Top 15 Companies in Venture Capital (VC) Market Worldwide in 2025: Market Research Report (2024–2035)

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

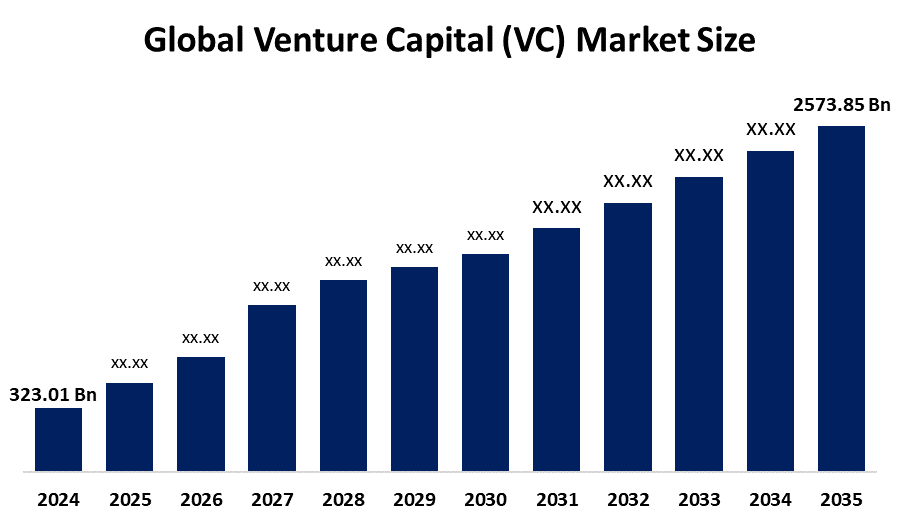

According to a research report published by Spherical Insights & Consulting, The Global Venture Capital (VC) Market Size is projected to Grow from USD 323.01 Billion in 2024 to USD 2573.85 Billion by 2035, at a CAGR of 20.77% during the forecast period 2025–2035. The expansion of the venture capital (VC) market is driven by a surge in startup activity, rapid technological advancements, heightened investor interest, supportive government initiatives, and growing demand for innovative businesses with high growth potential.

Introduction

Venture capital represents a private equity investment practice in which investors provide funds to rapidly expanding start-ups for ownership stakes typically within disruptive markets such as technology, healthcare, and clean energy. Venture capital financing thrives because technological progress combines with increased entrepreneurial activity and expanding market requirements for scalable new solutions. The market expansion occurs because low interest rates and strong investor interest in high-risk rewards have created a large pool of available funds. The recent trend shows venture capital firms backing diverse founders while focusing their investment efforts on green technologies through impact-driven and sustainable funding. The pandemic accelerated digital transformation, which led to increased investments in fintech applications alongside artificial intelligence and remote work solutions. Governments actively create policies that support innovation through tax incentives, together with financial assistance and co-investment programs. The venture capital ecosystem becomes more dynamic and supportive when initiatives such as the EU's Horizon Europe funding and the U.S. SBA's investment programs operate.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights-Download the Brochure now and dive deeper into the future of the Venture Capital (VC) Market.

Venture Capital (VC) Market Size & Statistics

The Market Size for Venture Capital (VC) Was Estimated to be worth USD 323.01 Billion in 2024.

The Market Size is Going to Expand at a CAGR of 20.77% between 2025 and 2035.

The Global Venture Capital (VC) Market Size is anticipated to reach USD 2573.85 Billion by 2035.

Asia Pacific is expected to generate the largest demand during the forecast period in the Venture Capital (VC) Market.

North America is expected to grow the fastest during the forecast period in the Venture Capital (VC) Market.

Regional growth and demand

North America is expected to grow the fastest during the forecast period in the venture capital (VC) market. The developed startup environment, together with leading venture capital firms and technological breakthroughs in artificial intelligence, biotech, fintech, and clean energy, drives this market expansion. Venture funding maintains its momentum in the United States because of regulatory advantages, nearby top research institutions, and entrepreneurial culture. The rapid growth of venture funding stems from both increased corporate venture activity and expanding interest in early-stage investments. The VC sector in North America will grow strongly despite increasing worldwide competition.

Asia Pacific is expected to generate the highest demand during the forecast period in the venture capital (VC) market. Strong economic growth, together with fast digital transformation and a thriving startup environment in major countries such as China, India, Singapore, and Indonesia, drives this expansion. The region experiences increased VC activity through government support for innovation and entrepreneurship, combined with rising foreign direct investment. Investor interest has dramatically increased because of the rising adoption of new technologies, including artificial intelligence, fintech, and healthtech. The Asia Pacific region stands as a vital venture capital funding hub because it surpasses conventional markets when measuring deal volume alongside investment value.

Top 10 trends in the Venture Capital (VC) Market

- Sector-Specific Venture Funds

- Climate Tech Investment Growth

- Surge in Early-Stage Investment

- Expansion into Emerging Markets

- Integration of AI and Data Analytics

- Rise of Corporate Venture Capital (CVC)

- Emphasis on Diversity, Equity & Inclusion (DEI)

- Development of Secondary Markets

- Profitability Over Hyper-Growth

- Global and Decentralized Deal Sourcing

1. Sector-Specific Venture Funds

Venture capital firms are progressively establishing funds that concentrate on sectors such as fintech, healthtech, or climate tech. This allows for specialized knowledge, enhanced risk evaluation, and customized assistance, which results in better startup growth and increased returns by ensuring investments are closely aligned with sector dynamics.

2. Climate Tech Investment Growth

The rising environmental concerns, together with government incentives, have led to increasing venture capital investment in climate technology startups. Venture capital investments target renewable energy alongside carbon capture technology and sustainable agriculture systems to achieve social impact through profitable returns while tackling pressing climate issues with innovative solutions.

3. Surge in Early-Stage Investment

Venture capitalists show a rising interest in backing seed and Series A startups to secure initial equity stakes while maintaining control. Early-stage investment through this approach presents higher potential returns, even though risks are higher, because investors want to guide startup strategies from their initial stages while facing late-stage valuation competition.

4. Expansion into Emerging Markets

Emerging markets, including Southeast Asia, Africa, and Latin America, experience rapid expansion of venture capital investments. Global investors seek fresh opportunities outside conventional tech hubs because these markets contain vast, underserved populations and expanding digital penetration and economic advancement.

5. Integration of AI and Data Analytics

VC firms utilize AI technologies along with advanced analytics to optimize their processes of deal sourcing, due diligence, and portfolio monitoring. The tools address bias while improving risk assessment capabilities and speeding up decisions, thus enhancing startup identification in competitive markets.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the venture capital (VC) market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 15 Companies Leading the Venture Capital (VC) Market

- Accel Partners

- NEA

- Insight Venture Partners

- Matrix Partners

- Redpoint Ventures

- Lightspeed Venture Partners

- Andreessen Horowitz

- SoftBank Vision Fund

- Kleiner Perkins Caufield Byers

- Tiger Global Management

- Index Ventures

- Union Square Ventures

- Bessemer Venture Partners

- Battery Ventures

- Sequoia Capital

1. Accel Partners

Headquarters: Palo Alto, California, USA

Accel Partners serves as a prominent venture capital firm that directs its investments toward early-stage and growth-stage technology companies. Accel maintains its reputation through supporting Facebook, Dropbox, Flipkart, and Atlassian while focusing on building enduring relationships with company founders. The firm uses its operational expertise and global network to accelerate innovation within SaaS, cybersecurity, fintech, and consumer technology. Through its offices in the U.S., India, and Europe, Accel provides startups with assistance to handle complex markets and grow their operations toward sustainable development. The company follows major VC patterns through expanding globally and focusing on early-stage investments while supporting cloud-native companies that use data across multiple industries.

2. NEA

Headquarters: Menlo Park, California, USA

NEA has established itself as one of the world's most diversified venture capital firms because it holds over $25 billion in committed capital. NEA supports businesses across healthcare, enterprise technology, and consumer services sectors at all development stages from seed to growth with portfolio companies including Robinhood, Coursera, and Salesforce. Through its wide network and operational experience, NEA helps portfolio companies grow internationally and develop products while finding important strategic team members. The company's investment approach combines cross-sector innovation with large fund size and multi-stage investments, which aligns with present VC market dynamics, including ecosystem development and deep tech and lifecycle partnerships.

3. Insight Venture Partners

Headquarters: New York City, New York, USA

Insight Partners functions as a major global investor that specializes in funding SaaS and technology companies that show fast growth. Insight Partners provides financial resources and operational help to help businesses grow internationally through its major investments in Monday.com, Shopify, and Qualtrics. The ScaleUp methodology from Insight Partners enables startups to optimize their operations and reach IPO readiness by integrating expert guidance with data structures and growth methods. The company focuses on enterprise software, together with artificial intelligence, cloud infrastructure, and cybersecurity, because these areas match the current trends in digital transformation, data intelligence, and scalable technology platforms. The support provided by Insight Partners extends to both secondary market transactions and late-stage funding rounds.

4. Matrix Partners

Headquarters: Boston, Massachusetts, USA

Matrix Partners stands as a respected VC firm that invests early in innovative technology companies, including HubSpot, Canva, and Zendesk. Matrix specializes in seed and Series A rounds while focusing on enterprise software, consumer applications, and marketplaces. The firm demonstrates a strong commitment to its portfolio by providing extensive founder support through the product-market fit stage and scaling phase. Matrix operates in the United States and India, which shows their worldwide vision. The investment strategy of this firm aligns with current venture capital industry trends toward vertical SaaS, user-centric design, and agile startup methodologies.

5. Redpoint Ventures

Headquarters: Menlo Park, California, USA

Redpoint Ventures functions as a prominent venture capital firm that invests in companies during their initial and expansion phases across both business-to-consumer and business-to-business markets. Through its founder-focused model, Redpoint provides operational support that has helped bring Netflix, Snowflake, and Twilio to successful exits. The company has established its expertise through investments in cloud computing, digital media, alongside mobile technologies, Web3, and AI technologies. Through its investment strategy, Redpoint supports startups that build user-focused platforms that scale while maintaining strong unit economics. The investment themes at Redpoint align with modern VC investment trends, which focus on vertical software developments as well as decentralized systems and enduring profitability strategies.

Are you ready to discover more about the venture capital (VC) market?

The report provides an in-depth analysis of the leading companies operating in the venture capital (VC) market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Accel Partners

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- NEA

- Insight Venture Partners

- Matrix Partners

- Redpoint Ventures

- Lightspeed Venture Partners

- Andreessen Horowitz

- SoftBank Vision Fund

- Kleiner Perkins Caufield Byers

- Others

Conclusion

The venture capital market continues to transform rapidly as new innovative approaches and sector-specific specialization, along with worldwide expansion, drive its development. The key drivers for growth include making investments during the initial stages, along with integrating artificial intelligence and funding projects with sustainability objectives. Venture capitalists now focus more on profitability and diversity despite market fluctuations. This has established an energetic environment that nurtures innovative startups while producing lasting value throughout the world.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?