Top 20 Oil and Gas Companies in Global 2025: Statistics View by Spherical Insights & Consulting

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Introduction

The global oil and gas market includes the exploration, extraction, refining, transportation, and marketing of oil and natural gas products. The industry is rising as global energy consumption rises, driven by industrialization, urbanization, and economic expansion in developing countries like as India and China. These factors are crucial for powering transportation, industry, and high-energy-demand sectors. The US oil and gas market plays an essential role globally, notably in shale production and energy exports. Hydraulic fracturing and horizontal drilling are two technological breakthroughs that have opened up unconventional deposits. Geopolitical issues, as well as the growing use of natural gas as a cleaner transitional fuel, influence market dynamics.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Oil & Gas Market.

Oil & Gas Market Size & Statistics

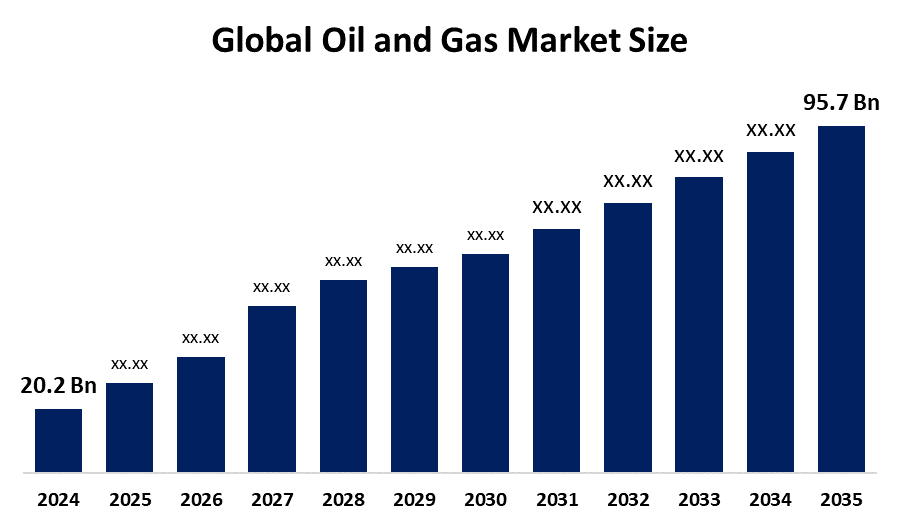

- The market for oil and Gas was estimated to be worth USD 20.2 Billion in 2024.

- The market is going to expand at a CAGR of 15.19 % between 2025 and 2035.

- The Global Oil and Gas Market is anticipated to reach USD 95.7 Billion by 2035.

- Asia Pacific is expected to generate the highest demand during the forecast period in the oil and gas market.

- North America is expected to grow the fastest during the forecast period in the oil and gas market.

Regional growth and demand

North America is expected to grow the fastest during the forecast period in the oil & gas market. North America is the world's fastest-growing oil and gas market, owing to strong production in the United States and Canada. Technological breakthroughs such as fracking and horizontal drilling have unlocked huge shale gas and oil deposits, propelling this region to the position of top oil and gas producer and LNG exporter. Policy developments and evolving market trends surrounding energy independence and export plans further influence this region, establishing North America's position as a key contributor to the international oil and gas sector.

Asia Pacific is expected to generate the highest demand during the forecast period in the oil & gas market. Asia Pacific leads the global oil and gas industry due to fast industrialization, population expansion, and rising energy consumption. Countries such as China and India are investing extensively in upstream and downstream areas, thus boosting regional market presence. To achieve cleaner energy objectives, the region prioritizes energy supply security through exploration, project development, and LNG infrastructure expansion. Efforts to mitigate oil import reliance by expanding local production and diversifying energy sources emphasize Asia Pacific's growing relevance in the global oil and gas industry.

Top 10 Oil & Gas Trends

- Energy Transition and Decarbonization

- Digital Transformation

- Increased Automation and Robotics

- Sustainability Focus

- Geopolitical Influences

- Supply Chain Resilience

- Technological advancements in oil & gas drilling

- Regulatory and Environmental Pressures

- Shifting Toward Natural Gas

- Renewable Energy Ventures

1. Energy Transition and Decarbonization

To meet global climate objectives, the oil and gas industry is rapidly moving to greener energy options. Companies are lowering their carbon footprints by investing in carbon capture, hydrogen energy, and renewable energy. Governments and investors are putting pressure on the sector to phase out high-emission activities and embrace more sustainable practices. This shift pushes to balance energy security with environmental responsibility, assuring long-term sustainability in a climate-constrained global economy.

2. Digital Transformation

Digital technology is transforming the oil and gas industry. Artificial intelligence, machine learning, and big data analytics tools improve decision-making, predictive maintenance, and real-time operation monitoring. The utilization of digital twins and IoT devices aids in streamlining exploration and manufacturing operations. This transformation not only cuts operating costs but also enhances safety, transparency, and efficiency across the value chain, making organizations more adaptable and competitive in a rapidly changing market.

3. Increased Automation and Robotics

Modern oil and gas operations are increasingly reliant on automation and robotic technology, eliminating the need for manual labor, especially in high-risk or offshore settings. It includes remote-controlled drilling rigs, automated inspection drones, and robotic process automation (RPA). This move improves safety, increases accuracy, and reduces operational risks and costs. With labor constraints and a focus on efficiency, firms are investing more in automated technology to optimize workflows and deliver consistent, high-performance output with minimum human interaction.

4. Sustainability Focus

Environmental restrictions and stakeholder expectations are driving an increased emphasis on sustainability in the oil and gas industry in order to assist firms to be compliant and future-ready in a green-conscious environment. Companies are working to reduce flaring, methane emissions, water use, and waste disposal. ESG (Environmental, Social, and Governance) reporting has become a common practice, reflecting corporate accountability.

5. Geopolitical Influences

Geopolitical factors are an important component in driving the market behavior and planning. The factors include the Russia-Ukraine war, trade tensions, and OPEC decisions are disrupting supply networks that resulting in volatility in prices. Further, sanctions, export tensions, and policy alterations are impacting the global investment and production plans.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the oil & gas market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 20 Companies Leading the Oil and Gas Market

- BP p.l.c.

- Chevron Corporation

- ConocoPhillips Company

- Equinor ASA

- Exxon Mobil Corporation

- PetroChina Company Limited

- PJSC Lukoil Oil Company

- PJSC Rosneft Oil Company

- Saudi Arabian Oil Co.

- Shell plc

- TotalEnergies SE

- Saudi Arabian Oil Co. (Saudi Aramco)

- Exxon Mobil Corporation

- Shell plc

- BP p.l.c.

- Chevron Corporation

1. BP p.l.c.

Headquarters – London, United Kingdom

BP p.l.c., a global oil and gas company, has its headquarters in London, United Kingdom. BP is one of the oil and gas “supermajors” and the world’s largest companies measured by revenues and profits. The company has operations in over 70 countries and is involved in the exploration, production, refining, and delivery of oil and gas. The corporation is diversifying into low-carbon technologies, including hydrogen and carbon capture. The company adjusts its operations to suit the rising demand for cleaner and more efficient fuels while decreasing environmental impact.

2. Chevron Corporation

Headquarters – San Ramon, California, United States

The headquarters of Chevron Corporation are located in San Ramon, California, United States. Chevron is a global leader in exploration, production, refining, and petrochemicals, with operations in over 180 countries. The company is investing in LNG and low-emission fuel programs, playing an important role in the global oil and gas industry by assuring a consistent crude oil and natural gas supply across various continents.

3. ConocoPhillips

Headquarters – Houston, Texas, United States

The headquarters of ConocoPhillips are located in Houston, Texas, United States. ConocoPhillips works in around 13 countries and specializes in the exploration and production of oil, natural gas, and LNG. The corporation has large holdings in the United States, Canada, Norway, and Australia, with an emphasis on unconventional shale development. It continues to impact the global oil and gas industry through its effective operations and smart investments in high-potential resource locations.

4. Equinor ASA

Headquarters – Stavanger, Norway

The headquarters of Equinor ASA are located in Stavanger, Norway. Equinor works in more than 30 countries and is well-known for its offshore oil and gas capabilities, notably in the North Sea. The company is a significant provider of Europe’s oil and gas supplies, and is noted for blending traditional operations with long-term sustainability efforts. There are significant investments in carbon capture and renewable technology.

5. Exxon Mobil Corporation

Headquarters – Basel, Switzerland

The headquarters of Exxon Mobil Corporation are located in Basel, Switzerland. It is one of the most powerful firms in the oil and gas sector, with large-scale activities to serve global energy demands. ExxonMobil is an oil and gas exploration, production, refining, and petrochemical manufacturing company with operations in over 60 countries. The company has substantial projects in Guyana, the United States, and the Middle East, and is also working on carbon capture and biofuel technology.

Are you ready to discover more about the oil & gas market?

The report provides an in-depth analysis of the leading companies operating in the global oil & gas market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- BP p.l.c.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Chevron Corporation

- ConocoPhillips

- Equinor ASA

- Exxon Mobil Corporation

- PetroChina Company Limited

- PJSC Lukoil Oil Company

- PJSC Rosneft Oil Company

- Saudi Arabian Oil Co.

- Shell plc

- TotalEnergies SE

- Saudi Arabian Oil Co. (Saudi Aramco)

- Exxon Mobil Corporation

- Shell plc

- BP p.l.c.

Conclusion

There is a gradual development in the oil and gas industry, owing to increased energy demand from industrialization, urbanization, and economic expansion in nations such as India and China. Geopolitical concerns, environmental laws, and the transition to cleaner fuels are all having a growing impact on the market. Hydraulic fracturing and horizontal drilling have opened up previously inaccessible deposits, increasing the world supply. Natural gas is gaining appeal as a transitional fuel, and businesses are investing in digital technologies and sustainable practices to meet long-term sector change and global decarbonization targets.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?