Top 15 Global Companies in Military Sensors Market 2025: Strategic Overview And Future Trends (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

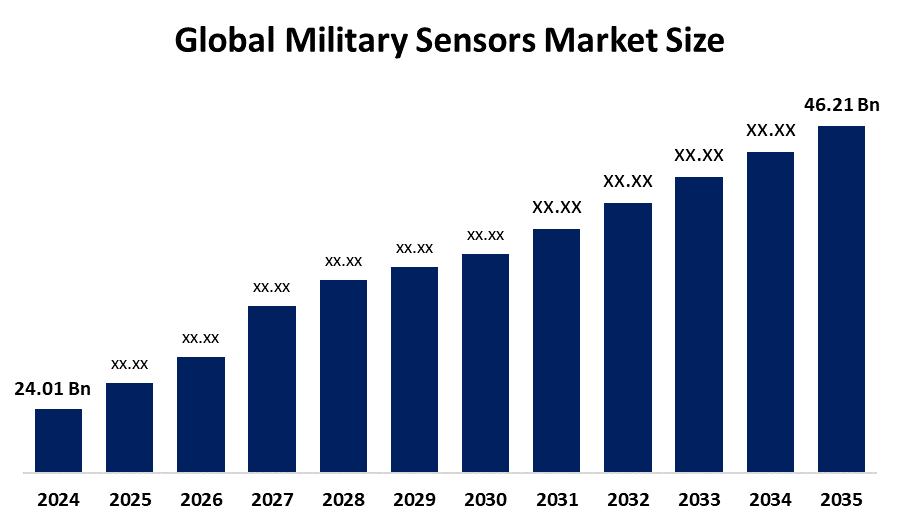

According to a research report published by Spherical Insights & Consulting, The Global Military Sensors Market Size is projected to Grow from USD 24.01 Billion in 2024 to USD 46.21 Billion by 2035, at a CAGR of 6.13% during the forecast period 2025–2035. Additionally, the growing use of unmanned systems, such as drones and self-driving vehicles, significantly fuels the market. These systems depend significantly on sophisticated sensors for navigation, monitoring, and combat activities. As armed forces transition to automation and remote combat to lower personnel risks, the need for sensors that deliver precise real time information is increasing substantially.

Introduction

The worldwide industry that develops, produces, and implements sensor technology especially made for military and defense applications is known as the military sensors market. To assist military operations, these sensors gather, identify, and evaluate data from a variety of contexts to offer real-time situational awareness, navigation, target detection, surveillance, reconnaissance, and threat identification. The market is gaining from multiple advancements in sensor technologies like infrared, RADAR, and SONAR, which improve the functionalities of military platforms including drones, aircraft, and naval ships. Moreover, the increase in asymmetric warfare and the necessity for border security are further driving the demand in the market. Intelligent and advanced sensor technologies are essential for security systems, making sensors a vital part of military systems. The growth of the military sensor market is due to advancements in microelectromechanical systems (MEMS). The increasing use of MEMS-based devices like micro gyroscopes, microbolometers, and micromirrors is anticipated to boost market growth. Additionally, military modernization initiatives implemented in different nations are anticipated to boost market expansion.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Military Sensors Market.

Military Sensors Market Size & Statistics

- The Market Size for Military Sensors Was Estimated to be worth USD 24.01 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 6.13% between 2025 and 2035.

- The Global Military Sensors Market Size is anticipated to reach USD 46.21 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the military sensors market.

- Asia Pacific is expected to grow the fastest during the forecast period in the military sensors market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the military sensors market.

The rising demand for fighter jets, unmanned aerial vehicles (UAVs), and missile defense systems is accelerating sensor adoption. Additionally, geopolitical tensions in the South China Sea and border disputes are prompting nations to enhance their defense capabilities. Moreover, advancements in AI, IoT, and electronic warfare in defense industries and collaborations with major key market players are expanding the regional market revenue. With continuous technological advancements and strategic defense initiatives, the Asia-Pacific region is expected to be a key growth driver in the military sensors market.

North America is expected to generate the highest demand during the forecast period in the military sensors market.

The United States, notably, spearheads the region with significant investments in sensor-driven defense systems, such as radar, infrared, electro-optical, and biochemical sensors. Moreover, the U.S. Department of Defense (DoD) and major defense firms such as Lockheed Martin, Northrop Grumman, and Raytheon enhance the area's robust market standing. Further, continuous acquisition of cutting-edge fighter aircraft, unmanned vehicles, and missile defense technologies boosts sensor utilization

Top 10 trends in the Military Sensors Market

- Integration of Artificial Intelligence and Machine Learning

- Miniaturization and Lightweight Sensor Designs

- Enhanced Cybersecurity Measures

- Development of Multi-Functional Sensors

- Advancements in Hyperspectral and Multi-Spectral Imaging

- Focus on Stealth and Low-Observable Sensors

- Expansion of Sensor Networking and Interoperability

- Increased Defense Spending Driving Market Growth

- Emergence of Autonomous and Swarming Systems

- Geopolitical Tensions Influencing Sensor Development

1. Integration of Artificial Intelligence and Machine Learning

AI and ML are improving sensor functions through real-time data assessment, predictive upkeep, and self-governing decision-making. These technologies enhance situational awareness and operational effectiveness in intricate combat scenarios.

2. Enhanced Cybersecurity Measures

With military sensors becoming increasingly interconnected, the likelihood of cyber threats escalates. A rising focus is being placed on incorporating strong cybersecurity measures, like encryption and secure communication protocols, to safeguard sensitive information and maintain the integrity of sensor systems.

3. Advancements in Hyperspectral and Multi-Spectral Imaging

Hyperspectral and multi-spectral sensors are being designed to deliver comprehensive data over an extensive array of wavelengths. These sensors improve the abilities to detect, identify, and classify targets, increasing the efficiency of surveillance and reconnaissance operations.

4. Increased Defense Spending Driving Market Growth

Worldwide military spending is increasing, as nations allocate more funds to cutting-edge technologies, such as defense sensors. Global military spending hit $2.44 trillion in 2023, representing a 6.8% rise compared to the previous year.

5. Geopolitical Tensions Influencing Sensor Development

Increasing global tensions are driving countries to speed up the creation and implementation of advanced sensor technologies. For instance, Germany's heightened defense expenditures due to geopolitical changes have resulted in a spike in requests for sophisticated sensor systems such as the TRML-4D radar.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the military sensors market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 15 Companies Leading the Military Sensors Market

- Honeywell International Inc.

- Lockheed Martin Corporation

- BAE Systems plc

- L3Harris Technologies; Inc.

- Leonardo S.p.A.

- Teledyne Technologies Incorporated

- Safran S.A.

- Textron Inc.

- Curtiss-Wright Corporation

- TE Connectivity Ltd.

- Thales Group

- General Electric Company

- Crane Aerospace & Electronics

- IMPERX; INC.

- RTX Corporation

- Others

1. RTX Corporation

Headquarters: Arlington, United States

RTX Corporation, previously recognized as Raytheon Technologies, is a worldwide leader in aerospace and defense, with a considerable part of its operations focused on creating, producing, and integrating advanced military sensors. The companys knowledge covers multiple fields and technologies, offering a diverse array of solutions for the U.S. government, its partners, and commercial clients. The organization is divided into three primary business divisions Pratt & Whitney, Collins Aerospace, and Raytheon. A sophisticated active electronically scanned array (AESA) radar employed on the U.S. Navy s F/A-18E/F Super Hornet and EA 18G Growler planes. It offers improved situational awareness, multi target tracking, and precise engagement features.

2. IMPERX; INC

Headquarters: Florida, USA

IMPERX, Inc. is a company located in the U.S. that focuses on designing and producing durable, high-performance digital cameras and imaging systems. They are a less prominent company than giants like RTX, their products are essential in various challenging applications, such as military and aerospace. IMPERX cameras are designed to endure tough environments. They are frequently engineered to satisfy or surpass MIL-STD-810G standards, which evaluate resistance to shock, vibration, extreme temperatures (e.g, -40C to 85C), and moisture. This renders them appropriate for application on aircraft, naval ships, and land vehicles.

3. Crane Aerospace & Electronics

Headquarters: Washington, United States

Crane Aerospace & Electronics, a division of Crane Co., is a worldwide leader in delivering highly specialized products for the commercial aviation, defense, and space sectors. The company does not develop large, intricate sensor systems such as radars or optical aiming devices. Rather, its proficiency is in producing the specialized and dependable sensing components and systems that are incorporated into these larger platforms and across various aircraft systems. Crane A&E creates and produces essential systems and parts across various product categories, such as sensing, power, fluid management, landing systems, and microwave technologies. They are utilized on landing gear to assess weight on wheels on doors and hatches to verify they are tightly closed, and on flight control surfaces to check they are in the appropriate position. This information is essential for ensuring flight safety and managing different systems on both military and commercial planes.

4. TE Connectivity Ltd

Headquarters: Galway, Ireland

TE Connectivity Ltd, is a worldwide leader in connectivity and sensor solutions across various sectors, such as defense and military. Although they assist sensor platforms such as radar systems or satellite imaging suites, they are an essential provider of the precisely engineered and dependable components that are fundamental to these systems. Their products are engineered to function in the toughest conditions, establishing them as a key component of contemporary military technology. TE Connectivity creates and produces a wide range of products that link and safeguard the movement of power, signals, and data. Their solutions exist in a wide range of products, including automobiles, medical devices, industrial machinery, and importantly, military and aerospace systems. TE s role in military sensors centers on delivering robust and high quality components that allow a broader system to operate effectively. Their product ranges in this area are broad and encompass a range of sensor varieties.

5. General Electric Company

Headquarters: Cincinnati, United States

General Electric Company has experienced a significant reorganization, and its aerospace and military segments are now part of an independent entity named GE Aerospace. This organization creates and produces military sensors and associated technologies. GE Aerospace is a top global supplier of jet and turboprop engines, along with integrated systems for commercial, military, private, and general aviation aircraft. Though renowned for their engines, their proficiency in avionics and integrated systems encompasses various military sensors. This encompasses systems that gauge air data (airspeed, altitude, angle of attack) and deliver inertial navigation. They have offered avionics assistance for key military platforms such as the U.S. Navys F/A-18 and AH-1Z fleets. For instance, they supplied inertial reference units and various sensor components for the U.S. Marine Corps Ground-Based Operation Surveillance System (G-BOSS).

Are you ready to discover more about the Military Sensors market?

The report provides an in-depth analysis of the leading companies operating in the global military sensors market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Honeywell International Inc.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Lockheed Martin Corporation

- BAE Systems plc

- L3Harris Technologies; Inc.

- Leonardo S.p.A.

- Teledyne Technologies Incorporated

- Safran S.A.

- Textron Inc.

- Curtiss-Wright Corporation

- TE Connectivity Ltd.

- Thales Group

- General Electric Company

- Crane Aerospace & Electronics

- IMPERX; INC.

- RTX Corporation

- Others

Conclusion

The worldwide military sensors market is set for continuous growth, almost reaching twice its size from 2024 to 2035 as armed forces globally emphasize technological advancements and automation. Fueled by progress in MEMS, hyperspectral imaging, AI integration, and strong cybersecurity, sensors are increasingly essential for situational awareness, autonomous systems, and resilient military platforms. Major defense leaders—such as Honeywell, Lockheed Martin, RTX, BAE Systems, L3Harris, and Thales, are driving this expansion, while niche innovators like IMPERX and TE Connectivity provide essential, resilient components for air, land, and maritime applications. North America is at the forefront of sensor demand, while Asia Pacific is boosting adoption via modernization and increased security requirements. The future of the sector will be influenced by ongoing investment in smart sensing, interoperable networked battlespace, and rapidly evolving sensor platforms designed for new threats and mission needs.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?