Top 50 Cellular Agriculture Companies in Globe 2025: Statistics View by Spherical Insights & Consulting

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

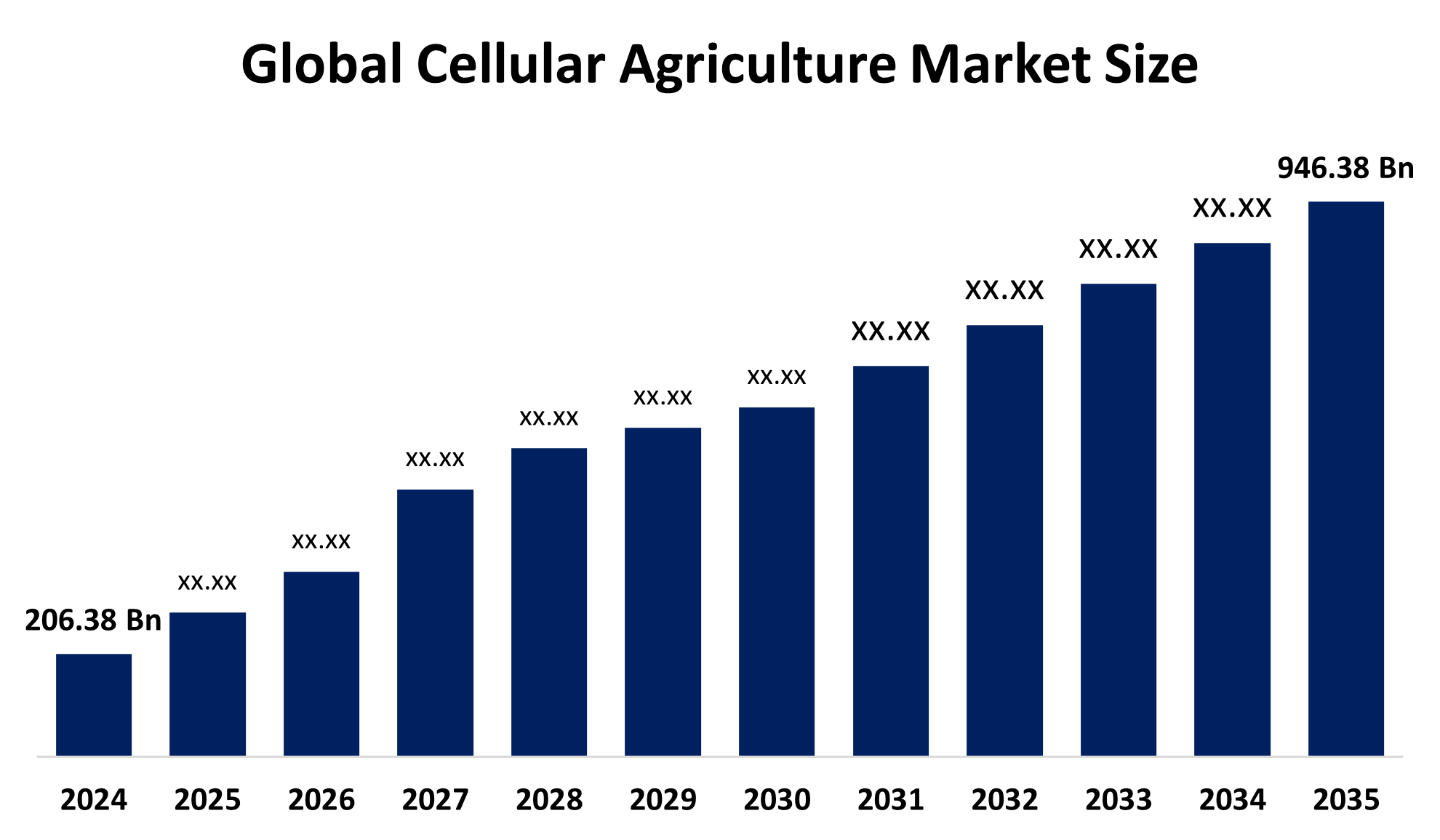

According to a research report published by Spherical Insights & Consulting, The Global Cellular Agriculture Market Size is projected to grow from USD 206.38 Billion in 2024 to USD 946.38 billion by 2035, at a CAGR of 16.45 % during the forecast period 2025–2035. Cellular agriculture offers sustainable alternatives to traditional farming, enabling eco-friendly meat, dairy, and leather production with reduced environmental impact.

Introduction

The cellular agriculture market refers to the industry focused on producing agricultural products like meat, dairy, and leather directly from cells using biotechnological methods, rather than raising and harvesting animals. This innovative field leverages tissue engineering, fermentation, and synthetic biology to develop sustainable and ethical alternatives to traditional farming. Key driving factors include rising global demand for protein, growing environmental concerns, increasing animal welfare awareness, and technological advancements in cell culture and bioprocessing. Additionally, regulatory support and investments from food-tech startups and major food corporations are accelerating market growth and commercialization across the globe.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Cellular Agriculture Market Size & Statistics

The market for Cellular Agriculture was estimated to be worth USD 206.38 Billion in 2024.

The market is going to expand at a CAGR of 16.45 % between 2025 and 2035.

The Global Cellular Agriculture Market is anticipated to reach USD 946.38 Billion by 2035.

Asia Pacific is expected to generate the highest demand during the forecast period in the cellular agriculture market.

North America is expected to grow the fastest during the forecast period in the cellular agriculture market.

Regional growth and demand

North America is expected to grow the fastest during the forecast period in the cellular agriculture market. The main reason for this is the region's substantial investment in cellular agriculture technologies. Considerable research and development efforts have been supported by continuous funding from various channels, such as governmental subsidies, private financiers, and venture capital firms. These experiments have resulted in significant advancements and improvements in the field, including improved cell culture methods, superior bioreactor designs, and increased scalability of manufacturing processes. For example, in 2021, the Sustainable Agricultural Systems (SAS) program of USDA-NIFA made a landmark investment in cultivated meat research by granting Tufts University a 10 million five-year award to launch the National Institute for Cellular Agriculture, the inaugural government-funded cultivated protein research center in the U.S.

Asia Pacific is expected to generate the highest demand during the forecast period in the cellular agriculture market. This has been attributed to raising awareness among consumers about healthy eating habits in the Asia-Pacific region. A growing variety of plant-derived meat alternatives, health benefits, environmental sustainability, animal rights, and cost-effectiveness are the key factors fostering growth in the Asia Pacific area. In October 2023, a newly established forum consisting of industry stakeholders from nine Asia-Pacific countries seeks to enhance collaboration to advance the region’s regulatory approval of cultivated meat. The APAC Regulatory Coordination Forum is described as a platform for transnational dialogue among cell-cultured food producers, industry groups and organizations, regulatory bodies and government entities across different jurisdictions, alongside the APAC Society for Cellular Agriculture and the Good Food Institute APAC.

Top 10 Cellular Agriculture Trends

- Cultured Meat

- Plant-based Cell Development

- Precision Fermentation

- Protein Engineering

- Advanced Bioreactors

- Bioengineered Materials

- Production Analytics

- Bioprinting

- Stem Cell Media

- Seafood Substitutes

1. Cultured Meat

Cellular agriculture allows meat production from animal cells without slaughter, reducing emissions and ensuring safe, hormone-free meat. Startups tackle challenges like thick tissue growth and sensory differences using tissue engineering, novel cell lines, and biosynthesis to improve texture and taste

- Cellx develops Hybrid Structured Meat

Chinese startup Cellx develops multi-species cell-based meat using core technologies in cell lines, scaffolds, and 3D bioprinting for safe, scalable, and cost-effective meat production.

- Luyef provides Bovine Myoglobin-based Meat Alternative

Chilean startup Luyef creates TAMEE, a bovine myoglobin-based ingredient that enhances the texture and taste of plant-based meats to mimic real meat.

2. Plant-based Cell Development

Plant-based cell line development supports sustainable meat alternatives with low-fat, allergen-free profiles, reduced GHG emissions, and tailored nutritional properties using genetically modified plant cells and recombinant proteins.

- Matrix Foods develops Nanofiber Scaffolds & Microcarriers

Matrix Foods is a US-based startup that creates plant-based and synthetic 3D nanofiber scaffolds and microcarriers to support cultivated protein growth. Their ACF, food-safe scaffolds mimic meat texture and enhance cell adhesion.

- Tiamat Sciences enables Plant Molecular Farming

Tiamat Sciences, a US-based startup, leverages plant molecular farming and vertical bioreactors to produce animal-free recombinant proteins and growth factors for cultivated meat and healthcare applications, reducing costs and time to market.

3. Precision Fermentation

Precision fermentation enables safe, scalable, and efficient production of animal-free proteins by genetically engineering microbes to create high-yield, high-value proteins with desired amino acid profiles and functional properties.

- Formo develops Animal Free Dairy Protein

German startup Formo produces animal-free cheese using precision fermentation. It engineers microorganisms to create dairy proteins like whey and casein, enabling lactose-, hormone-, and antibiotic-free cheese with authentic texture and taste.

- Air Protein develops Air-based Alternative Meat

US-based startup Air Protein produces sustainable alternative meat using air fermentation. Microbes consume CO2 and O2 to create protein-rich flour, enabling carbon-negative, renewable, animal-free meat with authentic texture and taste.

4. Protein Engineering

Innovations in protein production allow startups to create alternative proteins with enhanced nutrition, taste, and texture. Using gene editing, 3D structures, AI, and big data, they optimize yields and reduce waste.

- Shiru provides a Protein Discovery Platform

US-based startup Shiru builds Flourish, an ML-powered platform that identifies functional plant-based proteins for sustainable meat alternatives using bioinformatics and precision fermentation.

- Core Biogenesis produces Recombinant Proteins

French startup Core Biogenesis creates plant-based recombinant growth factors using engineered camelina seeds. Its oleosin fusion tech enables scalable, sustainable protein production for 3D cell culture and cultivated meat applications.

5. Advanced Bioreactors

Startups develop smart, scalable bioreactors with 3D scaffolds and sensors to reduce costs, enhance yield, and optimize cellular agriculture production.

- Ark Biotech Manufactures Industrial Bioreactors

Ark Biotech, a US-based startup, develops sensor-equipped, energy-efficient bioreactors and software to optimize and scale cultivated meat production with reduced operational costs.

- Unicorn Biotech offers Automated Biomanufacturing Systems

Unicorn Biotech, a UK-based startup, creates modular bioreactors and a cloud platform to automate, monitor, and scale mammalian cell-based meat production efficiently and affordably.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the cellular agriculture sector. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 11 Companies Leading the Cellular Agriculture Market

- DuPont

- ADM

- Kerry Group

- Ingredion Incorporated

- Roquette Frères

- PURIS

- Cargill

- Axiom Foods

- Sonic Biochem Ltd

- Crespel & Deiters

- Wilmar International Limited

- Sotexpro S.A

- The Nisshin OilliO Group

- A&B Ingredients

- Others

1. DuPont

Headquarters: Wilmington, Delaware, USA

DuPont is a global science and innovation company known for its contributions to nutrition, biosciences, and biotechnology. In the cellular agriculture market, DuPont plays a critical role by supplying ingredients, enzymes, and cultures used in alternative proteins and fermentation-based food technologies. The company leverages its expertise in biotechnology and fermentation to develop sustainable solutions for food, materials, and health sectors. With a strong emphasis on research and innovation, DuPont supports the development of animal-free dairy proteins, precision fermentation, and sustainable food systems. Its strategic collaborations and acquisitions aim to advance food innovation while meeting global sustainability and nutrition demands.

2. ADM (Archer Daniels Midland Company)

Headquarters: Chicago, Illinois, USA

ADM is a global leader in agricultural origination and processing, specializing in plant-based nutrition, alternative proteins, and biotechnologies. In the cellular agriculture space, ADM develops fermentation-ready inputs, functional ingredients, and support for precision fermentation and cultured meat production. The company’s robust global infrastructure and R&D capabilities support sustainable food innovation. ADM offers solutions that improve taste, texture, and nutrition in alternative meat and dairy products. By investing in startup partnerships and innovation centers, ADM accelerates the commercialization of next-gen food technologies, helping meet the rising consumer demand for clean-label, eco-friendly, and high-protein food solutions worldwide.

3. Kerry Group

Headquarters: Tralee, County Kerry, Ireland

Kerry Group is a global taste and nutrition company that delivers science-based ingredients and solutions to the food and beverage industry. In cellular agriculture, Kerry supports startups and manufacturers with fermentation-based flavor systems, functional proteins, and clean-label ingredients to enhance plant-based and cultured food products. The company’s advanced R&D centers help develop solutions that mimic animal-based flavor and texture, improving consumer acceptance of alternative proteins. With a strong focus on sustainability and innovation, Kerry partners across the value chain to support the development of ethical and nutritious food technologies. Its portfolio addresses global dietary shifts toward alternative, functional, and health-focused food.

4. Ingredion Incorporated

Headquarters: Westchester, Illinois, USA

Ingredion is a leading global ingredients solutions company focused on starches, sweeteners, plant-based proteins, and clean-label ingredients. The company supports the cellular agriculture industry with plant-derived proteins, texturizers, and emulsifiers that serve as key components in the formulation of meat and dairy alternatives. Ingredion invests in innovation centers and sustainable sourcing to support the growing alternative protein market. It collaborates with startups and food tech firms to enhance product development using pea protein, faba bean protein, and other novel ingredients. Ingredion’s solutions support clean-label, non-GMO, and allergen-friendly food innovations aimed at sustainability and improved consumer nutrition.

5. Roquette Freres

Headquarters: Lestrem, Hauts-de-France, France

Roquette Freres is a global leader in plant-based ingredients and pharmaceutical excipients. The company plays a pivotal role in the cellular agriculture and alternative protein sectors by offering a wide range of pea, wheat, and potato-based proteins. Roquette’s solutions enhance the structure, texture, and nutritional value of cultivated meats and dairy alternatives. It actively supports clean-label and sustainable food production through investments in biorefineries and research partnerships. The company’s strong focus on innovation enables food manufacturers to replace animal proteins without compromising taste or functionality. Roquette’s plant protein expertise contributes to sustainable food systems and improved consumer health.

Are you ready to discover more about the cellular agriculture market?

The report provides an in-depth analysis of the leading companies operating in the global cellular agriculture market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- DuPont

Business Overview

Company Snapshot

Products Overview

Company Market Share Analysis

Company Coverage Portfolio

Financial Analysis

Recent Developments

Merger and Acquisitions

SWOT Analysis

- ADM

- Kerry Group

- Ingredion Incorporated

- Roquette Freres

- PURIS

- Cargill

- Axiom Foods

- Sonic Biochem Ltd

- Crespel & Deiters

- Wilmar International Limited

- Sotexpro S.A

- The Nisshin OilliO Group

- A&B Ingredients

- Others

Conclusion

The cellular agriculture market is rapidly transforming the global food system by offering sustainable, ethical, and scalable alternatives to traditional animal farming. Driven by technological advancements, environmental concerns, and growing consumer demand for clean-label and cruelty-free products, the sector is reshaping how food is produced. Innovations in precision fermentation, bioreactor design, and protein engineering are accelerating the development and commercialization of alternative meat, dairy, and other agricultural products. Leading companies are supporting this shift through research, partnerships, and sustainable solutions. As regulatory frameworks evolve, cellular agriculture is set to become a cornerstone of a resilient, eco-friendly, and nutritious global food future.

Need help to buy this report?