Top 20 Companies in Mining Market (2024–2035): Key Insights, Growth Factors & Industry Trends

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

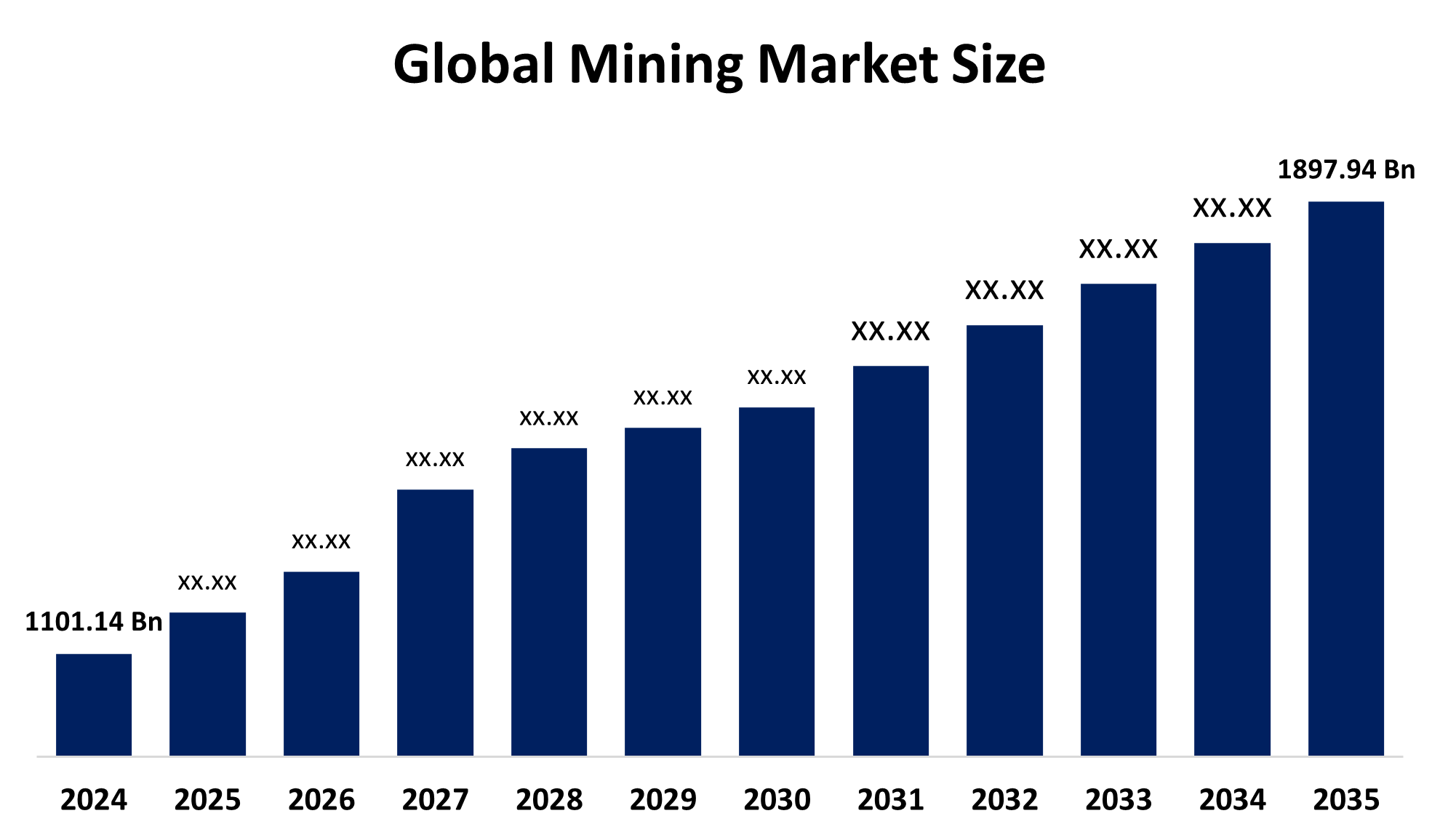

According to a research report published by Spherical Insights & Consulting, The Global Mining Market Size is projected To Grow from USD 1101.14 Billion in 2024 To USD 1897.94 Billion by 2035, at a CAGR of 5.07% During The forecast period 2025–2035. Technological developments, a rise in mining investments, advantageous government regulations, the use of renewable energy in mining, and the quick fluctuations in commodity prices are all responsible for the expansion during the historic period.

Introduction

Mining provides metals, minerals, and rare earth elements, which are crucial for the development of future technologies. Because mining is a very profitable industry with a global presence, stakeholders in the sector are expecting more and more ESG transparency and reporting. Companies that use ESG to increase customer confidence are more likely to see an increase in market share and have easier access to funding. Increased investment and government support for digital mine innovation are expected to drive demand for mining equipment during the projected period. It is expected that space mining activities will rise dramatically due to the growing interest of the commercial sector, the development of a practical space mining technology, and the decrease in project costs. Mining companies prioritize increasing productivity by offering state-of-the-art software solutions.

Top 10 trends in Mining Market

- Green Energy Transition

- AI and Automation

- Sustainable Mining Practices

- Deep-Sea and Space Mining

- IoT and Smart Operations

- GenAI and Workforce Transformation

- Resilient Supply Chains

- Critical Mineral Exploration

- Mergers and Acquisitions

- ESG and Nature-Positive Mining

1. Green Energy Transition

The global push toward clean energy is redefining mining priorities. As the demand for lithium, cobalt, copper, and rare earth elements surges—fueled by electric vehicles, solar panels, and wind turbines—mining companies are accelerating efforts to sustainably extract and process these materials. This shift is also pushing innovation in recycling and recovery methods to reduce waste and environmental impact.

2. AI & Automation

Artificial intelligence is revolutionizing mining operations, from mineral exploration to equipment management. Autonomous drilling and hauling systems reduce human risk while boosting productivity. Machine learning models analyze geological data to pinpoint mineral-rich zones, and predictive maintenance systems minimize downtime by forecasting equipment failures before they happen.

3. Sustainable Mining Practices

Environmental responsibility is becoming non-negotiable. Mining firms are integrating solar and wind energy into their operations and adopting zero-waste models that recycle tailings and wastewater. Biodiversity preservation and land rehabilitation programs are now central to license approvals and investor trust, transforming how mining aligns with planetary health.

4. Deep-Sea & Space Mining

Exploration is heading beyond Earth’s surface. Companies and researchers are investigating deep-sea mining for polymetallic nodules rich in nickel and cobalt, while aerospace initiatives explore asteroid mining for metals like platinum and gold. Though still experimental, these frontiers offer long-term solutions to terrestrial resource scarcity.

5. IoT & Smart Operations

The Internet of Things (IoT) is enabling real-time monitoring of safety, machinery health, and environmental data. Connected sensors track temperature, vibration, and air quality, improving decision-making and reducing hazards. Smart mining platforms also allow remote operation and predictive logistics in harsh or remote environments.

Key Drivers & Opportunities In Mining Market

Growing use of nanoparticles in medication administration

Drug delivery and medical device usage of nanomaterials is accelerating due to the growing need for effective and affordable healthcare treatment and diagnostics. The growing use of large-sized materials in drug administration presents a number of difficulties, such as in-vivo instability, poor body absorption, problems with target-specific delivery and tonic efficacy, low bioavailability, poor solubility, and likely negative pharmacological effects. Thus, mining is important for drug formulations and improved medicine. Additionally, mining improves the shelf-life, thermostability, and resistance to humidity fluctuations of current medications, which lowers transportation costs and even the necessary dosages. Consequently, the need for mining is growing in order to administer drugs more effectively and efficiently.

Increased demand for minerals and metals

Future mining industry expansion is anticipated to be driven by rising demand for metals and minerals. A naturally occurring material that is distinguished by its distinct composition, atomic structure, and chemical and physical characteristics is called a mineral. Gold, silver, and copper are examples of metals, which are simple substances that are lustrous, malleable, and frequently good conductors of heat and electricity. Economic expansion and the usage of raw materials for a variety of industries, including as construction, electronics, automotive, and renewable energy, are driving the need for minerals and metals. For instance, the Australian Bureau of Statistics, a government organization based in Australia, reported in June 2023 that mineral exploration spending had increased by 0.8% from the first quarter of 2023 to $1,039 million in the second quarter. Consequently, the mining market is expanding due to the rising demand for metals and minerals.

Mining Market Size & Statistics

The Market for mining was estimated to be worth USD 1101.14 Billion in 2024.

The Market is Going to expand at a CAGR of 5.07% between 2025 and 2035.

The Global Mining Market is anticipated to reach USD 1897.94 billion by 2035.

North America is expected to generate the highest demand during the forecast period in the mining market

Asia-pacific is expected to grow the fastest during the forecast period in the mining market.

Regional growth and demand

Asia-pacific is expected to grow the fastest during the forecast period in the mining market. Bauxite, gold, copper, iron ore, coal, and other vital minerals are abundant in the Asia-Pacific region, which encompasses China and India. The huge rare earth elements in China, the vast amounts of coal and iron ore in India, and the substantial nickel and bauxite reserves in Indonesia all emphasize the region's mining potential. Both domestic and foreign companies have made large investments in the mining sector, increasing production capabilities. For instance, significant investments in regional mining projects have been made feasible by China's Belt and Road Initiative (BRI). The area has attracted substantial foreign direct investment because of its favorable mining regulations and economic opportunities.

North America is expected to generate the highest demand during the forecast period in the mining market. The increasing need for base and precious metals for a variety of applications, especially in the US and Canada, has led to a boom in base and precious metal mining activities. With a compound annual growth rate (CAGR) of 1.66% from 2023 to 2033, the US mining market is expected to reach USD 102.01 billion, according to a study published by Spherical Insights & Consulting. Canada is the fourth-largest mining nation in the world. With over 60 distinct metals and minerals produced, Canada ranks in the top 10 producers in the world. Furthermore, Canada has a wealth of mineral and metal resources, including cobalt, nickel, copper, and platinum, all of which are essential for the development of renewable energy technology. Demand for minerals and metals will increase as EVs and batteries are made with them because they are necessary for low-carbon technology.

Top 20 Companies Leading the Mining Market

- BHP Group Ltd.

- Rio Tinto Group

- Glencore Plc

- Vale S.A.

- China Shenhua Energy Co. Ltd.

- Southern Copper Corporation

- Freeport-McMoRan Inc.

- Newmont Corporation

- Zijin Mining Group Co. Ltd.

- Anglo American Plc

- Barrick Gold Corporation

- Grupo México

- Ma’aden (Saudi Arabian Mining Company)

- Fortescue Metals Group

- Teck Resources Limited

- Gold Fields Limited

- Antofagasta Plc

- Vedanta Limited

- Norilsk Nickel

- First Quantum Minerals Ltd.

- BHP Group Ltd

Headquarters - Australia

The largest diversified mining corporation in the world, BHP is based in Melbourne, Australia, and dominates the worldwide mining industry with its operations in nickel, coal, copper, and iron ore. Its assets, which assist sectors including steelmaking and renewable energy, are spread across Australia, the Americas, and Africa. BHP is known for its operational excellence because of its emphasis on sustainable practices and high-quality, reasonably priced reserves. The company is making significant investments in digital mining and decarbonization technologies in order to future-proof its portfolio. BHP is still at the forefront of resource exploration and development in 2025, making a substantial contribution to global supply chains. Its dedication to ESG and strategic approach to commodity diversification make it a pillar of the global mining sector.

- Rio Tinto

Headquarters – UK

Rio Tinto, a mining industry leader with headquarters in London, UK, is well-known for its vast operations in iron ore, aluminum, copper, and lithium. The organization, which has operations in more than 35 nations, has a strong emphasis on sustainability, safety, and innovation. The Oyu Tolgoi copper project and the Pilbara iron ore mines owned by Rio Tinto are two of the most productive in the world. To maximize productivity, the business combines AI-driven exploration with autonomous haulage technologies. Rio Tinto is increasing its presence in vital minerals in 2025 in order to aid in the energy transition. Its dedication to ethical mining and community involvement strengthens its position as a reliable supplier in the world's mining industry.

- Glencore Plc

Headquarters – Switzerland

Metals, minerals, energy, and agricultural commodities are among the most diverse industries that Glencore operates in. The company is based in Baar, Switzerland. Along with being a major global trader of more than 60 commodities, it produces coal, copper, zinc, and nickel. With its vertically integrated business model, which integrates mining, processing, and marketing, Glencore has a distinct advantage in supply chain management. Through recycling and battery metal investments, the company is promoting the green economy. Glencore is still working to cut carbon emissions throughout its activities and broaden its ESG initiatives in 2025. Its global reach, adaptability, and scale make it an essential component of the mining industry's development.

4.Vale S.A.

Headquarters - Brazil

Vale is a major producer of copper, nickel, and iron ore in the global mining market. The company is based in Rio de Janeiro, Brazil. Major mines in Brazil, Canada, and Indonesia are run by it, providing raw materials for electronics, batteries, and steel. Among the world's biggest and most effective iron ore operations is Vale's S11D complex. Through its efforts in carbon neutrality, tailings management, and replanting, the corporation demonstrates its dedication to sustainable mining. In 2025, Vale is increasing its nickel output to satisfy the growing demand from producers of electric vehicles. Its position as a major provider in global resource networks is strengthened by its calculated investments in mineral processing and logistics.

- China Shenhua Energy Co. Ltd.

Headquarters - China

Beijing-based Shenhua is the biggest coal mining corporation in China and a significant force in the world mining industry. In order to facilitate effective resource delivery throughout Asia, it runs integrated coal, power, rail, and port companies. Shenhua's emphasis on emissions reduction and clean coal technologies is in line with China's sustainability objectives. Additionally, the corporation is looking into diversifying into renewable energy and rare earths. Shenhua is still updating its mining operations in 2025 by implementing automation and intelligent monitoring technologies. Its size, infrastructure, and support from the government make it a powerful player in Asia's mining and energy industries, promoting economic development and stability in the area.

Are you ready to discover more about the mining market?

The report provides an in-depth analysis of the leading companies operating in the global mining market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- BHP Group Ltd.

Business Overview

Company Snapshot

Products Overview

Company Market Share Analysis

Company Coverage Portfolio

Financial Analysis

Recent Developments

Merger and Acquisitions

SWOT Analysis

- Rio Tinto Group

- Glencore Plc

- Vale S.A.

- China Shenhua Energy Co. Ltd.

- Southern Copper Corporation

- Freeport-McMoRan Inc.

- Newmont Corporation

- Zijin Mining Group Co. Ltd.

- Others.

Conclusion

The growing need for essential minerals, technological advancements, and pro-mining government regulations are driving the fast-changing global mining business. Because of their strategic investments and quantity of resources, regions such as Asia-Pacific and North America are becoming important centers of growth. Mining is essential to facilitating the energy transition and infrastructure development as businesses move toward low-carbon technologies. The industry is well-positioned for long-term resilience and sustainable growth due to key firms' investments in digital mining technologies and ESG compliance

Need help to buy this report?