Top 30 Hedge Fund Companies in Globe 2025: Statistics View by Spherical Insights and Consulting

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

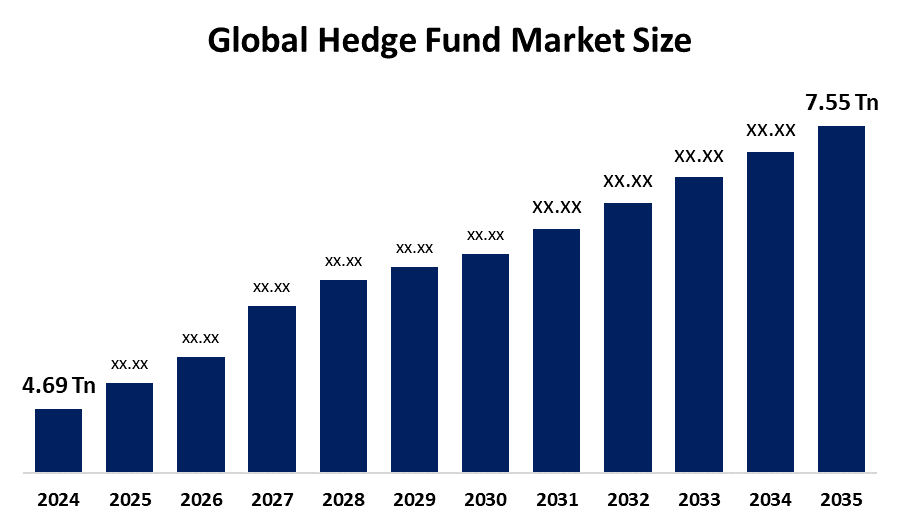

According to a research report published by Spherical Insights & Consulting, The Global Hedge Fund Market Size is projected To Grow from USD 4.69 Billion in 2024 to USD 7.55 Trillion by 2035, at a CAGR of 4.88 % during the forecast period 2025–2035. The hedge fund market offers opportunities in AI-driven strategies, ESG-focused investments, emerging markets, and digital assets, fueled by technological innovation, evolving regulations, and growing demand for diversified, risk-adjusted returns in dynamic global financial environments.

Introduction

The Hedge Fund Market Size is evolving as a dynamic segment of the global financial ecosystem, offering investors opportunities for diversification, higher returns, and innovative strategies. Hedge funds leverage advanced techniques such as algorithmic trading, quantitative analysis, and alternative investments to generate competitive performance across varying market conditions. With growing interest in ESG-compliant portfolios, digital assets, and emerging market opportunities, hedge funds are becoming more adaptive and sophisticated. Technological advancements and big data analytics are further enhancing decision-making and risk management. As global economic uncertainties persist, hedge funds continue to play a critical role in delivering strategic, risk-adjusted growth for institutional and individual investors.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Hedge Fund market.

Hedge Fund Market Size & Statistics

- The Market Size for Hedge Fund Was Estimated to be Worth USD 4.69 Trillion in 2024.

- The Market Size is going to Expand at a CAGR of 4.88 % Between 2025 and 2035.

- The Global Hedge Fund Market Size is Anticipated to Reach USD 7.55 Trillion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Hedge Fund Market.

- Asia Pacific is expected to grow the fastest during the forecast period in the Hedge Fund Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the Hedge Fund market. This swift expansion is fueled by the region's flourishing economies, rising affluence, and a growing number of high-net-worth individuals looking for varied investment options. The rules in major financial hubs such as Hong Kong and Singapore are becoming increasingly strong and clear, enhancing investor trust. Global hedge fund managers are increasingly interested in establishing a presence in Asia, drawn by the unexploited investment potential. The area’s technological progress in hedge fund software bolsters its rapid expansion.

North America is expected to generate the highest demand during the forecast period in the Hedge Fund market. The existence of a robust financial infrastructure and numerous hedge fund companies, particularly in financial centers such as New York and Connecticut, fuels the local market. The area gains from funding by institutional investors, such as pension funds, endowments, and insurance firms, looking for portfolio diversification and asset management options.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Hedge Fund market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 5 Trends in Hedge Fund Market

1. Rise of AI and Algorithmic Trading

Artificial Intelligence (AI) and machine learning are transforming hedge fund strategies, enabling faster, data-driven decision-making. Algorithmic trading leverages big data, predictive analytics, and automation to identify patterns, manage risk, and execute trades with precision. Funds are increasingly investing in proprietary algorithms to gain a competitive edge, improve accuracy, and reduce human biases. This trend also enhances portfolio diversification and supports complex trading strategies, such as high-frequency and quantitative trading. As technology advances, AI-driven hedge funds are expected to dominate the market, offering innovative approaches to generate consistent, risk-adjusted returns in volatile and complex financial environments.

2. Growth of ESG-Focused Investments

Environmental, Social, and Governance (ESG) criteria are becoming central to hedge fund strategies as investors demand responsible and sustainable investment options. Funds are integrating ESG factors into risk assessment, portfolio construction, and performance evaluation. This shift is driven by regulatory changes, growing awareness of climate risks, and the rising appeal of socially responsible investing. ESG focused hedge funds are gaining popularity among institutional investors, providing opportunities to align profitability with purpose. By targeting companies with strong sustainability practices and transparent governance, these funds are reshaping market behavior while delivering long-term value and addressing global environmental and social challenges.

3. Expansion into Digital Assets and Cryptocurrencies

Hedge funds are increasingly exploring digital assets, including cryptocurrencies, blockchain based tokens, and decentralized finance (DeFi) platforms, as part of their diversification strategies. These assets offer high-return potential and hedge against traditional market volatility. Funds are developing expertise in blockchain analytics, regulatory compliance, and custody solutions to manage risks effectively. With institutional adoption growing and clearer regulations emerging, digital assets are becoming a mainstream alternative investment class. This trend reflects the hedge fund industry’s adaptability and appetite for innovation, positioning digital asset-focused funds as key players in shaping the future of alternative investments and next-generation financial markets.

4. Data-Driven and Quantitative Strategies

The rise of big data analytics and quantitative models is reshaping hedge fund investment approaches. Funds now leverage alternative data sources such as satellite imagery, web traffic, and sentiment analysis to gain deeper market insights. These strategies enhance portfolio performance by identifying trends and anomalies that traditional analysis might miss. Quant-driven approaches also allow for more precise risk management and improved forecasting. As competition intensifies, hedge funds are investing heavily in data infrastructure and analytics capabilities to maintain an edge. This trend underscores the importance of technology and innovation in sustaining profitability and adaptability in the rapidly evolving financial landscape.

5. Increasing Regulatory Compliance and Transparency

Heightened regulatory scrutiny and investor demand for transparency are driving operational changes in the hedge fund market. Funds are adopting more robust compliance frameworks, enhanced reporting systems, and advanced risk management tools. Regulatory bodies worldwide are enforcing stricter rules on disclosures, anti-money laundering (AML), and investor protection. While these requirements pose operational challenges, they also build investor confidence and attract institutional capital. By improving governance, accountability, and operational efficiency, hedge funds can strengthen their market reputation. This trend reflects the industry’s shift toward sustainable growth, balancing innovation with the need for trust and regulatory alignment in global markets.

Top 16 Companies Leading the Hedge Fund Market

- Two Sigma Investments

- Renaissance Technologies

- Citadel Enterprise Americas

- Elliott Investment Management

- Millennium Management

- Davidson Kempner Capital Management

- Man Group

- Bridgewater Associates

- AQR Capital Management

- BlackRock

- TCI Fund Management

- D.E. Shaw Group

- Farallon Capital Management

- Ruffer Investment Company

- Winton Capital Management

- Others

1. Two Sigma Investments

Headquarters: New York, USA

Two Sigma Investments is a technology-driven hedge fund leveraging artificial intelligence, machine learning, and advanced data analytics to inform its investment strategies. The firm specializes in quantitative trading, applying scientific methods to identify market inefficiencies and generate consistent, risk-adjusted returns. With a global presence, Two Sigma focuses on equities, futures, options, and alternative assets, offering innovative solutions for institutional investors. Its research-driven approach and robust technological infrastructure make it a leader in the quantitative hedge fund space, driving innovation while maintaining a strong emphasis on data security, risk management, and sustainable long-term growth for its clients.

2. Renaissance Technologies

Headquarters: East Setauket, New York, USA

Renaissance Technologies is a pioneer in quantitative hedge fund management, renowned for its Medallion Fund, which has delivered exceptional returns over decades. The firm uses complex mathematical models, big data analytics, and machine learning to develop highly sophisticated trading strategies. By analyzing massive datasets, Renaissance identifies patterns and market signals invisible to traditional analysis. Its disciplined, research-focused approach ensures consistent performance across various asset classes, including equities, futures, and commodities. Renaissance’s success has positioned it as one of the most influential hedge funds globally, attracting top scientific talent to continually refine its proprietary models and maintain its competitive edge.

3. Citadel Enterprise Americas

Headquarters: Chicago, Illinois, USA

Citadel is a global hedge fund powerhouse known for its diversified strategies across equities, fixed income, commodities, credit, and quantitative investments. Founded by Ken Griffin, Citadel combines deep fundamental research with advanced analytics to deliver superior risk-adjusted returns. Its robust technology platform and dynamic trading models enable real-time market insights and efficient execution. With a strong emphasis on talent, innovation, and disciplined risk management, Citadel serves institutional and high-net-worth investors worldwide. The firm’s integrated approach to research, trading, and risk controls has established it as a leader in the hedge fund industry, consistently adapting to evolving global market dynamics.

4. Elliott Investment Management

Headquarters: West Palm Beach, Florida, USA

Elliott Investment Management is one of the world’s oldest and most prominent activist hedge funds, specializing in distressed securities, private equity, and multi-strategy investments. Founded by Paul Singer, Elliott is renowned for its activist approach, driving operational and strategic changes in underperforming companies to unlock shareholder value. The firm has a strong track record of engaging with global corporations, leveraging deep research and negotiation expertise. Elliott’s diversified strategies span equities, credit, and alternative investments, providing stable returns even in volatile markets. Its disciplined investment process and proactive management style have cemented its reputation as a key player in activist investing.

5. Millennium Management

Headquarters: New York, USA

Millennium Management is a multi-strategy hedge fund managing capital across various asset classes, including equities, fixed income, commodities, and derivatives. The firm operates a decentralized model, empowering portfolio managers to execute independent strategies while benefiting from shared resources and risk management systems. Millennium focuses on generating consistent, risk-adjusted returns through disciplined diversification and advanced analytics. Its global presence and robust infrastructure support innovative research and trading approaches. By fostering a culture of collaboration and innovation, Millennium has grown into one of the largest and most respected hedge funds, trusted by institutional investors seeking stability, performance, and operational excellence.

Are you ready to discover more about the Hedge Fund market?

The report provides an in-depth analysis of the leading companies operating in the global Hedge Fund market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Two Sigma Investments.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Renaissance Technologies

- Citadel Enterprise Americas

- Elliott Investment Management

- Millennium Management

- Davidson Kempner Capital Management

- Man Group

- Bridgewater Associates

- AQR Capital Management

- BlackRock

Conclusion

The Hedge Fund Market Size Industry stands at a strategic inflection point, driven by technology, shifting investor preferences, and evolving regulatory expectations. Firms that harness AI and quantitative analytics, embrace ESG integration, and expand into digital assets will capture new alpha while managing risk. Increasing transparency, stronger compliance, and robust operational infrastructures will attract institutional capital and broaden market participation. Geographic diversification especially into fast-growing Asia Pacific markets alongside talent investment and strategic partnerships will be crucial for scaling. Overall, adaptable managers who balance innovation with governance and client alignment are best positioned to thrive in the competitive, evolving hedge fund landscape.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?