Top 20 Global Companies in LED Driver Market 2025: Strategic Overview and Future Trends (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

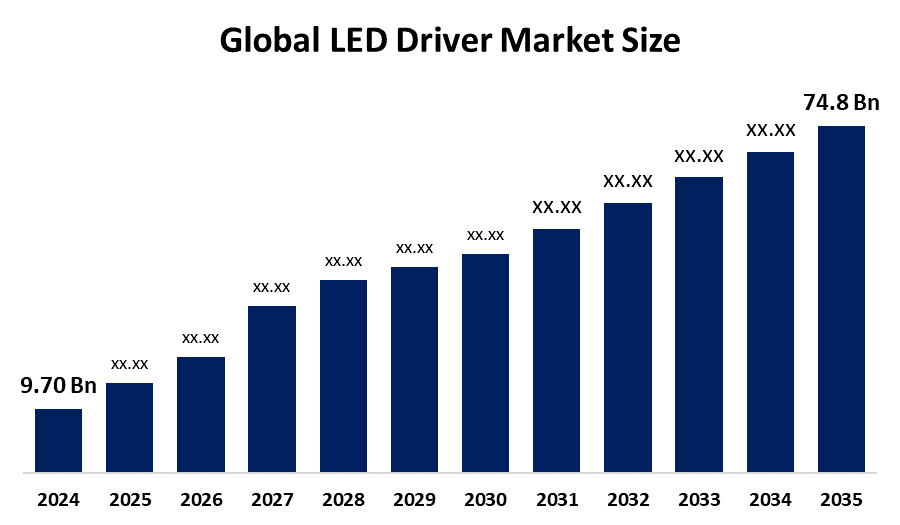

According to a research report published by Spherical Insights & Consulting, The Global LED Driver Market Size is projected To Grow from USD 9.70 Billion in 2024 to USD 74.8 Billion by 2035, at a CAGR of 20.41% during the forecast period 2025–2035. The growing popularity of LED lighting and the need for energy-efficient systems, along with government programs that favor LED over conventional lighting, are driving the market's expansion.

Introduction

The industry devoted to the creation, manufacturing, and distribution of electronic devices that control and power light-emitting diodes (LEDs) is known as The Global LED Driver Market Size. LED drivers guarantee that LEDs function within the designated voltage and current ranges, allowing for constant brightness, reduced energy consumption, and a longer lifespan. Numerous applications, such as lighting systems for homes, businesses, automobiles, industries, and outdoor spaces, depend on these drivers. Additionally, Recent trends in industrial expansion and population growth have also contributed to an increase in the world's energy demand. The world is currently facing an energy crisis as a result of growing demand for power and depleting resources. A number of countries have enacted legislation mandating the use of consumer devices with low energy consumption in order to address the energy crisis. As governments around the world implement various smart city initiatives to reduce expenses and emissions, it is also expected that the need for outside forces will increase significantly on a global scale. This implies that the demand for exterior LED drivers for street lights and other outdoor lighting systems will increase.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the LED Driver Market.

LED Driver Market Size & Statistics

- The Market Size for LED Driver Was Estimated to be Worth USD 9.70 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 20.41% Between 2025 and 2035.

- The Global LED Driver Market Size is Anticipated to Reach USD 74.8 Billion by 2035.

- Asia Pacific is expected to generate the highest demand during the forecast period in the LED Driver Market.

- North America is expected to grow the fastest during the forecast period in the LED Driver Market.

Regional growth and demand

North America is expected to grow the fastest during the forecast period in the LED driver market. The market for LED drivers in North America will be the largest due to the growing use of LED lighting in both high-end and low-end car segments. This will accelerate this region's market growth.

Asia Pacific is expected to generate the highest demand during the forecast period in the LED driver market. The region's growing use of LED lighting in the commercial, industrial, and residential sectors has been a major factor in the market's expansion. The need for LED drivers has increased in the area as a result of government programs encouraging sustainability and energy efficiency as well as growing knowledge of the advantages of LED lighting. The market has expanded as a result of nations like China, India, and Japan's rapid urbanization and infrastructure development.

Top 10 LED Driver Trends

1. Acceptance of Wireless Control

2. Integration of Silicon Carbide (SiC) and Gallium Nitride (GaN)

3. Initiatives for Smart Cities and Infrastructure

4. The Mandates for Sustainability and Energy

5. The Electrification of Automobiles

6. Retrofitting Commercial Buildings

7. Constant Power Surge Drivers

8. Sub-25W Segment Development

9. The Integration of Intelligent Lighting

10. Guidelines for Interoperability

1. Acceptance of Wireless Control

The market for LED drivers is changing dramatically as a result of the quick uptake of wireless control technologies like Matter/Thread, Bluetooth Mesh, and Zigbee. Lighting solutions for homes, businesses, and industries are becoming more adaptable, scalable, and remotely controlled thanks to the transition from conventional wired systems to wireless protocols. To improve energy efficiency and user convenience, wireless-enabled LED drivers offer sophisticated features like scheduling, real-time dimming, and integration with smart home or building automation platforms.

2. Integration of Silicon Carbide (SiC) and Gallium Nitride (GaN)

The design of LED drivers is being revolutionized by the integration of silicon carbide (SiC) and gallium nitride (GaN) semiconductors, which greatly improve thermal performance and power conversion efficiency. When compared to conventional silicon, these wide-bandgap materials enable higher switching frequencies and reduced energy losses, making drivers more compact, lightweight, and dependable. High-density smart lighting networks, industrial systems, and automotive lighting are just a few of the demanding applications that benefit greatly from their capacity to function at high voltages and temperatures

3. Initiatives for Smart Cities and Infrastructure

LED drivers are essential for powering energy-efficient, networked systems throughout urban infrastructure, and government-led smart city projects are propelling the broad adoption of LED lighting. These initiatives, which place a high priority on automation, sustainability, and cost reduction, result in significant improvements to public buildings, transit hubs, and street lighting. In line with the objectives of intelligent urban planning, LED drivers coupled with smart controls allow for remote diagnostics, adaptive brightness, and real-time monitoring.

4. The Mandates for Sustainability and Energy

LED drivers are a key enabler in both retrofit and new-build applications, and the adoption of LED lighting is being accelerated by global sustainability goals and energy efficiency regulations. Many legacy lighting systems are being replaced as a result of regional regulatory frameworks that are pushing for lower energy consumption and carbon emissions, such as the EU's Ecodesign Directive, India's UJALA scheme, and US DOE standards.

5. The Electrification of Automobiles

LED driver requirements are changing as a result of the growing electrification of the automotive industry, especially for EVs and smart mobility platforms. Compact, thermally resilient drivers that can function in hot environments and provide steady performance for headlights, ambient lighting, infotainment screens, and dashboard indicators are required for these cars. Advanced thermal management, EMI shielding, and integration-ready designs are being made into LED drivers to support intelligent lighting functions as EV architectures place a higher priority on energy efficiency and space optimization.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the LED driver market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 16 Companies Leading the LED Driver Market

1.Signify

2.ams OSRAM

3.Acuity Brands Lighting

4.Hubbell Incorporated

5.Eaton (Cooper Lighting)

6.Lutron Electronics

7.Cree LED (SGH)

8.MEAN WELL Enterprises

9.Inventronics

10.Tridonic (Zumtobel Group)

11.Delta Electronics

12.Shenzhen Done Power

13.ERP Power

14.Lifud Technology

15.Helvar

16.Murata Manufacturing

17.Others

1. Signify

Headquarters - Eindhoven, the Netherlands.

Lighting products are manufactured and marketed by Signify NV (Signify). High-intensity discharge (HID) lamps, compact fluorescent, halogen, incandescent, and light-emitting diode (LED) drivers, as well as conventional and specialty lighting, electronic components, electronic ballasts, and other lighting products, are all part of the company's product line. Indicate which products are sold under the Philips, Interact, Philips Hue, Color Kinetics, Philips Dynalite, and EcoLink brands. It focuses on offering lighting solutions for consumers, businesses, and the Internet of Things (IoT).

2.ams OSRAM

Headquarters - Premstaetten, Austria.

An electronics equipment manufacturer with a focus on cutting-edge light and sensor solutions is called ams OSRAM AG (ams OSRAM). Developing and producing sensors, CMOS integrated circuits, software, and conventional lighting technologies are among the company's primary endeavors. Among its offerings are LEDs, laser diodes, photodetectors, lamps, and sensor solutions. Products from ASOSRAM serve a range of markets, including consumer electronics, automotive, industrial, and healthcare.

3.Acuity Brands Lighting

Headquarters - Atlanta, Georgia, the US.

Acuity Inc., formerly known as Acuity Brands Inc. (Acuity Brands), is a company that offers building management and lighting solutions. Lighting controls, prismatic skylights, power supplies, luminaires, and building management systems are just a few of the many products it designs, produces, and sells. Product brands Lithonia Lighting, Holophane, Peerless, Gotham, Mark Architectural Lighting, and Juno are all used by Acuity Brands. The business provides solutions for new construction, renovation, and maintenance applications, and its products are used by clients in the commercial, institutional, industrial, infrastructure, and residential sectors. A network of independent sales agencies, internal sales representatives, and consumer retail channels are used by Acuity Brands to distribute its goods.

4.Hubbell Incorporated

Headquarters - Shelton, Connecticut, the US

Electronic and electrical products are produced by Hubbell Inc. (Hubbell). Arresters, insulators, connectors, anchors, bushings, enclosures, cutouts, switches, smart meters, communications systems, and protection and control devices are some of its leading products. Additionally, it provides custom products like electrical equipment, connectors and grounding, rough in electrical products, and standard and special application wiring devices. Among others, Hubbell's products are sold to telecommunications firms, electric utilities, OEMs, distributors, wholesalers, hardware stores, and retail establishments.

5.Eaton (Cooper Lighting)

Headquarters - Peachtree City, Georgia, United States.

A division of Eaton, Cooper Lighting Solutions focuses on cutting-edge lighting and controls for use in commercial, industrial, and residential settings. The company provides a wide range of lighting products for both indoor and outdoor use that are intended to improve safety, energy efficiency, and aesthetic comfort. Cooper Lighting, which is renowned for its inventive connected lighting systems, incorporates smart technologies to support human-centric design, sustainability objectives, and building automation. Its solutions, which place a high priority on performance, dependability, and adherence to international standards, are used in a variety of industries, including healthcare, education, retail, and infrastructure.

Are you ready to discover more about the LED driver market?

The report provides an in-depth analysis of the leading companies operating in the global LED driver market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

1.Signify

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

2.ams OSRAM

3.Acuity Brands Lighting

4.Hubbell Incorporated

5.Eaton (Cooper Lighting)

6.Lutron Electronics

7.Cree LED (SGH)

8.MEAN WELL Enterprises

9.Tridonic (Zumtobel Group)

10.Delta Electronics

11.Shenzhen Done Power

12.ERP Power

13.Lifud Technology

14.Murata Manufacturing

15.Others

Conclusion

The Market Size for LED Drivers is expected to undergo revolutionary expansion due to the growing need for smart infrastructure, energy-efficient lighting, and sophisticated semiconductor integration. In the commercial, industrial, automotive, and residential sectors, adoption is accelerating due to strategic government initiatives and sustainability mandates. Intelligent lighting and wireless control are two examples of emerging technologies that are changing how products are developed and implemented. While North America exhibits the potential for rapid expansion, regional dynamics show Asia Pacific as the demand leader. Due to fierce competition from leading businesses, the market is expected to develop into a vital component of lighting ecosystems that are prepared for the future.

Need help to buy this report?