Top 50 Companies in Carbon Offset/Carbon Credit Market: Statistics Report Till 2035

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

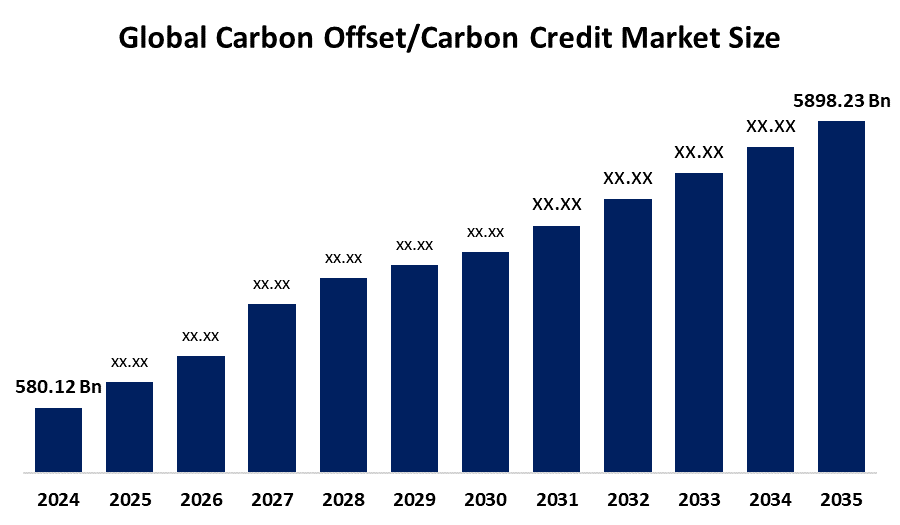

According to a research report published by Spherical Insights & Consulting, The Global Carbon Offset/Carbon Credit Market Size is projected to grow from USD 580.12 Billion in 2024 to USD 5898.23 Billion by 2035, at a CAGR of 23.47% during the forecast period 2025–2035. The demand for carbon credits has been increasing in recent years due to factors such as various government-introduced policies & regulations aimed at reducing greenhouse gas (GHG) emissions.

Introduction

The carbon offset/carbon credit market enables individuals, companies, and governments to compensate for their greenhouse gas emissions by investing in environmental projects that reduce or capture carbon. Benefits include promoting sustainable development, encouraging clean technology, and aiding in climate change mitigation. The renewable energy, reforestation, and carbon capture projects, attracting investments and fostering green innovation. Governments worldwide support the market through policies like cap-and-trade systems, tax incentives, and international agreements such as the Paris Agreement. These initiatives aim to meet emissions targets, promote transparency, and ensure the credibility of carbon credits. As climate concerns grow, the carbon market plays a crucial role in global sustainability efforts while creating economic value through environmental responsibility.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Carbon Offset/Carbon Credit Market.Carbon Offset/Carbon Credit Market Size & Statistics

- The Market Size for Carbon Offset/Carbon Credit Was Estimated to be worth USD 580.12 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 23.47% between 2025 and 2035.

- The Global Carbon Offset/Carbon Credit Market Size is anticipated to reach USD 5898.23 Billion by 2035.

- Europe is expected to generate the highest demand during the forecast period in the Carbon Offset/Carbon Credit Market

- Asia Pacific is expected to grow the fastest during the forecast period in the Carbon Offset/Carbon Credit Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the carbon offset/carbon credit market. The main economies of the world, including China, India, and Japan, are located in the Asia Pacific region, and each has a significant carbon footprint. These nations are increasingly focusing on sustainability and climate change mitigation, which is driving up demand for carbon offsets and credits. The Asia-Pacific region also provides a range of carbon offset programs, including waste management, renewable energy, and forest conservation, all of which support the market's rapid growth.

Europe is expected to generate the highest demand during the forecast period in the carbon offset/carbon credit market. The strict government regulations and targets to reduce greenhouse gas emissions, which made carbon offsets more necessary. Furthermore, European nations assert a long history of sustainability and ecological concern, which has led to a greater understanding and acceptance of carbon offset innovations. Furthermore, the large number of established carbon offset projects and organizations in the region has reinforced Europe's leadership in the carbon offset/carbon credits market. This covers actions like installing renewable energy, reforestation, and methane collection.

Top 10 trends in the Carbon Offset/Carbon Credit Market

- Focus on High-Integrity Credits

- Surge in Voluntary Carbon Market (VCM)

- Nature-Based Solutions (NbS)

- Technology-Driven Carbon Removal

- Blockchain and Digital MRV Tools

- Standardization and Regulation

- Tokenization and Carbon Credit Exchanges

- Corporate Insetting

- Carbon Price Volatility and Differentiation

- Government and Compliance Market Expansion

Focus on High-Integrity Credits

High-integrity credits represent real, measurable, additional, and permanent emission reductions or removals. These credits undergo stringent third-party verification to ensure compliance with globally recognized standards such as Verra and the Gold Standard. In light of growing concerns over greenwashing, buyers are increasingly prioritizing transparent, science-backed offsets. High-integrity credits enhance market credibility, support genuine climate action, and align closely with corporate ESG and net-zero objectives making them an indispensable element of a trustworthy and effective carbon trading ecosystem.

Surge in the Voluntary Carbon Market (VCM)

The Voluntary Carbon Market is witnessing rapid expansion as businesses and individuals commit to net - zero targets beyond regulatory mandates. Within the carbon offset and credit sector, the VCM enables organizations to voluntarily purchase credits to compensate for their emissions. This surge is fueled by heightened environmental awareness, investor expectations, and corporate sustainability commitments. As demand escalates, the VCM is evolving with stronger standards, greater transparency, and a wider variety of project types positioning it as a vital driver of global climate action and carbon finance innovation.

Nature-Based Solutions (NbS)

Nature-based solutions leverage ecosystems to naturally absorb or mitigate carbon emissions, forming a crucial pillar of the carbon offset market. Initiatives such as reforestation, afforestation, mangrove restoration, and soil carbon sequestration generate valuable credits while delivering additional benefits, including biodiversity preservation and water resource protection. With rising demand for sustainable, high-impact offsets, NbS are increasingly preferred for their scalability, cost - effectiveness, and alignment with global climate and environmental goals, cementing their role in credible offset strategies.

Technology-Driven Carbon Removal

Technological innovations are transforming the carbon credit market by offering permanent, measurable solutions for CO2 capture and storage. Methods such as Direct Air Capture (DAC), Bioenergy with Carbon Capture and Storage (BECCS), and carbon mineralization produce high-integrity credits backed by verifiable data. These approaches are gaining momentum due to their durability, scalability, and precision in quantifying results. As demand grows for robust, verifiable offsets, technology - based removal solutions are becoming essential to achieving long-term climate targets and reinforcing the integrity of carbon markets.

Blockchain and Digital MRV Tools

Emerging digital solutions are revolutionizing carbon market transparency, traceability, and trust. Blockchain technology provides secure, tamper-proof tracking of carbon credits, mitigating risks of fraud and double counting. Complementing this, digital MRV (Monitoring, Reporting, and Verification) tools harness satellites, AI, and IoT to deliver real-time, precise emissions data. Combined, these innovations enhance market integrity, streamline verification, and strengthen buyer and regulator confidence—accelerating the growth and efficiency of global carbon trading systems

Company Profiles

- South Pole

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- ClimatePartner

- EcoAct (an Atos company)

- Natural Capital Partners

- Verra

- Gold Standard

- Carbonfund.org

- Nori

- Pachama

- Project Vesta

- Climeworks

- Offsetra

- Others

Conclusion

The carbon offset/carbon credit market is poised for significant growth, with Asia Pacific leading in rapid expansion due to major economies like China, India, and Japan focusing on sustainability and diverse offset programs. Meanwhile, Europe is expected to generate the highest demand, driven by stringent government regulations, strong environmental commitment, and a well-established network of carbon offset projects. Together, these regions highlight the growing global emphasis on climate change mitigation and the vital role of carbon credits in achieving emission reduction targets.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?