Top 50 Chemical Vapor Deposition Companies in Globe 2025: Statistics View by Spherical Insights & Consulting

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

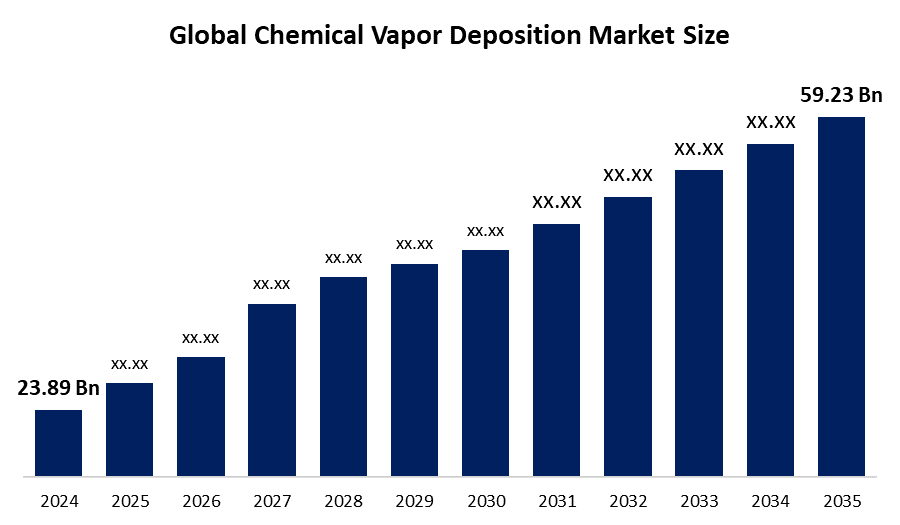

According to a research report published by Spherical Insights & Consulting, The Global Chemical Vapor Deposition Market Size is projected to Grow from USD 23.89 Billion in 2024 to USD 59.23 Billion by 2035, at a CAGR of 9.5 % during the forecast period 2025–2035. The chemical vapor deposition (CVD) market offers future opportunities in semiconductor manufacturing, solar energy, nanotechnology, biomedical devices, and advanced coatings, driven by precision surface engineering and growing demand for miniaturized electronics.

Introduction

The chemical vapor deposition (CVD) market refers to the industry focused on the use of a vacuum-based chemical process to deposit thin films or coatings onto various substrates. This technique involves the reaction of vapor-phase chemicals that produce high-purity, high-performance solid materials used in electronics, optics, aerospace, and medical applications. Key driving factors fueling market growth include the expanding semiconductor and microelectronics industry, increasing demand for high-efficiency solar panels, advancements in nanotechnology and medical implants, and the need for durable, wear-resistant coatings. The shift toward miniaturized, energy-efficient devices further boosts the adoption of CVD technologies across multiple end-use sectors.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights—Download the Brochure now and dive deeper into the future of the chemical vapor deposition market.

Chemical Vapor Deposition Market Size & Statistics

- The Market Size for Chemical Vapor Deposition was Estimated to be Worth USD 23.89 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 9.5 % between 2025 and 2035.

- The Global Chemical Vapor Deposition Market Size is Anticipated to Reach USD 59.23 Billion by 2035.

- Asia Pacific is Expected to generate the highest demand during the forecast period in the chemical vapor deposition market.

- North America is Expected to Grow the fastest during the forecast period in the Chemical Vapor Deposition market.

Regional growth and demand

North America is expected to grow the fastest during the forecast period in the chemical vapor deposition market.

North America, especially the United States, holds an important position in the worldwide CVD market. The area serves as a center for semiconductor production, advanced research, and innovation. The existence of prominent tech firms, research organizations, and semiconductor fabrication facilities fuels the need for CVD tools and materials.

Asia Pacific is expected to generate the highest demand during the forecast period in the chemical vapor deposition market.

The Asia-Pacific region, especially China, South Korea, and Taiwan, dominates the worldwide CVD market. This region is an industrial hub, specializing in electronics, semiconductors, and solar energy. Due to its large semiconductor and electronics sectors, the Asia-Pacific region uses the greatest amount of CVD equipment, materials, and services.

Top Key Drivers & Chemical Vapor Deposition Trends

- Growing Demand from the Semiconductor and Electronics Industry

The semiconductor industry is a major driver of the chemical vapor deposition market. CVD technology is essential for manufacturing advanced integrated circuits and microelectronic devices by enabling precise, uniform, and high-purity thin film deposition. As demand surges for faster, smaller, and more powerful consumer electronics, including smartphones, laptops, and wearable devices, the need for CVD processes increases. Additionally, the expansion of 5G networks, artificial intelligence, and IoT devices fuels CVD adoption for next-gen chip fabrication. The ongoing transition to smaller nodes (e.g., 5nm, 3nm) further intensifies the need for advanced CVD solutions to support complex architectures.

- Rising Adoption in Solar Energy and Renewable Technologies

The global shift toward clean energy sources are accelerating the demand for high-efficiency photovoltaic (PV) cells, significantly driving the chemical vapor deposition market. CVD plays a pivotal role in producing thin-film solar cells and coatings for anti-reflective and conductive layers, enhancing energy conversion efficiency. The growing adoption of solar energy in residential, commercial, and utility-scale projects combined with government incentives and climate targets is boosting investment in advanced solar technologies. As the need for cost-effective and scalable production methods grows, CVD systems become vital for achieving uniform deposition on large surfaces, ensuring consistent performance and reduced manufacturing costs.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the chemical vapor deposition market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 5 Chemical Vapor Deposition Solutions Impacting the Materials Industry

1. Grolltex – Graphene Manufacturing

Chemical vapor deposition produces thin films of substances that exhibit consistency, impermeability, and cleanliness. Present advancements in materials, such as premium graphene rolls and thin films, are crucial for high-performance electronics, displays, and sensors. CVD also allows for the production of items with a consistent thickness of a single atom over the whole surface, in a budget-friendly way. The startup Grolltrex, located in the US, produces sheets made of single-layer graphene and boron nitride. The startup produces single-layer graphene sheets through a patented chemical vapor deposition method for transfer and processing. This technique enables Grolltrex to produce high-quality graphene products while also providing them at reduced prices.

2. DropWise – Polymer Thin-Film Coatings

Chemical vapor deposition is utilized to create high-quality and high-performance materials that demand precision in their manufacturing process, particularly in thin films. CVD offers chances for new startups to develop innovative materials by integrating thin-films with different polymers. Polymer films are adaptable materials used in protective and functional coatings, bio-surfaces, microfluidics, sensors, adhesion, and friction and lubrication modification, among various other applications. This also aids in promoting progress in nanotechnology and biomedical applications. The US startup DropWise specializes in producing functional polymer thin-film coatings through chemical vapor deposition. DropWise addresses certain issues associated with conventional CVD techniques regarding accuracy by utilizing their non-line of sight coating approach. This solvent-free coating method at low temperatures enables the development of substrates that react to alterations in temperature or chemical composition.

3. Epiluvac – Gallium Nitride (GaN) & Silicon Carbide (SiC) Deposition

The semiconductor sector is shifting towards utilizing SiC and GaN as possible alternatives to existing silicon-based materials. Los semiconductors Sic y GaN, en particular, pedant supporter voltages y frequencies mass altos en products electronica’s. This prompts materials startups to offer effective CVD systems to quickly and efficiently manufacture SiC and GaN semiconductors. The Swedish company Epiluvac creates and produces cutting-edge CVD epitaxy reactors. The startup utilizes its patented cross-flow design to enhance gas flow concentration on the substrate, thereby reducing undesired deposition. This approach mitigates some issues associated with hot-wall CVD systems by decreasing the duration of reactor upkeep. Epiluvac’s CVD epitaxial reactors for SiC and GaN provide excellent uniformity, a modular structure, automation features, and are ideal for research and development (R&D) applications.

4. Forge Nano – Particle Atomic Layer Deposition (ALD)

The adoption of chemical vapor deposition is swiftly increasing in numerous sectors because of its accurate material deposition. Additionally, the technology facilitates the creation of novel and cutting-edge manufacturing methods. Nonetheless, the majority of CVD systems are presently created for very specific uses. New startups are developing appropriate CVD systems to facilitate extensive commercial production. The company Forge Nano, located in the US, produces particle ALD systems intended for extensive commercial use. The startup utilizes unique high-throughput methods to enhance nano-coating management and surface engineering for its customers. This ALD system is used to enhance a variety of materials such as powders, sheets, and various items. Forge Nano’s CVD systems also offer advantages regarding material management and coating. For instance, when creating air-sensitive substances, electrodes for electronic gadgets, and moisture-absorbing halide-derived materials, among others.

5. Enhelios – Spatial ALD Thin-Film Printer

The rising demand for renewable energy, especially solar power, is fueled by the declining prices of effective solar energy collection systems. The ongoing enhancement of the cost-to-performance ratio of photovoltaics (PV) results from the research and development initiatives of companies specializing in deposition technology. Improvements in CVD methods allow startups to restructure manufacturing processes and also enhance and optimize products for superior performance. French startup Enhelios employs spatial ALD to create thin-film printers that incorporate passivation, capping layer deposition, and contact opening. The startup's modular thin-film printers handle one or several wafers per printing head, based on its use in research and development or manufacturing. EnHelios’ printers allow for rapid layer deposition with precision at the micrometer scale. This technology is used in photovoltaics, electronics, sensors, and optics, among various other fields. For instance, the company’s printers produce rear-passivated solar cells (PERC), removing the necessity for employing various tools or methods for their manufacturing.

Top 16 Companies Leading the Chemical Vapor Deposition Market

- CVD Equipment Corporation

- Tokyo Electron Limited

- IHI Corporation

- Veeco Instruments Inc.

- ASM International NV

- Plasma Therm LLC

- Applied Materials Inc.

- Oerlikon Group

- Voestalpine AG

- ULVAC Inc.

- Aixtron SE

- Taiyo Nippon Sanso Corporation

- LPE

- Nuflare Technology Inc.

- RIBER

- Others

1. CVD Equipment Corporation

Headquarters: Central Islip, New York, USA

CVD Equipment Corporation is a leading provider of chemical vapor deposition systems, equipment, and process solutions used in research and production across various sectors, including aerospace, medical, semiconductors, and energy. Founded in 1982, the company specializes in designing and manufacturing custom CVD systems for advanced materials like graphene, carbon nanotubes, and silicon carbide. With a strong focus on innovation and quality, CVD Equipment supports both universities and industrial clients in scaling up their technologies for commercial applications. Its advanced systems play a critical role in material science research and next-generation device fabrication.

2. Tokyo Electron Limited (TEL)

Headquarters: Tokyo, Japan

Tokyo Electron Limited is one of the world’s top semiconductor and flat panel display production equipment manufacturers. Founded in 1963, TEL provides cutting-edge equipment and services used in the fabrication of integrated circuits and other advanced electronic components. With a robust portfolio that includes CVD, etching, and cleaning tools, the company plays a vital role in the evolution of the global electronics industry. Known for its emphasis on precision, innovation, and customer collaboration, TEL maintains strong partnerships with major chipmakers and display manufacturers around the world. The company operates across Asia, Europe, and North America.

3. IHI Corporation

Headquarters: Tokyo, Japan

IHI Corporation, formerly known as Ishikawajima-Harima Heavy Industries, is a diversified engineering and manufacturing company offering a wide range of products and services. Its core businesses span aerospace, energy systems, industrial machinery, infrastructure, and chemical processing equipment, including CVD systems. With a history dating back to 1853, IHI is renowned for its large-scale infrastructure solutions and industrial innovation. The company supports a global customer base through its advanced engineering capabilities and commitment to sustainability. IHI’s Chemical Process Equipment Division supplies high-performance vacuum and deposition systems that are critical to semiconductor and materials industries.

4. Veeco Instruments Inc.

Headquarters: Plainview, New York, USA

Veeco Instruments Inc. is a prominent supplier of process equipment used to develop and manufacture high-tech electronic devices, such as LEDs, power electronics, MEMS, and semiconductor chips. The company specializes in thin film process technologies, including molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD). With decades of innovation, Veeco serves customers in data storage, advanced packaging, and compound semiconductors. Its customizable, high-performance systems are trusted by leading manufacturers worldwide. Veeco’s R&D-driven approach ensures that its customers remain competitive in evolving markets like 5G, electric vehicles, and photonics.

5. ASM International N.V.

Headquarters: Almere, Netherlands

ASM International N.V. is a global leader in semiconductor wafer processing technologies, specializing in deposition solutions such as atomic layer deposition (ALD), epitaxy, and CVD. Founded in 1968, the company provides advanced equipment used by the world’s top chip manufacturers to build next-generation semiconductor devices. ASM focuses heavily on innovation, sustainability, and precision engineering to meet the growing complexity of semiconductor design. With R&D centers in Europe, the U.S., and Asia, ASM continues to drive advancements in materials and device performance. Its tools play a crucial role in enabling Moore’s Law and shrinking chip geometries.

Are you ready to discover more about the chemical vapor deposition market?

The report provides an in-depth analysis of the leading companies operating in the global chemical vapor deposition market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- CVD Equipment Corporation.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Tokyo Electron Limited

- IHI Corporation

- Veeco Instruments Inc.

- ASM International NV

- Plasma Therm LLC

- Applied Materials Inc.

- Oerlikon Group

- Voestalpine AG

- ULVAC Inc.

- Aixtron SE

- Taiyo Nippon Sanso Corporation

- LPE

- Nuflare Technology Inc.

- RIBER

- Others

Conclusion

The chemical vapor deposition (CVD) market is poised for robust growth, driven by advancements in semiconductor manufacturing, renewable energy technologies, and high-performance materials. As industries increasingly demand precision, miniaturization, and energy efficiency, CVD technologies are becoming indispensable across electronics, biomedical, and nanotechnology sectors. The presence of innovative startups and established global players is accelerating the adoption of advanced deposition solutions. With strong regional contributions from Asia Pacific and North America, the market continues to evolve, offering vast opportunities for both existing and emerging stakeholders. Staying informed through research and insights will be key to capitalizing on this dynamic market landscape.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?