Top 30 Companies in Convenience Stores Worldwide 2025: Strategic Insights And Market Trends (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

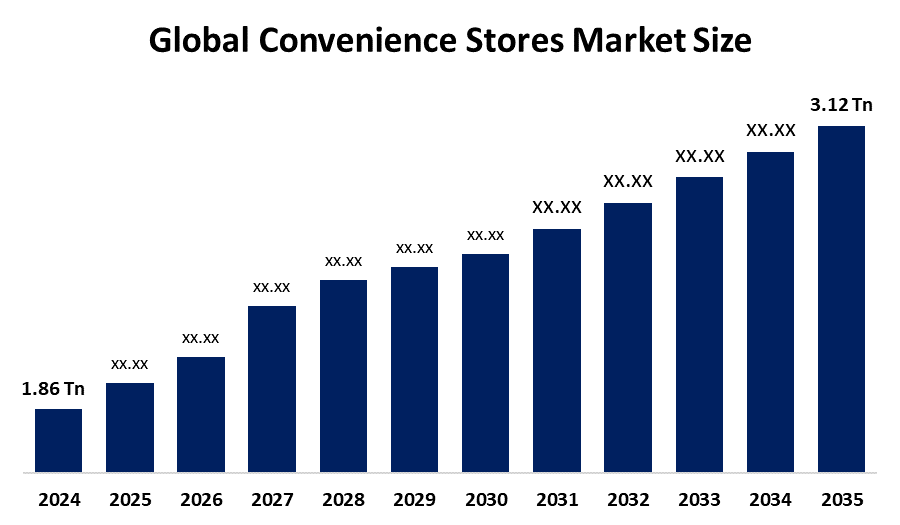

According to a research report published by Spherical Insights & Consulting, Ghe Global Convenience Stores Market Size is projected to Grow from USD 1.86 Trillion in 2024 to USD 3.12 Trillion by 2035, at a CAGR of 4.81% during the forecast period 2025–2035. The global convenience stores market is being driven by the industry grew as a result of several factors, including robust economic growth in emerging economies, rising urban population density, growing retail investment in developing countries, and the growing appeal of franchising.

Introduction

The Entire Convenience Store Market Size grew as a result of several factors, including strong economic growth in emerging economies, greater population density in metropolitan areas, increased retail investments in developing nations, and the growing appeal of the franchising idea. Convenience stores are becoming more and more popular since they have all the essentials, so in an emergency, customers can get what they need. Additionally, relative to other retail businesses, the market is flourishing because of the extended opening hours, which allow clients to quickly choose essential products. One of the main factors propelling market expansion is that convenience stores are typically located in crowded areas, like next to trains or gas stations. They offer several benefits, including the ability for customers to quickly get necessities. Convenience stores' prepared or packed food offerings are attracting new customers. The increasing number of retailers that sell products online is probably going to hinder the expansion of the business during the forecast period.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Convenience Stores Market.

Convenience Stores Market Size & Statistics

- The Market Size for Convenience Stores Was Estimated to be worth USD 1.86 Trillion in 2024.

- The Market Size is Going to Expand at a CAGR of 4.81% between 2025 and 2035.

- The Global Convenience Stores Market Size is anticipated to reach USD 3.12 Trillion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Convenience Stores Market

- Asia Pacific is expected to grow the fastest during the forecast period in the Convenience Stores Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the Convenience Stores Market.

The rising spending power of the middle class in China and Vietnam is the reason behind the rise in demand for convenience stores. Convenience stores have also increased the most in Vietnam, especially in urban areas, as a result of consumers' fast-paced lifestyles and changing lifestyles. Additionally, the number of shops increases in popularity as infrastructure advances, and agreements among local businesses to collaborate enhance the market as a whole.

North America is expected to generate the largest demand during the forecast period in the Convenience Stores market. With a market value of US$651 billion and a projected 35% market share in 2024, North America leads the world's convenience store market thanks to substantial expansion and robust sector growth. exceeding all other commercial sectors, the US supermarket industry added 2,222 new sites, while sales increases in Canada and Mexico also contributed to notable expansion. The increased variety of items is driving this expansion and drawing in more customers.

Top 10 Trends in the Convenience Stores Market

- Focus on Health and wellness

- Emphasis on digital Transformation

- Expansion in emerging markets

- Growing importance of private label brands

- Focus on sustainability

- Product diversification

- Strategic locations

- Adaptation to online competition

- Operational resilience

- Elevated Food Offerings

1. Focus on Health and wellness

Convenience stores are expanding their range of natural, low-sugar, and healthful products in response to consumer demand for healthier food and drink options. This trend is expected to continue as consumers become more health-conscious.

2. Emphasis on Digital Transformation

New technologies are being implemented by convenience stores to improve consumer happiness and streamline operations. This includes self-checkout, mobile payment options, and inventory management systems.

3. Expansion in emerging markets

Many convenience store brands are opening locations in developing nations like Southeast Asia and Africa as a result of the growing demand for their products.

4. Growing importance of private label brands

Due to their unique product offerings and lower prices compared to national brands, privately held companies are becoming more and more well-liked in the convenience store sector.

5. Focus on Sustainability.

To reduce their environmental impact, convenience stores are adopting more sustainable practices, such as reducing plastic waste and offering eco-friendly packaging options.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Convenience Stores market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 15 Companies Leading the Convenience Stores Market

- 7-Eleven

- Casey’s

- Alimentation couche- Tard Inc.

- Murphy USA Inc.

- FamilyMart

- Lawson Inc.

- Parkland Corporation

- 24 SEVEN

- Alfamart

- Indomaret

- Alibaba Group Holding Limited

- OXXO

- Amazon.co, Inc

- Royal Farms

- Circle K

- Others

1. 7-Eleven

Headquarters: Irving, Texas, United States

7-Eleven Inc, is an American convenience store chain, headquartered in Irving, Texas, with operations in 20 countries. In 1927, the Southland Ice Company, which operated an ice house storefront in Dallas, was the forerunner of the franchise. From 1928 until 1946, the number of convenience stores that were owned by Southland Corporation increased and were renamed Tote'm Stores. 7-Eleven's 24-hour accessibility and comparatively huge drink quantities are well-known. Drinks from 7-Eleven come in up to 128-ounce portions. In the Chroy Changvar area of Phnom Penh, 7 Eleven and Thailand's CP Group launched the first 7 Eleven location on August 30, 2021. On October 7, 2021, Reliance Retail announced that it would be opening outlets in India in collaboration with 7-Eleven. The first 7-Eleven in India opened its doors at Blue Fortune, Marol, Andheri East, Mumbai, on October 9, 2021. Mumbai, Pune, Thane, Kalyan Dombivli, Mira Bhayander, and Vasai Virar are now the locations where 7 Eleven is open.

2. Casey’s

Headquarters: Ankeny, Iowa, United States

Casey’s, headquartered in Ankeny, Iowa, United States, is a chain of convenience stores in the Midwestern

and Southern United States. There were 2500 Casy's locations in 16 states. In the United States, Casy's is

the third-biggest chain of convenience stores. It is one of two Fortune 500 firms based in Iowa. The fifth

largest pizza business in the United States, Casey's is well-known for its pizza, which includes taco and

market pizzas. In Casey announced a redesign in October 2020, which included removing General Stores from their signs and introducing a new logo. Casey's launched a third distribution hub in Joplin, Missouri, in April 2021. With the intention of converting those businesses into Casey's sites, Casey's acquired 63 Minit Mart and Certified Oil outlets in Kentucky and Middle Tennessee in August 2023.

3. Alimentation couche- Tard Inc.

Headquarters: Laval, Quebec, Canada.

Alimentation Couche, headquartered in Laval, Quebec, Canada, has operated in approximately 16,700 stores across. Another name for it is a basic Couche Tard, an international convenience store operator based in Canada. Located in Laval, Quebec, Canada, the company was founded by its current chairman, Alain Bouchard. For an undisclosed amount, Couche-Tard announced on August 19, 2024, that it had purchased all 270 GetGo stores from Giant Eagle. Additionally, after the promotion is over, Giant Eagle's MyPerks rewards program will still be available at GetGo locations. The sale was finalized on June 29, 2025. The announcement of the GetGo agreement coincided with Couche-Tard's approach to purchase Seven & I Holdings, a Japanese business that operates the global chain of 7-Eleven convenience stores. After the initial proposal was turned down, Couche-Tard delivered a revised offer later that year.

4. Murphy USA Inc.

Headquarters: El Dorado, Arkansas, United States

Murphy USA Inc., headquartered in El Dorado, Arkansas, United States, is an American corporation. With more than 1,700 outlets in 27 states nationwide, it is one of the biggest independent merchants of convenience store goods and fuel products. It runs a series of retail gas stations, most of which are close to Walmart shops. Murphy USA declared a shift in its partnership with Walmart in the first quarter of 2016 when it started establishing its own internal convenience stores and petrol stations. It intends to open more locations on its own, separate from Walmart outlets. Murphy USA declared in 2016 that Core-Mark will serve as their chain's exclusive distributor. It was placed 89th on Fortune's 100 Fastest-Growing Companies and 214th on the Fortune 500 list of the biggest American firms by revenue as of June 2024.

5. FamilyMart

Headquarters: VTamachi Station Tower S, Shibaura, Minato, Tokyo, Japan

FamilyMart, headquartered in VTamachi Station Tower S, Shibaura, Minato, Tokyo, Japan. is a franchise chain of convenience stores in Japan that is a division of the Japanese commercial business Itochu. After Seven-Eleven Japan, it is the second-biggest chain of convenience stores in Japan. Currently, there are 24,574 stores across the globe. Basic grocery products, magazines, manga, soft drinks, alcoholic beverages like sake, nikuman (steamed pork buns), fried chicken, onigiri/omusubi (rice balls), and bento are among the traditional Japanese convenience store items sold at FamilyMart locations. When a customer enters FamilyMart, the store's signature doorbell melody is played.

Are you ready to discover more about the convenience stores market?

The report provides an in-depth analysis of the leading companies operating in the global convenience stores market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- 7- Eleven

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Casey’s

- Alimentation couche- Tard Inc.

- Murphy USA INC.

- FamilyMart

- Lawson Inc.

- Parkland Corporation

- 24 SEVEN

- Alfamart

- Indomaret

- Alibaba Group Holding Limited.

- OXXO

- Amazon.Co., Inc.

- Circle K

- Royal Farm

- Others

Conclusion

The global Convenience Stores market is witnessing robust economic growth in emerging economies, rising urban population density, growing retail investment in developing countries, and the growing appeal of franchising. Strong economic growth in emerging economies, greater population density in metropolitan areas, increased retail investments in developing nations, and the growing appeal of the franchising idea. Asia Pacific is emerging as the fastest-growing region, while North America is the largest growing region.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?