Discover Top 50 Companies in Microfinance Market: Global Share, Market Size, Revenue Report (2024-2035)

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

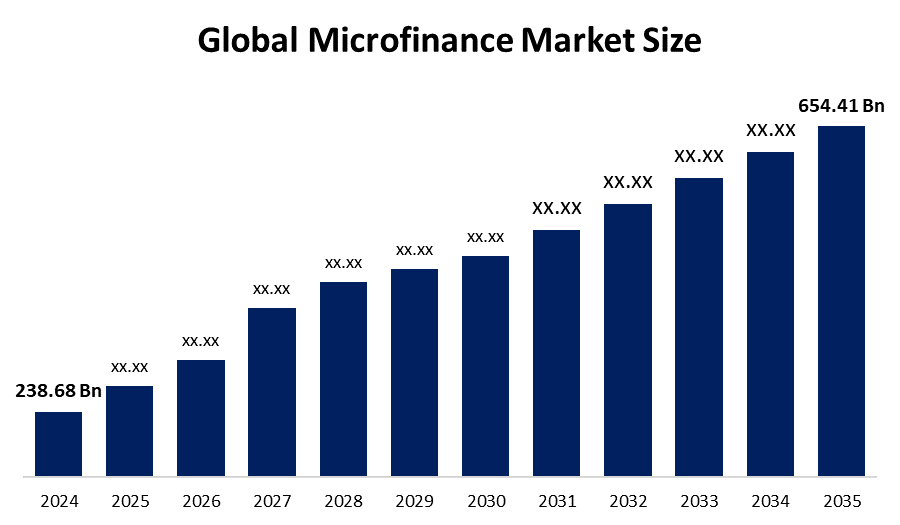

According to a research report published by Spherical Insights & Consulting, The Global Microfinance Market Size is projected to Grow from USD 238.68 Billion in 2024 to USD 654.41 Billion by 2035, at a CAGR of 10.61 % during the forecast period 2025–2035. The microfinance market offers future opportunities in promoting financial inclusion, supporting women entrepreneurs, expanding digital lending platforms, empowering rural economies, and fostering sustainable development through accessible credit for underserved and low-income populations.

Introduction

The microfinance market refers to a financial services sector that provides small loans, savings, insurance, and other financial products to individuals or small businesses lacking access to traditional banking services. These services are primarily targeted at low-income populations to support income-generating activities, reduce poverty, and promote financial inclusion. Key driving factors for the growth of the microfinance market include increasing government initiatives for financial inclusion, rising demand for accessible credit in rural and semi-urban areas, the growth of women entrepreneurship, advancements in mobile banking and digital lending platforms, and the supportive role of microfinance institutions (MFIs) in economic empowerment.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights—Download the Brochure now and dive deeper into the future of the microfinance market.

Microfinance Market Size & Statistics

- The Market Size for Microfinance was Estimated to be Worth USD 238.68 Billion in 2024.

- The Market Size is going to Expand at a CAGR of 10.61 % between 2025 and 2035.

- The Global Microfinance Market Size is Anticipated to Reach USD 654.41 Billion by 2035.

- Asia Pacific is Expected to generate the highest demand during the forecast period in the microfinance market.

- Europe is Expected to Grow the fastest during the forecast period in the microfinance market.

Regional growth and demand

Europe is expected to grow the fastest during the forecast period in the microfinance market. This stems from the increasing importance of microfinance in promoting financial inclusion and aiding entrepreneurship, resulting in the establishment of regulatory frameworks and microfinance institutions. A range of institutions, including microfinance banks, cooperatives, social enterprises, and non-governmental organizations, provide financial services to individuals and small businesses, focusing on sustainable development and social impact.

Asia Pacific is expected to generate the highest demand during the forecast period in the microfinance market. This growth is due to the rise in government efforts aimed at improving the overall living standards of the population and alleviating poverty, a significant trend in the microfinance sector. Most of the population resides in rural regions, where access to traditional financial services is limited. Consequently, to offer financial assistance to this disadvantaged population, microfinance is crucial.

Top Key Drivers & Microfinance Trends

- Growing Financial Inclusion Initiatives

One of the major drivers of the microfinance market is the growing emphasis on financial inclusion by governments and development organizations. Many low-income individuals and small businesses lack access to formal credit due to inadequate collateral or credit history. Microfinance institutions (MFIs) help bridge this gap by offering small, collateral-free loans and financial services tailored to underserved populations. Government programs like India's Pradhan Mantri Jan Dhan Yojana and global initiatives by the World Bank and UN are supporting the sector. These initiatives are fostering economic self-reliance, improving livelihoods, and reducing poverty through accessible and inclusive financial systems.

- Rise of Digital and Mobile Microfinance Solutions

The integration of digital technology and mobile platforms is transforming the microfinance landscape. With the expansion of smartphone usage and mobile internet, microfinance services are becoming more efficient, scalable, and accessible. Mobile banking apps, digital wallets, and fintech platforms are enabling quicker loan disbursement, real-time monitoring, and enhanced customer service in remote regions. This digital shift reduces operational costs for MFIs while expanding outreach. It also improves transparency, credit assessment, and repayment tracking. As digital literacy rises, especially in developing economies, technology-driven microfinance is expected to dominate the future, empowering clients with faster and more flexible financial solutions.

Top 6 Microfinance Startups Impacting the Financial Sector

1. Rufi Rural FinTech – Micro-Lending for Rural Communities

Microfinance provides small loans, typically aimed at supporting young, marginalized, and unbanked communities. Globally, microcredit is becoming increasingly popular and demonstrates potential for elevating substantial portions of the population from poverty. Families utilizing microfinance options can extend their focus beyond merely surviving on essentials to include savings and investments. Mexican startup Rufi Rural FinTech uses big data and sophisticated analytics methods to provide micro-lending services to rural areas. Rufi focuses on businesses by offering digitization services for rural companies while also creating digital communities and internet cafes aimed at young individuals in rural areas.

2. Momentum Credit – Loan Products for Small & Medium Enterprises (SMEs)

Micro, small, and medium enterprises often constitute the largest share of businesses in numerous countries globally. This consequently prioritizes SME development for various governments, with many implementing initiatives to foster SME growth. Microfinance serves as a potent resource for SMEs by offering timely funds, regardless of how small the sum may be. Consistent investment in small enterprises enhances economic diversity and fosters stability. Kenyan company Momentum Credit provides organized working capital to individuals and small to medium enterprises. The startup offers a variety of micro-loan products such as invoice factoring, logbook loans, bid bonds, and guarantees for payments. These options enable individuals with limited income or assets to fund their enterprises using alternative forms of security.

3. MoneyBank – Peer-To-Peer (P2P) Lending Platform

Governments are progressively seeking methods to enforce financial inclusion policies, primarily to integrate more individuals into the formal banking system. Microfinance serves a crucial function in reaching out to previously unbanked groups such as women and young individuals from low-income areas. Startups create straightforward and user-friendly P2P solutions to enhance the lives of millions globally. MoneyBank, a Vietnamese startup, offers a round-the-clock digital P2P lending platform throughout Vietnam. The startup utilizes digital technologies to provide loans without needing any documentation or collateral. borrowers can select from various choices regarding their loan amounts and repayment schemes. MoneyBank aims to reduce investors’ risk by employing a dependable scoring technology based on data, supplemented by insights from risk analysts and specialists.

4. ThitsaWorks – Microfinance Data Sharing Platform

Microfinance is often viewed as a low-risk enterprise, primarily due to the fact that the amounts of money at stake are quite modest. Nonetheless, it requires strong data-driven insights to guarantee that financing is provided solely to those who are most likely to repay the funds. The microfinance sector creates jobs and fosters local development from the ground level. ThitsaWorks, a startup based in Myanmar, is creating various financial and regulatory technology solutions aimed at microfinance institutions. The startup provides a data-sharing platform for microfinance, as well as data visualization services. In collaboration with Musoni, the startup offers core banking systems for financial institutions to governments. ThitsaWorks is developing a Facebook Messenger bot named Pite Pite to enhance financial literacy within local communities in Myanmar.

5. Sandah – Microfinance for Financial Inclusion

One of the more unexpected features of microfinance relates to the elevated repayment rates, based on multiple studies carried out in current markets. By taking out loans and striving to pay back smaller amounts, more individuals can obtain the financing they require, regarding both funds and repayment duration. Earnings for low-income workers often stay the same, hindering their ability to obtain credit from major lenders. Microfinance assists these community segments in steering clear of the complexities of traditional banking and predatory lenders. Egyptian startup Sandah offers microfinancing and home financing options ranging from 1,000 Egyptian Pounds (EGP) to 30,000 EGP. Furthermore, the startup aims to enhance project opportunities, generate job openings for young professionals, and upgrade the skills of industrial employees.

6. Awami – Biometric Microfinance Software

Ultimately, financial difficulties, especially for families with low income, result in higher levels of stress and depression. Microfinance startups aim to ease various societal challenges by providing small loans that significantly enhance living conditions. Solutions based on biometrics seek to assist, specifically, the impoverished, underbanked, and unbanked groups, enabling them to transition from mere survival to actual prosperity. The German FinTech company Awamo is developing its software called awamo 360 – a mobile, biometric banking solution designed for microfinance institutions and savings and credit cooperative organizations (SACCOs). This software fully digitizes client enterprises at reasonable prices. The startup provides various functionalities on the platform, including biometric security, automated accounting, reporting tools, loans, activity and location tracking, in addition to client management.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Microfinance market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 14 Companies Leading the Microfinance Market

- SKS Microfinance (BFIL)

- Compartamos Banco

- ASA International

- BRAC

- Bandhan Bank

- Opportunity International

- FINCA International

- Accion International

- Kiva

- Oikocredit

- Ujjivan Financial Services

- Fonkoze

- PRASAC

- Others

1. SKS Microfinance (Now Bharat Financial Inclusion Ltd. - BFIL)

Headquarters: Hyderabad, Telangana, India

BFIL, formerly known as SKS Microfinance, is one of India’s largest microfinance institutions, focused on providing small loans to economically disadvantaged women in rural areas. Founded in 1997, the organization aims to promote financial inclusion through group lending models without collateral. Now a subsidiary of IndusInd Bank, BFIL offers financial products like income-generating loans, emergency loans, and insurance services. With a strong rural presence, it empowers low-income households by facilitating entrepreneurship and self-sufficiency. Its integration with digital platforms ensures efficient loan disbursement and repayment, supporting India’s broader financial inclusion agenda.

2. Compartamos Banco

Headquarters: Mexico City, Mexico

Compartamos Banco is a leading microfinance bank in Latin America, serving millions of clients across Mexico. Originally founded as an NGO in 1990, it transitioned into a regulated bank in 2006 and is part of Grupo Gentera. The institution specializes in providing small loans, insurance, and savings products primarily to women entrepreneurs in underserved communities. With a mission to improve lives through financial inclusion, Compartamos Banco promotes responsible lending and community development. The bank’s group lending model encourages mutual accountability and support, making it a pioneer in Latin America’s microfinance movement with a focus on social impact and sustainability.

3. ASA International

Headquarters: Amsterdam, Netherlands

ASA International is a global microfinance institution operating in Asia and Africa, providing financial services to low-income, predominantly female entrepreneurs. With a presence in countries like India, Pakistan, the Philippines, and Ghana, ASA follows a standardized, cost-efficient operational model. Founded as a joint venture between ASA Bangladesh and Catalyst Microfinance Investors, the company offers small business loans to foster self-employment and reduce poverty. Headquartered in Amsterdam, ASA International emphasizes social performance, financial sustainability, and gender empowerment. It operates over 2,000 branches and serves millions of clients, focusing on financial inclusion and grassroots economic development in some of the world's most underserved markets.

4. BRAC

Headquarters: Dhaka, Bangladesh

BRAC (formerly Bangladesh Rural Advancement Committee) is one of the world’s largest NGOs and a leading microfinance provider. Founded in 1972, BRAC operates an extensive microfinance program aimed at empowering marginalized populations, particularly women, through access to financial services. It offers microloans, savings, insurance, and financial literacy training. BRAC’s holistic approach integrates health, education, and social development programs alongside microfinance, ensuring comprehensive poverty alleviation. Headquartered in Dhaka, BRAC serves millions of clients across multiple countries, including Bangladesh, Uganda, and Myanmar. Its impact-oriented model has earned global recognition for driving economic empowerment and community resilience in developing regions.

5. Bandhan Bank

Headquarters: Kolkata, West Bengal, India

Bandhan Bank began as a microfinance institution in 2001 and transformed into a full-fledged commercial bank in 2015. It continues to maintain a strong focus on financial inclusion, offering microloans to underserved segments, especially women entrepreneurs in rural and semi-urban areas. Headquartered in Kolkata, Bandhan Bank provides a comprehensive range of banking services including savings, deposits, insurance, and SME loans. It leverages its deep microfinance roots to blend inclusive banking with modern financial infrastructure. With thousands of banking outlets across India, Bandhan Bank plays a vital role in bridging the gap between formal financial systems and marginalized communities.

Are you ready to discover more about the microfinance market?

The report provides an in-depth analysis of the leading companies operating in the global microfinance market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- SKS Microfinance (BFIL).

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Compartamos Banco

- ASA International

- BRAC

- Bandhan Bank

- Opportunity International

- FINCA International

- Accion International

- Kiva

- Oikocredit

- Ujjivan Financial Services

- Fonkoze

- PRASAC

- Others

Conclusion

The microfinance market plays a transformative role in global financial inclusion by offering accessible financial services to underserved populations, especially in rural and low-income regions. It continues to evolve with the integration of digital technologies, mobile lending platforms, and supportive government initiatives. The sector is empowering women entrepreneurs, supporting small businesses, and fostering economic resilience across emerging economies. With growing institutional involvement and innovative fintech solutions, microfinance is poised to bridge gaps in traditional banking and drive inclusive growth. As demand for sustainable and equitable financial systems rises, microfinance will remain a crucial pillar of socioeconomic development worldwide.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?