Top 15 Companies in The Neobanking Market - Key Insights & Industry Trends (2024–2035)

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

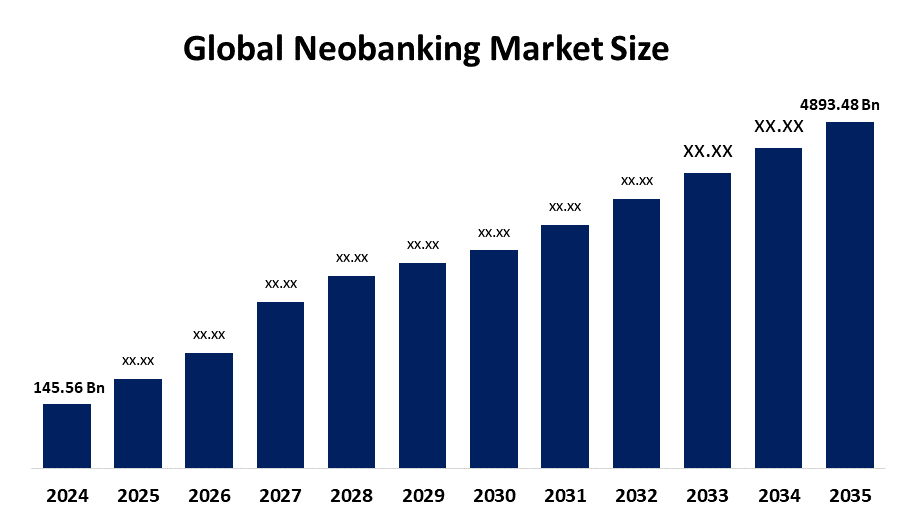

According to a research report published by Spherical Insights & Consulting, The Global Neobanking Market Size is projected to Grow from USD 145.56 Billion in 2024 to USD 4893.48 Billion by 2035, at a CAGR of 37.65% during the forecast period 2025–2035. Neobanks use digital technologies to deliver seamless, user-friendly banking services. As consumers get more comfortable with digital platforms, they are more inclined to select neobanking options over traditional banking services.

Introduction

The new banking industry has grown significantly in recent years due to a number of factors, including the desire for easier and accessible banking services, changing consumer preferences, and advancements in technology. Neo banks are financial organizations that do all of their operations online or through mobile apps, placing a higher priority on digitization than physical branches. In general, they offer a range of banking services, including payment processing, lending products, and checking and savings accounts. The neobanking market has been expanding rapidly on a global scale. According to multiple projections, the global neobanking market is expected to reach billions of dollars by the mid-2020s, with double-digit growth rates expected. Neobanks typically serve tech-savvy people, small businesses, and millennials seeking efficient, user-friendly banking services. Neobanks' innovative features, reasonable rates, and emphasis on digital ease regularly attract these customers.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Neobanking Market Size & Statistics

The market for neobanking was estimated to be worth USD 145.56 Billion in 2024.

The market is going to expand at a CAGR of 37.65% between 2025 and 2035.

The Global Neobanking Market is anticipated to reach USD 4893.48 Billion by 2035.

Europe is expected to generate the highest demand during the forecast period in the neobanking market

Asia Pacific is expected to grow the fastest during the forecast period in the neobanking market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the neobanking market. The neobanking industry in the area was changing significantly and growing quickly. Neobanks, or digital-only banks without physical branches, were gaining popularity due to their distinctive features, user-friendliness, and often lower fees than regular banks. In the Asia-Pacific region, digital technology—like cell phones and internet banking is gaining traction quickly. Online banking choices are more acceptable to this technologically savvy population. Neobanks' growing mobile-first banking solutions demonstrate the growing need for banking services that better fit the preferences and lifestyles of their numerous youthful, digitally native customers. Neobanks' simplified account opening processes and reduced entry hurdles may help them target these segments more effectively.

Europe is expected to generate the highest demand during the forecast period in the neobanking market. European consumers are increasingly using digital banking solutions due to the ease of use of online and mobile banking services. Regulations such as the EU's Payment Services Directive 2 (PSD2), which promoted open banking and allowed third-party providers access to customer account data, made it simpler for new players to enter the banking sector. Neobanks attracted customers, particularly younger ones, with their individualized financial services, transparency, and ease of use. A number of neobanks offered services including budgeting software, easy overseas transfers, and real-time spending notifications to meet the demands of modern customers.

Top 10 trends in Neobanking Market

- Digital-only banking platforms

- Personalization through AI and data analytics

- Open banking and API integrations

- Mobile banking and contactless payments

- Blockchain and cryptocurrency adoption

- Regulatory technology (RegTech) for compliance

- Innovative lending and credit solutions

- Enhanced security and fraud prevention

- Customer onboarding automation

- Seamless user experience and interface

- Blockchain and Cryptocurrency Adoption

Neobanks are increasingly integrating blockchain technology and cryptocurrencies into their services. This allows for secure, transparent transactions and new financial products like crypto wallets and trading platforms. By adopting blockchain, neobanks can offer faster, cheaper cross-border payments and improve overall security, attracting tech-savvy customers interested in digital assets.

- Regulatory Technology (RegTech) for Compliance

Neobanks are leveraging RegTech solutions to ensure compliance with evolving financial regulations efficiently. These tools automate reporting, monitor transactions for fraud, and help manage risk, reducing manual effort and minimizing regulatory penalties.

- Innovative Lending and Credit Solutions

Neobanks are introducing new lending products such as instant personal loans, microloans, and dynamic credit scoring. These solutions use advanced data analytics and AI to offer personalized credit options, making borrowing faster and more accessible.

- Enhanced Security and Fraud Prevention

With increasing digital transactions, neobanks focus heavily on security measures like biometric authentication, real-time fraud detection, and encryption. These technologies protect customer data and build trust by preventing unauthorized access and cyber threats.

- Customer Onboarding Automation

Neobanks are streamlining the onboarding process with automated identity verification, digital KYC procedures, and instant account setup. This reduces wait times, enhances user experience, and enables quick customer acquisition.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the neobanking market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 15 Companies Leading the Neobanking Market

- Chime

- Revolut

- N26

- Monzo

- Wise (formerly TransferWise)

- Starling Bank

- Ally Bank

- Nubank

- Varo Money

- Up Bank

- Atom Bank

- Bunq

- Zopa Bank

- OakNorth Bank

- SoFi Money

- Chime

Headquarters- UK

Chime is a leading neobank based in the United States, founded in 2013. It offers no-fee checking accounts, savings accounts, and early direct deposit services, focusing on providing accessible banking for underserved consumers. Chime’s key strengths include its user-friendly mobile app, real-time transaction alerts, and automated savings features. The company leverages advanced data analytics and AI to personalize customer experiences and prevent fraud. Chime's innovative approach to digital banking, emphasizing financial inclusion and transparency, has helped it grow rapidly, serving millions of customers without traditional banking fees. Its strategic partnerships with FDIC-insured banks ensure secure transactions and compliance with regulatory standards, making it a key player in the evolving neobanking landscape.

2. Revolut

Headquarters- UK

Founded in 2015 in the UK, Revolut is a global neobank offering a wide range of financial services, including currency exchange, international money transfers, cryptocurrency trading, and personal banking. Revolut’s key differentiator is its focus on cross-border banking, appealing to travelers and expatriates. The platform integrates AI-driven fraud detection, real-time notifications, and budgeting tools to enhance customer experience. Revolut’s innovative use of open banking APIs and blockchain technology supports seamless transactions and secure digital assets management. Its rapid expansion across Europe, Asia, and North America underscores its position as a leading neobank. Revolut’s commitment to innovation and regulatory compliance makes it a significant player in the digital banking revolution.

3. N26

Headquarters- Germany

German neobank N26 was founded in 2013 and is well-known for its user-friendly mobile banking software and clear price schedule. It provides commercial banking, financial products, and personal accounts for tech-savvy consumers. With real-time transaction alerts, AI-powered fraud detection, and biometric identification, N26 places a strong emphasis on security. Digital identity verification and automation are used in its user-centric design and smooth onboarding process to make banking simple. Partnerships with regional banks and authorities are part of N26's worldwide expansion plan, which guarantees security and compliance. By emphasizing innovation and offering features like cryptocurrency trading and budgeting tools, the company presents itself as a leader in the neobanking sector and serves a new generation of digitally native customers.

4. Monzo

Headquarters- UK

Monzo is a leading neobank recognized for its vibrant community and customer-first approach. Monzo offers free checking accounts, savings pots, and budgeting tools, emphasizing transparency and ease of use. Its key features include instant notifications, AI-driven spending insights, and secure biometric login. Monzo’s innovative use of APIs and open banking allows integration with third-party financial services, fostering a rich ecosystem. The company invests heavily in security measures like encryption and fraud detection to ensure safe digital banking experiences. Monzo’s focus on customer engagement, combined with its rapid product innovation, has driven its growth, making it a prominent player in the competitive neobanking market.

- Wise (formerly TransferWise)

Headquarters- UK

Wise is a neobank specializing in international money transfers and borderless banking. Its core strengths include transparent fee structures, real exchange rates, and multi-currency accounts. Wise leverages blockchain technology and AI to facilitate fast, secure cross-border transactions with minimal costs. Its digital platform offers features like debit cards, local bank details, and currency exchange, making it ideal for expatriates, freelancers, and global businesses. Wise’s commitment to transparency and compliance with international regulations has helped it build trust worldwide. Its innovative approach to digital banking, emphasizing low-cost international financial services, positions Wise as a key player in the global neobanking ecosystem.

Are you ready to discover more about the neobanking market?

The report provides an in-depth analysis of the leading companies operating in the global neobanking market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Chime

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Revolut

- N26

- Monzo

- Wise (formerly TransferWise)

- Starling Bank

- Ally Bank

- Nubank

- Varo Money

- Others

Conclusion

The rapid growth of the neobanking and neobanking markets highlights the increasing reliance on digital technologies and innovation across industries. Neobankings are advancing quickly, driven by technological breakthroughs and shifting demand patterns, especially in regions like Asia-Pacific and Europe. Similarly, neobanks are transforming the financial landscape by providing more accessible, user-friendly, and efficient banking services, catering to the preferences of digitally native consumers. Key trends such as AI-driven personalization, open banking, blockchain adoption, and enhanced security measures are shaping the future of both sectors.

Need help to buy this report?