Top 50 Companies in Blockchain Technology Market: Market Research Report (2024–2035)

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

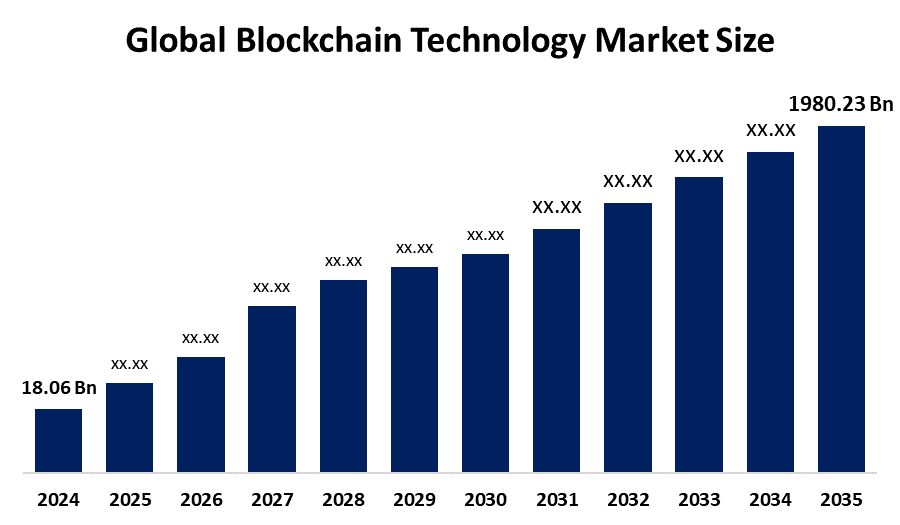

According to a research report published by Spherical Insights & Consulting, The Global Blockchain Technology Market Size is projected To Grow from USD 18.06 Billion in 2024 to USD 1980.23 Billion by 2035, at a CAGR of 53.27% during the forecast Period 2025–2035. The increasing need for e-identity is the main factor driving the blockchain technology market. In nations that require well-established regulatory frameworks and in regions with insufficient identification processes, blockchain-powered platforms have a wide range of uses.

Introduction

Blockchain is a decentralized digital record that makes transactions in a variety of businesses safe, transparent, and impenetrable. It now enables enterprise use in supply chains, identity management, and finance. Blockchain is becoming a vital component of digital transformation in business-to-business (B2B) ecosystems, driven by the need for automation, trust, and real-time verification. A number of factors are propelling the market for blockchain technology. A fundamental tenet of blockchain technology, decentralization, does away with the need for middlemen, enabling a network that is more resilient and transparent. Because it provides improved security, less reliance on centralized authorities, and higher efficiency, this has attracted interest from a variety of businesses. Smart contracts allow for trustless transactions, which guarantee that parties can enter into agreements without depending on a third party or central authority. This growing interest reflects a larger movement to improve privacy, empower people, and transform established structures of government and trust.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download The Brochure now and dive deeper into the future of the Blockchain Technology Market.

Blockchain Technology Market Size & Statistics

- The Market Size for Blockchain Technology Was Estimated to be worth USD 18.06 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 53.27% between 2025 and 2035.

- The Global Blockchain Technology Market Size is anticipated to reach USD 1980.23 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Blockchain Technology Market

- Asia Pacific is expected to grow the fastest during the forecast period in the Blockchain Technology Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the blockchain technology market. The region has seen tremendous growth as a result of the broad use of blockchain technology in a number of industries, such as digital identity, supply chain management, and financial services. The development of blockchain infrastructure is being fueled by significant investments from the public and private sectors. Important countries like China, Singapore, and Japan have played a significant role in this expansion. With large expenditures from both public and private organizations, China is clearly the country most interested in adopting blockchain technology.

North America is expected to generate the highest demand during the forecast period in the blockchain technology market. The region's broad adoption of blockchain technology has been greatly aided by the involvement of large firms like IBM, Microsoft, and Oracle in the development and investment of blockchain infrastructure. Furthermore, the area's financial services industry has seen a boom in the use of blockchain technology, with many banks and other financial organizations implementing it to provide safe and open payment systems.

Top 10 trends in the Blockchain Technology Market

- Expansion of Decentralized Finance (DeFi)

- NFTs diversify beyond digital art

- Advancements in blockchain interoperability

- Sustainability and green blockchain initiatives

- Enhanced privacy and security measures

- Rise of Central Bank Digital Currencies (CBDCs)

- Integration of Artificial Intelligence (AI) with blockchain

- Tokenization of real-world assets

- Growth of Blockchain-as-a-Service (BaaS)

- Blockchain for supply chain transparency and traceability

1. Expansion of Decentralized Finance (DeFi)

DeFi is maturing fast, moving beyond basic crypto lending to offering a full suite of financial services—without traditional intermediaries. In 2025, interoperability among DeFi protocols and deeper integration with the mainstream financial system are unlocking new avenues for global access, cross-chain transactions, and decentralized governance, reshaping who can participate in financial markets and how value flows.

2. NFTs Diversify Beyond Digital Art

NFTs, once mainly associated with digital art, are now established in industries like gaming (for in-game assets), real estate (tokenized ownership), intellectual property rights, and even event ticketing. This evolution enables secure verification, programmable functionality, and new revenue streams for creators, businesses, and end-users, expanding far past art collectibles.

3. Advancements in Blockchain Interoperability

Multiple blockchain networks now interact seamlessly. Through cross-chain bridges and protocols like Polkadot and Cosmos, developers can build applications that span different blockchains. This collaboration leads to greater scalability, innovation, and the creation of complex decentralized applications addressing one of blockchain’s longest-standing challenges.

4. Sustainability and Green Blockchain Initiatives

Concerns over blockchain’s energy usage have sparked a move to sustainable protocols like Proof of Stake (PoS), pH-neutral mining, and greener consensus algorithms. There’s rapid growth in eco-friendly blockchains, carbon offsetting, and regulatory compliance for environmental impact, making blockchain adoption more aligned with global sustainability goals.

5. Enhanced Privacy and Security Measures

As blockchain’s use grows in sensitive sectors (like healthcare and finance), privacy and security receive renewed focus. Technologies like zero-knowledge proofs, homomorphic encryption, and secure multi-party computation protect user data and transactions while enabling compliance with new data regulations, a must for broader enterprise uptake and trust.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the blockchain technology market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Blockchain Technology Market

- IBM

- Microsoft

- JPMorgan Chase

- Binance

- Ripple

- Consensys

- Bitfury

- Coinbase

- Blockstream

- Chainalysis

- R3

- Digital Asset Holdings

- Corda

- Anchain.AI

- Gem

- Altoros

- Hedera Hashgraph

- Kraken

- Block.one

- Bakkt

- Circle

- VeChain

- EOSIO

- IOHK

- Chainlink

1. IBM

Headquarters: New York, USA

IBM is a foundational leader in the blockchain technology market, driving global enterprise adoption through its IBM Blockchain Platform and early stewardship of the Hyperledger Fabric project. The company’s solutions enable trusted, permissioned blockchain networks for applications in finance, supply chain, and healthcare, emphasizing security, traceability, and workflow automation. IBM’s extensive patent portfolio and AI integration capabilities position it at the forefront of enterprise blockchain, offering consulting, digital asset tokenization, and performance-optimized systems. Recent years have seen IBM focus on blockchain for supply chain transparency, digital identity, and multi-party data sharing, aligning its offerings with the market’s demand for trust, privacy, and operational efficiency.

2. Microsoft

Headquarters: Redmond, Washington, USA

Microsoft is a top force in the global blockchain space with its Azure Blockchain Service, which provides enterprise-grade Blockchain-as-a-Service through a secure, scalable cloud framework. By leveraging Quorum, Azure supports decentralized applications, confidential ledgers, and tamperproof data solutions for large-scale business use. Microsoft’s approach integrates blockchain into existing business workflows, especially for supply chain transparency, digital identity, and multi-party collaboration. Emphasizing security, compliance, and interoperability, Microsoft is pivotal in blockchain innovation, facilitating Web3 and decentralized application development across industries worldwide.

3. JPMorgan Chase

Headquarters: New York, USA

JPMorgan Chase stands as the global leader in financial blockchain adoption, processing trillions through its Kinexys platform (formerly Onyx). It pioneered Liink, a permissioned blockchain dramatically streamlining interbank transfers, and JPM Coin, a recognized stablecoin for real-time payments. The bank’s focus on secure, scalable blockchain applications for instant settlements and reduced counterparty risk has shaped industry standards. As a founding member of several interbank blockchain consortia, JPMorgan continues to advance the use of digital assets, interoperability, and tokenized financial products within regulated environments.

4. Binance

Headquarters: Malta

Binance is the world’s leading blockchain ecosystem, best known for the largest cryptocurrency exchange globally. Beyond trading, Binance has developed its Binance Chain and BNB Chain, supporting thousands of decentralized apps and facilitating high-speed, low-cost transactions. Binance drives blockchain infrastructure through innovative financial products, NFT markets, and DeFi initiatives. Its subsidiaries enable cross-border payments, asset tokenization, and blockchain education, offering users robust security, scalability, and global market access. Binance’s relentless innovation cements its leadership in crypto, DeFi, and blockchain’s real-world adoption.

5. Ripple

Headquarters: San Francisco, USA

Ripple is a fintech powerhouse revolutionizing global payments with blockchain. Its RippleNet leverages blockchain and its native XRP token to provide seamless, cost-effective international transfers for banks, businesses, and governments. Ripple’s solutions, designed for speed and transparency, have redefined cross-border settlements by partnering with leading financial institutions worldwide. Its focus on enterprise-grade blockchain and regulatory compliance propels its adoption in digitized financial infrastructure for the digital economy era, helping unleash the full potential of blockchain for financial services.

Are you ready to discover more about the blockchain technology market?

The report provides an in-depth analysis of the leading companies operating in the global blockchain technology market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- IBM

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Microsoft

- JPMorgan Chase

- Binance

- Ripple

- Consensys

- Bitfury

- Coinbase

- Blockstream

- Others.

Conclusion

Blockchain technology is evolving into an essential foundation for digital trust and transparency across global industries. Growth is driven by the expansion of decentralized finance (DeFi), interoperability advancements, sustainability initiatives, and applications beyond cryptocurrency, such as supply chain and digital identity. The integration of AI, IoT, and privacy-enhancing features is expanding blockchain’s business utility. As enterprise adoption accelerates, the market is positioned for mainstream relevance in secure, traceable, and efficient digital transactions.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?