Top 20 Key Players in The Cryptocurrency Market (2024–2035): Statistics Report Till 2035

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

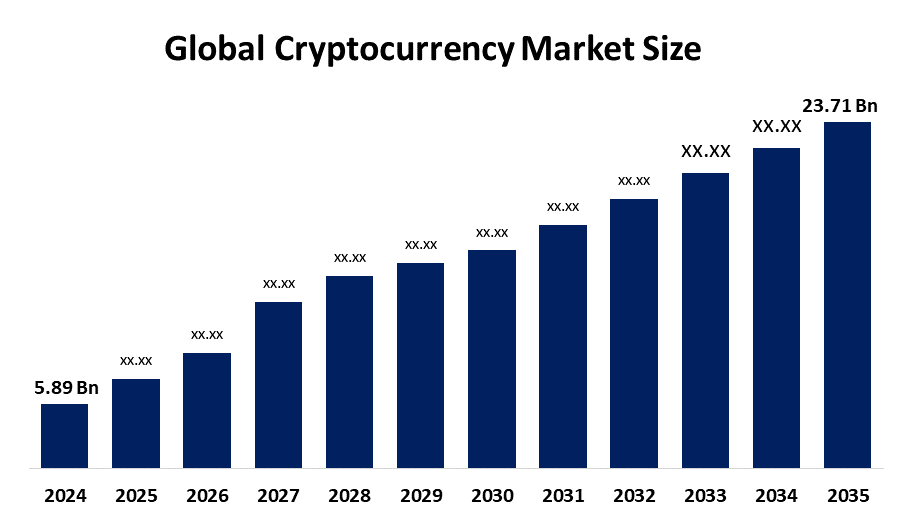

According to a research report published by Spherical Insights & Consulting, The Global Cryptocurrency Market Size is projected to grow from USD 5.89 Billion in 2024 to USD 23.71 Billion by 2035, at a CAGR of 13.5% during the forecast period 2025–2035. Decentralized finance (DeFi) adoption, institutional investment, and interest in blockchain-based financial systems are the main factors propelling the market.

Introduction

A digital asset known as cryptocurrency makes use of distributed ledger technology, or blockchain, to facilitate safe transactions. Every cryptocurrency has its own set of regulations. Since no government or financial organization has control over cryptocurrencies, they are decentralized. Cryptocurrencies can be purchased, sold, traded, and stored using them. A number of variables, including the state of the economy, governmental policies, media coverage, and more, can cause substantial swings in cryptocurrency prices. Private venture businesses have made large investments in cryptocurrencies due to their increasing significance as a decentralized asset class, which has helped the market continue to thrive. According to CoinGecko, the cryptocurrency market struck a historic milestone in November 2024 when its total market capitalization touched a record high of USD 3.2 trillion. This increase in value is a reflection of the growing interest and investment in a variety of cryptocurrencies, which has been fueled by developments in blockchain technology, the growth of decentralized finance (DeFi) platforms, and increased institutional use.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Cryptocurrency Market Size & Statistics

The market for cryptocurrency was estimated to be worth USD 5.89 Billion in 2024.

The market is going to expand at a CAGR of 13.5% between 2025 and 2035.

The Global Cryptocurrency Market is anticipated to reach USD 23.71 Billion by 2035.

North America is expected to generate the highest demand during the forecast period in the cryptocurrency market

Asia Pacific is expected to grow the fastest during the forecast period in the cryptocurrency market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the cryptocurrency market. With the help of tech-savvy citizens, high mobile penetration, lenient laws in some nations, and an increasing demand for blockchain innovation, the Asia-Pacific cryptocurrency market is rising quickly. The region is varied, with growing economies like India and the Philippines driving retail usage and cross-border transfers, while nations like South Korea and Japan exhibit early acceptance.

North America is expected to generate the highest demand during the forecast period in the cryptocurrency market. North America is driven by a thriving blockchain innovation environment, extensive retail adoption, robust institutional investment, and cutting-edge financial infrastructure. Digital asset-focused venture capital funds, blockchain developers, mining firms, and some of the biggest cryptocurrency exchanges in the world are based in this region. Although it is changing, regulatory clarity is also very important in determining investment and adoption patterns.

Top 10 trends in Cryptocurrency Market

- Decentralized Finance (DeFi) Growth

- Mainstream Adoption of CBDCs

- NFTs and Digital Assets Expansion

- Enhanced Security and Regulation

- Energy-Efficient Blockchain Technologies

- Expansion of Crypto Payment Gateways

- Tokenization of Real-World Assets

- Growth of Decentralized Autonomous Organizations (DAOs)

- Regulatory Clarity and Compliance Measures

- Development of User-Friendly Wallets and Platforms

- Decentralized Finance (DeFi) Growth

DeFi platforms are expanding, offering decentralized lending, borrowing, and trading services that eliminate traditional intermediaries, making financial transactions more accessible and transparent.

- Mainstream Adoption of CBDCs

Central banks worldwide are developing and testing Central Bank Digital Currencies (CBDCs), which aim to combine the benefits of cryptocurrencies with the stability of national currencies, fostering wider acceptance and integration into the financial system.

- NFTs and Digital Assets Expansion

NFTs are evolving beyond art and collectibles into areas like gaming, real estate, and intellectual property, creating new revenue streams and ownership models for digital assets.

- Enhanced Security and Regulation

As cryptocurrencies grow, governments and industry players are focusing on stronger security protocols and clearer regulations to prevent fraud, protect investors, and promote sustainable growth.

- Energy-Efficient Blockchain Technologies

The industry is shifting towards eco-friendly blockchain networks, reducing energy consumption and addressing environmental concerns associated with mining activities.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the cryptocurrency market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 15 Companies Leading the Cryptocurrency Market

- Coinbase

- Binance

- Ripple (Ripple Labs)

- Bitmain

- Chainalysis

- Kraken

- Gemini

- Huobi

- Bittrex

- KuCoin

- OKX

- Bitfinex

- eToro

- CoinDCX

- WazirX

- Bitstamp

- Gemini Trust

- Coinone

- Liquid

- KuCoin

- Coinbase

Headquarters- UK

Coinbase is a leading cryptocurrency exchange known for its user-friendly platform and strong security measures. It allows users to buy, sell, and store major cryptocurrencies like Bitcoin and Ethereum easily. The platform emphasizes regulatory compliance and offers advanced trading tools, secure wallets, and insurance coverage for digital assets. Coinbase’s focus on transparency, security, and ease of access has made it a preferred choice for retail and institutional investors. Its innovative features support the mainstream adoption of cryptocurrencies, and strategic partnerships help expand blockchain technology’s reach. As a pioneer in the crypto industry, Coinbase continues to drive growth and trust in digital assets globally.

- Binance

Headquarters- UK

Binance is the largest crypto exchange globally by trading volume, offering a vast range of cryptocurrencies and trading options. It provides spot trading, futures, staking, and DeFi services, supported by its own Binance Smart Chain (BSC). Known for low trading fees and extensive listings, Binance also develops new blockchain projects and NFT marketplaces. Its focus on security, innovation, and global expansion has helped it maintain leadership in the industry. Binance’s ecosystem supports decentralized applications, cross-chain interoperability, and crypto payments, making it a key player in shaping the future of digital currencies and blockchain adoption worldwide.

3. Ripple (Ripple Labs)

Headquarters- UK

Ripple is renowned for its digital payment protocol and XRP cryptocurrency, designed to facilitate fast and low-cost cross-border transactions. RippleNet connects banks and financial institutions, enabling real-time international transfers without intermediaries. Its blockchain technology and consensus algorithms provide high scalability and security, making it ideal for global remittances. Ripple emphasizes regulatory compliance and strategic partnerships with major banks, aiming to revolutionize international payments. Its innovative approach helps banks adopt blockchain solutions, fostering wider acceptance of digital currencies in the traditional financial system.

4. Bitmain

Headquarters- UK

Bitmain is a major manufacturer of cryptocurrency mining hardware, especially ASIC miners used for Bitcoin mining. Its Antminer series is known for high efficiency, durability, and powerful hash rates, supporting the security and decentralization of blockchain networks like Bitcoin. The company also operates large-scale mining farms and provides mining pool services. Bitmain’s focus on hardware innovation and energy-efficient mining solutions has made it a dominant force in the crypto mining industry. As the industry moves towards sustainable practices, Bitmain’s advancements in eco-friendly mining hardware are crucial for the future of blockchain networks and digital currencies.

5. Chainalysis

Headquarters- UK

Chainalysis specializes in blockchain analytics and compliance solutions, helping government agencies, financial institutions, and crypto exchanges monitor transactions for fraud, money laundering, and illicit activities. Its software offers real-time transaction analysis, risk assessment, and regulatory reporting, promoting transparency and security in the crypto ecosystem. Chainalysis’s focus on anti-money laundering (AML) and compliance technology supports the mainstream adoption of cryptocurrencies by addressing regulatory concerns. Its innovative analytics platform builds trust, prevents illegal activities, and fosters sustainable growth in the global digital currency industry.

Are you ready to discover more about the cryptocurrency market?

The report provides an in-depth analysis of the leading companies operating in the global cryptocurrency market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Coinbase

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Binance

- Ripple (Ripple Labs)

- Bitmain

- Chainalysis

- Kraken

- Gemini

- Huobi

- Bittrex

- Other

Conclusion

The cryptocurrency market is poised for significant growth driven by increasing institutional investment, the expansion of DeFi, and the adoption of blockchain-based financial systems. Rapid technological advancements, regulatory developments, and rising mainstream acceptance, especially in North America and Asia-Pacific, further fuel this growth. Key trends such as CBDCs, NFTs, and energy-efficient blockchain solutions highlight the industry’s evolving landscape.

Need help to buy this report?