Top 20 FinTech Companies in Global 2025: Statistics View by Spherical Insights & Consulting

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

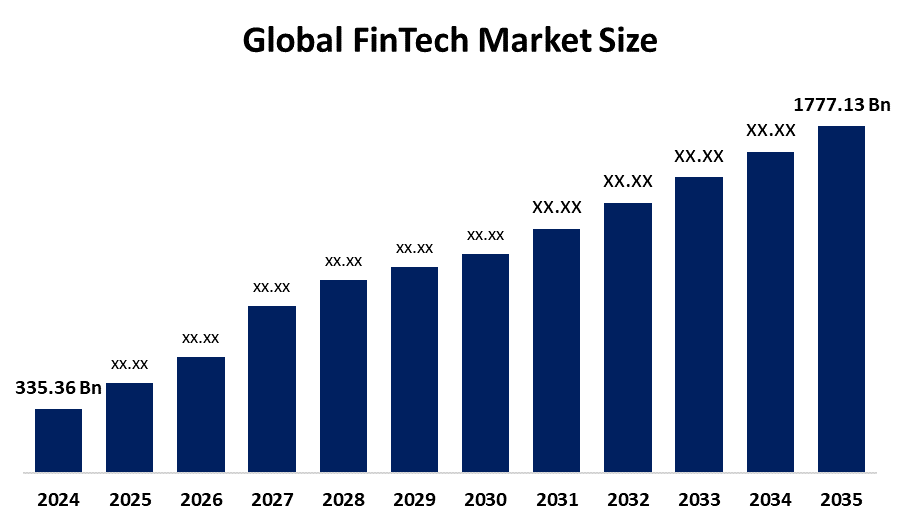

According to a research report published by Spherical Insights & Consulting, The Global FinTech Market Size is projected to grow from USD 335.36 Billion in 2024 to USD 1777.13 Billion by 2035, at a CAGR of 16.37% during the forecast Period 2025–2035. Fintech companies are able to swiftly and economically contact millions of people because to this growing interconnectedness. Additionally, it gives people in rural or isolated locations access to financial resources that were previously only available in urban regions. The market opportunity is expanding as a result of the increasing number of connected devices creating new opportunities.

Introduction

Financial technology, or fintech for short, is the application of technology to enhance and automate financial services and procedures. It covers everything from digital wallets and mobile banking apps to online lending platforms, robo-advisors, and blockchain technology. Globally, governments and regulators are fostering innovation and enacting benevolent regulations to assist the expansion of fintech. One instance is open banking, where banks must use safe APIs to exchange consumer data with third-party fintech companies with consent. This makes it possible to build new financial services on top of the infrastructure already in place at banks. Customers benefit from improved experiences and more options as a result. In addition to leveling the playing field, supportive legislation encourages new businesses to enter the market and take on well-established institutions. These days, people want to pay for goods and services in quicker, safer, and more convenient ways. Digital payments are replacing cash, which is one of the reasons fintech is expanding so quickly. In January 2025, Google Pay was used in India to make transactions totaling USD 951.91 million, according to the National Payments Corporation of India. Online transfers, contactless cards, mobile wallets, and QR code payments are all increasingly commonplace.

Top 10 trends in FinTech Market

- Wide-bandgap semiconductor adoption (SiC & GaN)

- Electrification of transportation

- Renewable energy integration

- 5G and high-frequency RF applications

- AI-driven power management

- Miniaturization and high-density packaging

- Cybersecurity in power systems

- Thermal management innovations

- Strategic M&A and ecosystem partnerships

- Sustainability and energy efficiency

- Wide-Bandgap Semiconductor Adoption (SiC & GaN)

Silicon carbide (SiC) and gallium nitride (GaN) are replacing traditional silicon due to superior efficiency, thermal performance, and switching speed. These materials enable compact, high-power-density designs in EVs, solar inverters, and fast chargers, driving innovation across automotive and renewable sectors.

- Electrification of Transportation

Power electronics are central to electric vehicles (EVs), hybrid systems, and charging infrastructure. The shift to 800V platforms and bidirectional converters is increasing demand for advanced modules and integrated power ICs, making transportation cleaner and more efficient.

- Renewable Energy Integration

Solar and wind systems rely on power electronics for energy conversion, grid synchronization, and storage. Utility-scale inverters and smart converters are being upgraded to handle higher voltages and fluctuating loads, supporting the global transition to clean energy.

- 5G and High-Frequency RF Applications

GaN-based RF amplifiers are powering 5G base stations and telecom infrastructure. These devices offer higher power-added efficiency and thermal stability, enabling dense urban deployments and low-latency networks.

- AI-Driven Power Management

Artificial intelligence is optimizing energy flow, predicting failures, and enhancing system reliability. Smart power controllers and adaptive algorithms are improving performance in industrial automation, consumer electronics, and smart grids.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights—Download the Brochure now and dive deeper into the future of the Global FinTech Market.

FinTech Market Size & Statistics

- The Market for Fintech was estimated to be worth USD 335.36 Billion in 2024.

- The Market is going to expand at a CAGR of 16.37% between 2025 and 2035.

- The Global FinTech Market Size is anticipated to reach USD 1777.13 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the fintech market.

- Asia Pacific is expected to grow the fastest during the forecast period in the fintech market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the FinTech market. A sizable population, expanding internet usage, and growing smartphone penetration are all factors contributing to Asia Pacific's anticipated major share during the forecast period. Leading nations in peer-to-peer lending, mobile wallets, and digital payments include China, Singapore, and Australia. In order to obtain financial services more quickly and easily, many customers in the area are completely switching from traditional banks to fintech solutions. Strong investor interest and benevolent government policies also help the area. The Asia Pacific market is expanding as a result of these reasons combined.

North America is expected to generate the highest demand during the forecast period in the FinTech market. North America is controlled by a high degree of digital adoption and a robust technological infrastructure. In the United States, digital wallet adoption increased by 31% annually, reaching 62% in 2023, according to the Federal Reserve. Many of the leading fintech firms and startups in the world are based in the United States, namely. The region's consumers embrace digital banking, mobile payments, and investment platforms with rapidity. Financial institutions are also making significant investments in open banking, blockchain, and artificial intelligence. Innovation is further stimulated by venture capital investment and supportive legislation, which propels the market expansion in North America.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the FinTech market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 20 Companies Leading the FinTech Market

- Visa Inc.

- Mastercard

- Intuit Inc.

- Shopify

- Stripe

- PayPal

- Square (Block Inc.)

- Adyen

- Coinbase

- Chime

- Robinhood

- Fiserv

- Ant Financial

- Nubank

- Binance

- Checkout.com

- Revolut

- Plaid

- WeBank

- SoFi

- Visa Inc.

Headquarters – USA

Visa is the world’s most valuable fintech company, processing over 233 billion transactions worth $15.7 trillion in 2024. Its network powers embedded finance across banking, retail, and mobility platforms. Visa’s APIs enable seamless integration of real-time payments, fraud detection, and loyalty programs. The company is investing in blockchain infrastructure and tokenized payments, supporting secure cross-border transactions. With partnerships in Buy Now, Pay Later (BNPL) and digital wallets, Visa is expanding financial access globally. Its commitment to cybersecurity and AI-driven analytics makes it a cornerstone of the fintech ecosystem.

- Mastercard

Headquarters – USA

Mastercard is a global fintech powerhouse with a market cap exceeding $500 billion. It leads in open banking, enabling secure data sharing between banks and third-party apps. Through its Fintech Express program, Mastercard supports startups in launching digital payment solutions quickly. The company’s innovations in contactless payments, AI fraud prevention, and cross-border remittances are reshaping global commerce. Mastercard is also investing in green finance and ESG-linked payment tools, aligning fintech with sustainability goals. Its inclusive finance initiatives target underserved communities, making digital banking more accessible.

- Intuit Inc.

Headquarters – USA

Intuit is a leading fintech firm known for products like QuickBooks, TurboTax, and Mint, which streamline accounting, tax filing, and personal finance. With a market cap over $200 billion, Intuit is integrating AI-driven financial planning and cash flow forecasting into its platforms. Its acquisition of Credit Karma expanded its reach into consumer lending and credit monitoring. Intuit’s ecosystem supports embedded finance for SMBs, enabling payroll, invoicing, and loan access from a single dashboard. The company’s focus on automation and financial literacy makes it a trusted partner for millions of users worldwide.

- Shopify

Headquarters – Canada

Shopify is a top fintech innovator in the ecommerce space, with a market valuation of over $148 billion. Its platform integrates Shopify Payments, Shop Pay, and BNPL options, enabling merchants to manage storefronts and finances seamlessly. Shopify’s fintech stack includes capital lending, fraud protection, and real-time analytics, empowering small businesses to scale. The company is expanding into cross-border commerce and cryptocurrency payments, aligning with global fintech trends. Shopify’s embedded finance model turns every merchant into a fintech-enabled enterprise, redefining digital entrepreneurship.

- Stripe

Headquarters – USA

Stripe is a privately held fintech giant valued at $50 billion, powering payments for millions of online businesses. Its APIs support embedded finance, subscription billing, fraud detection, and real-time payouts. Stripe Climate enables merchants to fund carbon removal projects, linking fintech with sustainability. The company’s expansion into banking-as-a-service, crypto infrastructure, and identity verification makes it a full-stack fintech provider. Stripe’s developer-centric approach and global reach position it as a key enabler of the digital economy.

Are you ready to discover more about the FinTech market?

The report provides an in-depth analysis of the leading companies operating in the global FinTech market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Visa Inc.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Mastercard

- Intuit Inc.

- Shopify

- Stripe

- PayPal

- Square (Block Inc.)

- Adyen

- Coinbase

- Others.

Conclusion

The FinTech market is rapidly reshaping global finance by digitizing payments, expanding financial access, and accelerating innovation in banking and investment. Powered by trends like embedded finance, blockchain, and AI-driven analytics, it enables faster, safer, and more personalized services across sectors. Startups and tech giants alike are unlocking new business models—from decentralized finance (DeFi) to buy-now-pay-later platforms.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?