Top 10 Companies in the South Korea Diabetes Care Devices Market and Report (2025-2035): Key Insights and Innovations

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

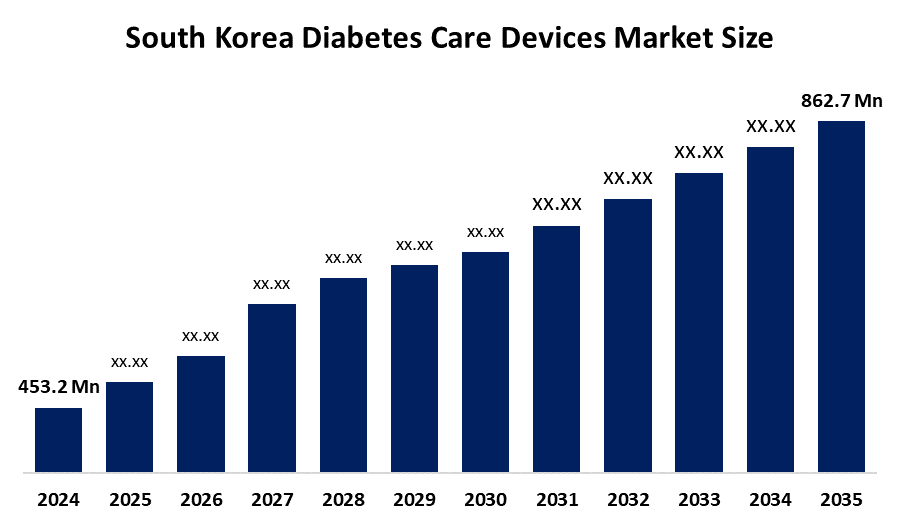

According to a research report published by Spherical Insights & Consulting, The South Korea Diabetes Care Devices Market Size is projected To Grow from USD 453.2 Million in 2024 to USD 862.7 Million by 2035, at a CAGR of 5.82% during the forecast period 2025-2035. The market is witnessing growth due to rising diabetes prevalence, technological advancements in glucose monitoring and insulin delivery systems, and growing awareness of self-management solutions among the aging population in South Korea.

Introduction

The South Korea diabetes care devices market includes diagnostic and treatment equipment such as blood glucose monitors, continuous glucose monitoring (CGM) systems, insulin pumps, smart pens, and lancets. These tools are crucial in managing both type 1 and type 2 diabetes, offering real-time data and automated insulin delivery to reduce complications and enhance patient outcomes. With the rise in diabetes diagnoses driven by aging demographics, sedentary lifestyles, and dietary changes, South Korea is increasingly embracing innovative digital healthcare solutions. Government initiatives, insurance reimbursement policies, and collaborations between public hospitals and MedTech companies are supporting adoption. Moreover, mobile health apps, wearable integrations, and AI-based monitoring are transforming diabetes care into a more personalized, predictive, and preventative domain.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download The Brochure now and dive deeper into the future of the South Korea Diabetes Care Devices Market.

South Korea Diabetes Care Devices Market Size & Statistics

- The Market Size for South Korea Diabetes Care Devices Market Was Estimated to be worth USD 453.2 Million in 2024.

- The Market is Going to Expand at a CAGR of 5.82% between 2025 and 2035.

- The South Korea Diabetes Care Devices Market Size is anticipated to reach USD 862.7 Million by 2035.

Top 10 trends in the South Korea Diabetes Care Devices Market

- Increasing prevalence of Type 2 diabetes in aging population

- Rising demand for Continuous Glucose Monitoring (CGM) systems

- Integration of diabetes care devices with mobile health apps

- Surge in insulin pump adoption and wearable devices

- Personalized and AI-based digital diabetes management

- Reimbursement expansion for advanced diabetic technologies

- Collaborations between hospitals and medical device startups

- Introduction of smart insulin pens and closed-loop systems

- Public health initiatives to promote early diabetes detection

- Shift toward remote monitoring and telemedicine-based diabetes care

1. Increasing Prevalence of Type 2 Diabetes

Sedentary lifestyles, urban diets, and an aging population have led to a surge in Type 2 diabetes cases in South Korea. This is driving long-term demand for monitoring and insulin administration devices, especially in outpatient and home settings.

2. Rising Demand for CGM Systems

Continuous Glucose Monitoring (CGM) devices are gaining traction as they provide real-time glucose data and better control compared to traditional blood glucose meters. CGM adoption is increasing among type 1 and type 2 patients alike, especially the elderly and tech-savvy youth.

3. Integration with Mobile Health Apps

Digital health applications that sync with CGM systems, smart pens, and insulin pumps are helping patients monitor their glucose trends, receive medication reminders, and communicate with doctors remotely. South Korea's smartphone penetration supports this digital shift.

4. Growth of Insulin Pump Usage

Insulin pumps, especially tubeless or patch varieties, are being increasingly prescribed for patients with unstable glucose levels. Local and global brands are expanding pump availability through partnerships with South Korean hospitals and clinics.

5. Rise of Personalized and Predictive Diabetes Management

Artificial Intelligence and data analytics are being applied to predict glucose fluctuations, optimize insulin dosing, and customize care plans. South Korea's advanced tech infrastructure makes it a fertile ground for precision diabetes care platforms.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the warehouse management system market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the South Korea Diabetes Care Devices Market

- Medtronic

- Abbott Laboratories

- Dexcom, Inc.

- F. Hoffmann-La Roche Ltd

- Ascensia Diabetes Care (PHC Group)

- B. Braun Melsungen AG

- Terumo Corporation

- Insulet Corporation

- Ypsomed AG

- Nipro Corporation

- LifeScan, Inc.

- Arkray, Inc.

- Sanofi

- Eli Lilly and Company

- Novo Nordisk A/S

- Tandem Diabetes Care

- SOOIL Development Co., Ltd. (South Korea)

- Daewoong Pharmaceutical Co., Ltd.

- i-SENS, Inc. (South Korea)

- Menarini Diagnostics

- AgaMatrix

- Becton, Dickinson and Company (BD)

- Senseonics Holdings, Inc.

- Companion Medical

- Cambridge Sensors Ltd

1. Medtronic

Headquarters: Dublin, Ireland

Medtronic is a prominent global player in insulin pump technologies and comprehensive diabetes management solutions. Its MiniMed insulin pump range and Guardian CGM products are widely adopted in South Korea. The company continues to invest in integrated closed-loop technologies and real-time digital monitoring platforms.

2. Abbott Laboratories

Headquarters: Illinois, USA

Abbott’s FreeStyle Libre platform has achieved significant uptake in South Korea owing to its affordability, ease of use, and reimbursement accessibility. The company remains focused on advancing CGM innovation and expanding mobile-enabled, patient-centric care solutions.

3. Dexcom, Inc.

Headquarters: California, USA

Dexcom is a market leader in real-time CGM technologies with its G6 and G7 systems. The company partners with South Korean healthcare providers to enhance CGM adoption and is recognized for its highly accurate, Bluetooth-enabled monitoring solutions.

4. F. Hoffmann-La Roche Ltd

Headquarters: Basel, Switzerland

Roche is a global pioneer in diagnostics and personalized healthcare. The company recently received CE approval for its Accu-Chek SmartGuide CGM solution, which leverages AI-driven predictive algorithms to identify glucose trends up to two hours in advance. It also provides early alerts for hypoglycemia and nocturnal glucose fluctuations, enabling proactive diabetes management.

5. Ascensia Diabetes Care (PHC Group)

Headquarters: Basel, Switzerland

Ascensia Diabetes Care, a subsidiary of the PHC Group, is a global leader in diabetes care operating in more than 100 countries. Known for its accurate CONTOUR blood glucose monitoring systems, the company also serves as the exclusive global distributor of the Eversense implantable long-term CGM solution. In 2024, Ascensia strengthened its CGM business by appointing Brian Hansen as President of CGM, underscoring its strategic focus on long-term, innovative diabetes solutions.

Are you ready to discover more about the South Korea Diabetes Care Devices Market?

The report provides an in-depth analysis of the leading companies operating in the South Korea Diabetes Care Devices Market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Medtronic

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Abbott Laboratories

- Dexcom, Inc.

- F. Hoffmann-La Roche Ltd

- Ascensia Diabetes Care (PHC Group)

- B. Braun Melsungen AG

- Terumo Corporation

- Insulet Corporation

- Ypsomed AG

- Others

Conclusion

The South Korea diabetes care devices market is on a solid upward trajectory, supported by technological advancements, growing diabetic populations, and strong healthcare infrastructure. Leading global and local companies are reshaping the landscape with AI-integrated CGMs, wearable insulin pumps, and mobile-enabled care platforms. As the government and private sector increasingly promote preventive care and digital health, the market will remain a vital segment of South Korea's broader healthcare evolution through 2035.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?