850 financial institutions worldwide, keeping pace with the latest industry trends in the digital banking era.

Are you ready to discover more about the digital banking platform market?

The report provides an in-depth analysis of the leading companies operating in the global digital banking platform market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Mambu

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Temenos

- Finastra

- Backbase

- nCino

- Oracle FLEXCUBE

- Finacle

- ebankIT

- SDK.finance

- Others.

Conclusion

Digital banking platforms are transforming financial services through cloud migration, open banking ecosystems, and AI-powered automation. This evolution enables personalized and seamless customer experiences, real-time payments, and embedded finance integration. Banks, both traditional and challengers, are leveraging these trends to innovate rapidly, improve operational efficiency, and remain competitive in a digital-first world.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?