Top 20 Green Finance Companies in Global 2025: Statistics View by Spherical Insights & Consulting

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

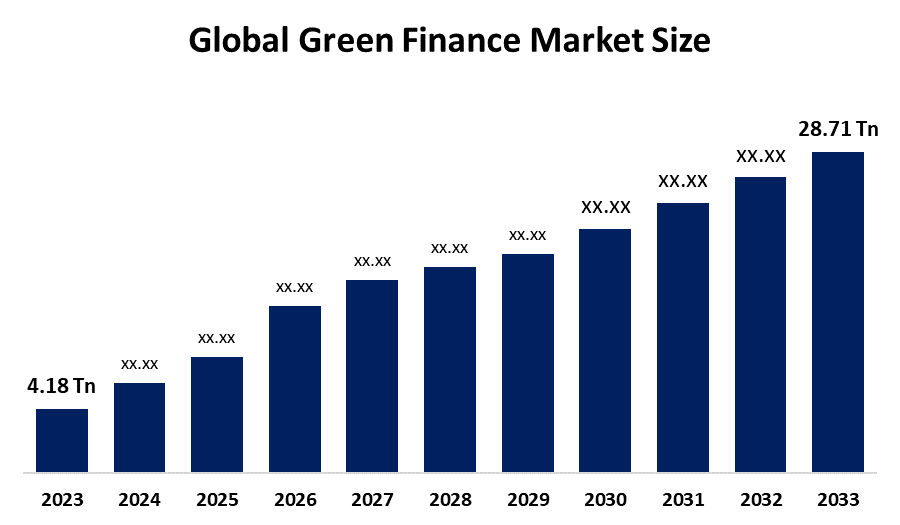

According to a research report published by Spherical Insights & Consulting, The Global Green Finance Market Size is projected to grow from USD 4.18 trillion in 2023 to USD 28.71 Trillion by 2033, at a CAGR of 21.25% during the forecast period 2023–2033. The shift to a low-carbon economy and the growing worldwide emphasis on sustainability are driving the market for green finance, which is expanding quickly. Both the public and commercial sectors are realizing how crucial green finance is to accomplishing environmental objectives.

Introduction

The goal of the green finance market is to provide capital for projects that benefit the environment. This includes funding for carbon emission reduction initiatives, sustainable agriculture, and renewable energy. Environmentally friendly initiatives are financed using a variety of financial products known as "green finance," such as green bonds, loans, and stocks. The demand for green finance is rising as climate change becomes more widely recognized. This market is being driven in part by governments, businesses, and investors. Its expansion is further supported by incentives and regulatory frameworks. High return potential and environmental advantages are what define the market. Making money is only one aspect of green finance; another is helping to ensure a sustainable future.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Key Market Drivers:

Growing Need for Improved Customer Experience to Accelerate Market Development

Globally, governments and regulatory agencies are essential in propelling the green finance market's expansion. Clear guidelines for sustainable investments have been established by comprehensive policy frameworks like the Green Deal, the European Union's Sustainable Finance Action Plan, and taxonomy laws. These programs aim to increase openness, lessen greenwashing, and direct funding toward ecologically conscious projects. In a similar vein, nations such as China, the United Kingdom, and Canada have implemented transparency rules and national green bond guidelines to promote market growth. Investors may now find qualified green assets and make well-informed selections that support sustainability and climate goals due to the creation of green taxonomies.

Growing Interest in Sustainable and ESG Investments

The demand for green finance solutions is being driven by a growing shift in investor sentiment toward Environmental, Social, and Governance (ESG) factors. Both retail and institutional investors are actively looking for portfolios that produce quantifiable environmental effects in addition to financial gains. One example of how big businesses are becoming more committed to sustainability is Unilever, which is incorporating sustainability into its business model by emphasizing sustainable agricultural methods and cutting waste throughout its supply chain. The increasing issue of climate funds, sustainability-linked loans, and green bonds all reflect this trend. As stakeholder expectations and shareholder activism increase, asset managers and pension funds are incorporating ESG factors into their investing strategies.

Green Finance Market Size & Statistics

The Market for Green finance was estimated To be worth USD 4.18 Trillion in 2023.

The Market is Going To expand at a CAGR of 21.25% between 2023 and 2033.

The Global Green Finance Market Size is anticipated to reach USD 28.71 Trillion by 2033.

North America is expected to generate the highest demand during the forecast period in the Green finance market.

Europe is expected To Grow the fastest during the forecast period in the Green finance market.

Regional growth and demand

Europe is expected to grow the fastest during the forecast period in the green finance market. Strong legal frameworks that encourage sustainable behavior and financial incentives for environmentally friendly projects are the main causes of this leadership. Significant market growth is being fostered by European governments and organizations prioritizing investments in environmentally friendly technology and renewable energy. The public's awareness of and desire for sustainability serve to further solidify Europe's leadership in the green finance sector. The market dynamics in the region are supported by the active involvement of major European banks in green bonds and sustainable assets, as well as the incorporation of ESG (Environmental, Social, Governance) criteria into investment decisions.

North America is expected to generate the highest demand during the forecast period in the green finance market. The market's expansion might be linked to growing regulatory support as well as investors' and consumers' increased awareness of environmental issues. To keep up with the growing demand for sustainable investment products like sustainability-linked loans and green bonds, the region's financial institutions are innovating quickly. Government programs that support sustainability have strengthened this trend and made the climate more conducive to sustainable financing. North America is therefore anticipated to continue on a strong growth trajectory, with forecasts showing a sustained increase in sustainable investments over the ensuing years.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the green finance market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 20 Companies Leading the Green Finance Market

- Stripe Climate

- Triodos Bank

- Clim8 Invest

- Aspiration

- Doconomy

- BlackRock Inc.

- BNP Paribas

- Amundi

- HSBC Holdings Plc

- European Investment Bank (EIB)

- Adani Green Energy Ltd.

- Suzlon Energy

- Praj Industries

- Gravita India Ltd.

- VA Tech Wabag

- ION Exchange

- Indian Renewable Energy Development Agency (IREDA)

- Waaree Renewable Technologies

- Tata Power Company Ltd.

- JSW Energy Ltd.

- Stripe Climate

Headquarters - San Francisco

Stripe Climate is a sustainability program that enables companies to use their profits to fund carbon removal projects. Leading the green finance space, Stripe Climate allows businesses to set aside a percentage of their profits for long-term carbon removal solutions such as increased weathering and direct air capture. Over $1 trillion in carbon removal purchases by 2030 have been committed by Stripe's initiative, which is run by Frontier. Both startups and large corporations may take climate action because of its smooth interaction with Stripe's payment system. Stripe Climate's integration of green money into routine transactions is increasing demand for scalable climate solutions and changing the way digital platforms affect the environment.

- BlackRock

Headquarters – US

A major player in the green finance industry, BlackRock is the biggest asset management in the world. With its ESG investment methods and Aladdin Climate platform, BlackRock assists investors in assessing climate risk and coordinating portfolios with sustainability objectives. In order to encourage decarbonization across industries, it has introduced net-zero transition funds and low-carbon exchange-traded funds (ETFs). BlackRock puts pressure on portfolio firms to comply with climate legislation and report their environmental performance. Corporate accountability and open sustainability measures are given top priority in its voting procedures. BlackRock has a significant impact on institutional investors, pension funds, and sovereign wealth funds, managing trillions of dollars' worth of assets. By combining green investing guidelines with climate analytics, BlackRock establishes industry norms for moral finance and global resilience.

- BNP Paribas

Headquarters – France

France-based BNP Paribas is a well-known European banking organization dedicated to developing the green finance industry. It actively funds loans related to sustainability, low-carbon infrastructure, and renewable energy. BNP aligns its lending approach with the goals of the Paris Agreement and has phased out coal funding. Climate tech startups in Asia and Europe are supported by its Clean Energy Transition Fund. Corporate clients can shift to more environmentally friendly business models with the aid of BNP's environmental risk assessment tools and advising services. In accordance with EU taxonomy rules, the bank also provides comprehensive climate disclosures and underwrites green bonds. BNP Paribas is influencing the direction of climate-resilient banking as a financial partner in decarbonization and biodiversity conservation.

- Amundi

Headquarters - France

The biggest asset manager in Europe and a division of Crédit Agricole, Amundi is a significant player in the green financing industry. The company offers thematic funds in renewable energy, water conservation, and climate transition, and incorporates ESG principles into all aspects of its investment strategy. Amundi assists institutional investors in reaching net-zero goals by offering sustainability ratings and impact analyses. It has reinforced fossil fuel exclusions and is an active participant in the Climate Action 100+ campaign. Its selection of green exchange-traded funds (ETFs) and carbon tracking tools at the portfolio level facilitate responsible investment for regular investors. Amundi is a leading platform for climate-conscious investing in Europe and beyond due to its combination of financial success and environmental expertise.

- HSBC

Headquarters - UK

One of the biggest banks in the world, HSBC, is a key player in the green finance industry when it comes to funding sustainable development. It offers a variety of green financial products, such as climate transition loans, sustainability-linked bonds, and green asset-backed securities. HSBC works with groups like the Green Finance Institute and has pledged to achieve net-zero emissions throughout its financed portfolio by 2050. Its Sustainable Financing and Investment section assists customers with the implementation of ESG strategies and decarbonization. HSBC changes its fossil fuel exclusion rules on a regular basis and discloses climate risk under TCFD. HSBC is a major driver behind environmentally conscious banking and international green investments through its specialized climate hubs and cutting-edge financial products.

Are you ready to discover more about the green finance market?

The report provides an in-depth analysis of the leading companies operating in the global green finance market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Stripe Climate

Business Overview

Company Snapshot

Products Overview

Company Market Share Analysis

Company Coverage Portfolio

Financial Analysis

Recent Developments

Merger and Acquisitions

SWOT Analysis

- Triodos Bank

- Clim8 Invest

- Aspiration

- Doconomy

- BlackRock Inc.

- BNP Paribas

- Amundi

- HSBC Holdings Plc

- Others.

Conclusion

As global investment strategies are reshaped by ESG principles, the green finance market is about to enter a transformational period. Through climate-linked funds, green bonds, and ethical banking, the public and commercial sectors are intensifying their commitment to sustainability in light of the robust growth anticipated in North America and Europe. By integrating climate accountability into their services, leading businesses—from financial behemoths like BlackRock and BNP Paribas to fintech startups like Stripe Climate and Clim8—are spurring innovation. Green finance is poised to emerge as a key component of robust, low-carbon economies across the globe as investor interest soars and governmental backing grows.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?