Top 15 Companies in Industrial Cybersecurity Market (2024–2035): Statistics View by Spherical Insights & Consulting

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

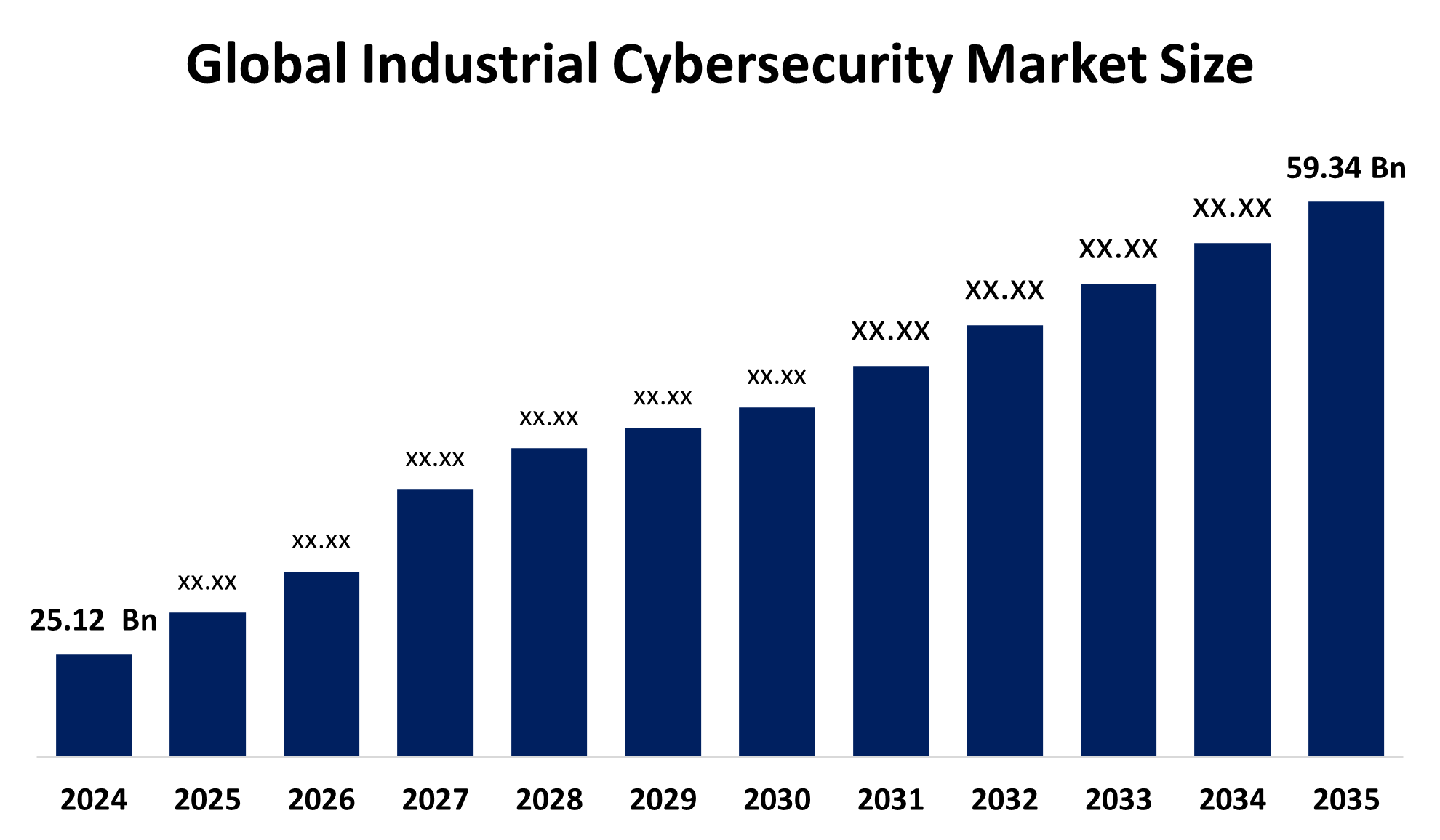

According to a research report published by Spherical Insights & Consulting, The Global Industrial Cybersecurity Market Size is projected To Grow from USD 25.12 Billion in 2024 To USD 59.34 Billion by 2035, at a CAGR of 8.13% during the forecast period 2025–2035. The industrial cybersecurity market is anticipated to develop as a result of the increasing frequency of cyberattacks on industrial control systems. Growing IoT integration across a range of industries may propel market expansion in the years to come.

Introduction

The increasing reliance on cyber technology and the rising dangers of cyberattacks have made industrial cyber security more important than ever. The disruption of vital infrastructure, the loss of private information, and the compromising of machinery and systems are just a few of the dire outcomes that can arise from such attacks on industrial systems. Cloud-based security solutions facilitate the deployment and maintenance of security systems, allow enterprises to swiftly grow their security resources, and react to changing threats. However, because of their susceptibility to cyberattacks, cloud-based industrial systems have raised security concerns. Therefore, to safeguard sensitive data and stop unwanted access, strong encryption and access control systems are crucial.

Top 10 trends in Industrial Cybersecurity Market

- Cloud and Edge Security Integration

- AI-Powered Threat Detection

- Convergence of IT and OT Security

- Rise of Endpoint and IoT Protection

- Regulatory Compliance and Standards

- Cybersecurity-as-a-Service (CaaS)

- Digital Twin and Simulation Security

- Zero Trust Architecture

- M&A and Strategic Partnerships

- Sustainability and Cyber Resilience

1. Cloud & Edge Security Integration

Industrial firms are rapidly adopting cloud and edge computing to boost scalability and real-time analytics. However, this shift exposes operational technology (OT) systems to complex cyber threats. As a result, companies are investing in hybrid security frameworks that combine cloud-native tools with edge-based threat detection to protect critical infrastructure.

2. AI-Powered Threat Detection

Artificial Intelligence and Machine Learning are transforming industrial cybersecurity. These technologies enable predictive analytics, anomaly detection, and automated incident response. AI-driven platforms help identify zero-day vulnerabilities and reduce response time across industrial control systems (ICS).

3. Convergence of IT & OT Security

The merging of Information Technology (IT) and Operational Technology (OT) environments is creating unified security architectures. This convergence demands integrated solutions that monitor both enterprise networks and industrial assets, ensuring seamless protection across digital and physical layers.

4. Rise of Endpoint & IoT Protection

With the proliferation of industrial IoT devices and smart sensors, endpoint security is becoming a top priority. Companies are deploying Extended Detection and Response (XDR) and Managed Detection and Response (MDR) systems to secure millions of connected endpoints in manufacturing, energy, and logistics.

5. Regulatory Compliance & Standards

Governments and industry bodies are enforcing stricter cybersecurity regulations, such as NIST, GDPR, and ISO/IEC 62443. Compliance is now a strategic imperative, driving demand for audit-ready solutions and continuous monitoring tools that align with global standards.

Key Drivers & Opportunities in Industrial Cybersecurity Market

AI/Gen AI model implementation in industrial settings

The market is expected to be driven in the near future by generative AI and artificial intelligence (AI). In 2024, the deployment of generative AI and other AI technologies will raise security expenses. Businesses that want to use generative AI must spend more on cybersecurity in two ways. Using Al assistants to enhance security analysts' skills is the second goal, while the first is to secure the development and application of generative AI tools. The majority of the retail, energy, and automotive industries are implementing IoT devices and autonomous systems driven by Al. Not only do these systems rely on Al to function, but they are also integrated with a number of state-of-the-art technologies, which poses additional security risks.

Growing need for safety-compliant automation solutions

Nowadays, with every organizational activity focused on digital processes, cloud-based services are essential for cybersecurity. In addition, cloud solutions are typically more scalable and versatile in terms of security features, which are critical for protecting critical infrastructures and sensitive data. The modern corporation must contend with a complex array of sophisticated cyber dangers that necessitate several levels of protection as remote working, IoT devices, and system interconnectivity grow more commonplace. Threat management, system upgrades, and ongoing monitoring are just a few benefits of cloud-based cybersecurity services. Consequently, businesses may respond to dynamic threats and adjust their defenses accordingly without having to pay for the upkeep of massive, traditional premises-based systems.

Industrial Cybersecurity Market Size & Statistics

The market for industrial cybersecurity was estimated to be worth USD 25.12 Billion in 2024.

The market is going to expand at a CAGR of 8.13% between 2025 and 2035.

The Global Industrial Cybersecurity Market is anticipated to reach USD 59.34 Billion by 2035.

North America is expected to generate the highest demand during the forecast period in the industrial cybersecurity market

Asia-pacific is expected to grow the fastest during the forecast period in the industrial cybersecurity market.

Regional growth and demand

Asia-pacific is expected to grow the fastest during the forecast period in the industrial cybersecurity market. The government's growing emphasis on a proactive cybersecurity approach, which includes risk and vulnerability assessments, frequent security audits, and incident response planning, is driving the market in the region. Additionally, the region is witnessing initiatives to improve the protection of vital infrastructure. By building specialized engineering teams and growing security data centers, market providers are introducing cutting-edge cyber capabilities to assist businesses in fortifying their defenses and expediting their digital transformation, which might increase their market share throughout the forecast period.

North America is expected to generate the highest demand during the forecast period in the industrial cybersecurity market. The early adoption of new technology has been a major factor in the North American market's recent rise. Furthermore, efficient management and security of endpoint devices across untrusted networks are necessary due to the sizeable capital and IT markets and their varied business operations. Growing cybersecurity concerns in the US and Canada, especially with relation to vital infrastructure including industrial, transportation, energy, and water systems, are another factor driving market expansion. In order to address industrial cybersecurity, the US government is creating guidelines, rules, and best practices.

Top 15 Companies Leading the Industrial Cybersecurity Market

- ABB Ltd.

- Cisco Systems, Inc.

- Fortinet, Inc.

- Honeywell International Inc.

- Siemens AG

- IBM Corporation

- Microsoft

- Rockwell Automation

- Schneider Electric

- Palo Alto Networks

- Dragos Inc.

- Kaspersky Industrial CyberSecurity

- Trend Micro

- Check Point Software Technologies

- ABS Group of Companies, Inc.

- ABB

Headquarters - Switzerland

ABB, a global leader in automation and electrification with its headquarters located in Switzerland, is well-represented in the industrial cybersecurity sector. By incorporating cybersecurity into its industrial control systems, the business provides solutions that shield vital infrastructure from ever changing threats. Advanced threat detection and response technologies designed for the manufacturing, energy, and transportation industries are created at ABB's Cyber Security Lab. Security features are integrated into its System 800xA and Asset Health Center platforms to provide operational resiliency. To influence cybersecurity standards and compliance, ABB works with governments and trade associations. By emphasizing safe digital transformation, ABB enables its industrial customers to embrace Industry 4.0 technologies while protecting their data and networks.

- Cisco

Headquarters – US

Cisco, a major player in the industrial cybersecurity market and a leading force in networking, is headquartered in the United States. Its Industrial Threat Defense suite protects cyber-physical infrastructure and SCADA systems, among other operational technology (OT) environments. Cisco Cyber Vision offers comprehensive insight into industrial assets, facilitating the identification and categorization of threats in real time. Manufacturers and utilities may reduce hazards across converging IT/OT networks with the help of the company's AI-powered threat intelligence and zero-trust architecture. Cisco offers cloud-based security solutions that are scalable and customized for critical infrastructure and smart factories in collaboration with industrial companies. It is well-known in industrial cybersecurity due to its dedication to reliable operations and secure communication.

- Fortinet

Headquarters – California

Fortinet, a prominent player in the industrial cybersecurity market, is well-known for its high-performance network security solutions. The company is based in California. To safeguard OT environments, its FortiGate firewalls, FortiNAC access control, and FortiSIEM analytics are extensively used in industrial industries. Across dispersed systems, Fortinet's Security Fabric architecture provides automatic threat response and uniform visibility. The business offers SD-WAN, endpoint security, and secure remote access for business environments. While protecting against ransomware and other advanced persistent threats, Fortinet's AI-driven threat intelligence and compliance solutions assist businesses in adhering to legal requirements. It is positioned as the cybersecurity backbone of industrial organizations due to its extensive worldwide reach and strong portfolio.

4.Honeywell

Headquarters - US

The American multinational Honeywell is a market leader in industrial cybersecurity and a pioneer in industrial automation. For industrial control systems, its Honeywell Forge Cybersecurity Suite provides risk reduction, threat detection, and real-time monitoring. In order to improve its OT and IoT security capabilities and provide extensive network protection, Honeywell purchased SCADAfence. Vulnerability assessments, incident response, and compliance support are among the cybersecurity services offered by the organization to industries such as manufacturing, utilities, and oil and gas. Clients are assisted in creating cyber-resilient infrastructures by Honeywell's comprehensive domain expertise and integrated solutions. It is a popular partner for digital transformation projects because of its proactive approach to protecting industrial environments.

- Siemens

Headquarters - Germany

Siemens is a major player in the industrial cybersecurity sector and a worldwide technology powerhouse with its headquarters located in Germany. For OT systems, the SINEC Security Guard platform offers centralized security management and automatic vulnerability mapping. Siemens ensures safe operations in the manufacturing, transportation, and energy industries by incorporating cybersecurity into its digital twin and automation solutions. Industrial clients benefit from the company's AI-enhanced threat detection solutions and Zero Trust principles, which help them avoid breaches and preserve uptime. Siemens advances cybersecurity standards by working with industry alliances and regulators. Because of its dedication to safe innovation and digitization, it is a global leader in industrial cybersecurity.

Are you ready to discover more about the industrial cybersecurity market?

The report provides an in-depth analysis of the leading companies operating in the global industrial cybersecurity market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- ABB Ltd.

Business Overview

Company Snapshot

Products Overview

Company Market Share Analysis

Company Coverage Portfolio

Financial Analysis

Recent Developments

Merger and Acquisitions

SWOT Analysis

- Cisco Systems, Inc.

- Fortinet, Inc.

- Honeywell International Inc.

- Siemens AG

- IBM Corporation

- Microsoft

- Rockwell Automation

- Schneider Electric

- Others.

Conclusion

The growing need for essential minerals, technological advancements, and pro-industrial cybersecurity government regulations are driving the fast-changing global industrial cybersecurity business. Because of their strategic investments and quantity of resources, regions such as Asia-Pacific and North America are becoming important centers of growth. Industrial cybersecurity is essential to facilitating the energy transition and infrastructure development as businesses move toward low-carbon technologies. The industry is well-positioned for long-term resilience and sustainable growth due to key firms' investments in digital industrial cybersecurity technologies and ESG compliance.

Need help to buy this report?