Discover Top 20 Companies in Wedding Loans Market: Global Share, Market Size, Revenue Report (2024-2035)

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

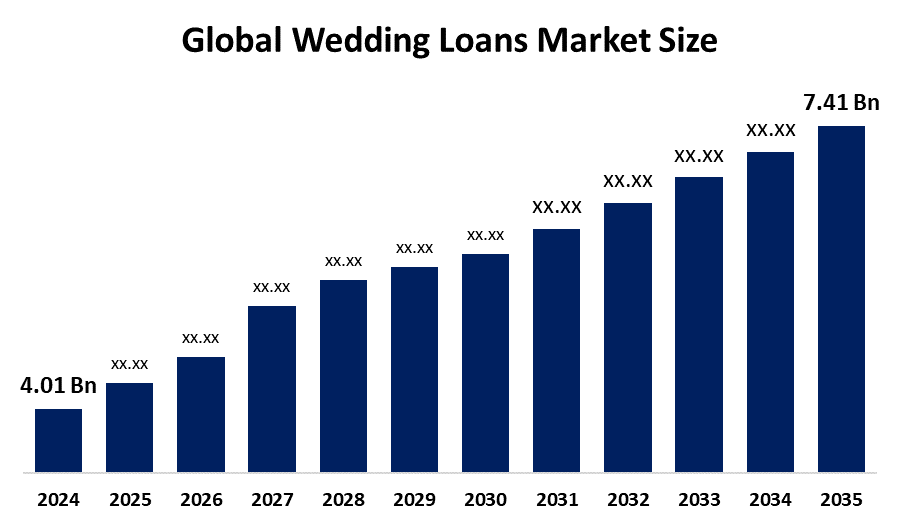

According to a research report published by Spherical Insights & Consulting, The Global Wedding Loans Market Size is projected To Grow from USD 4.01 Billion in 2024 to USD 7.41 Billion by 2035, at a CAGR of 6.33 % during the forecast period 2025–2035. The Wedding Loans market offers opportunities in digital lending platforms, tailored financing options, destination wedding funding, vendor partnerships, and rising demand from millennials and Gen Z seeking flexible, tech-driven solutions for financing memorable wedding experiences.

Introduction

The Wedding Loans Market Size is gaining traction as couples increasingly seek financial flexibility to plan their dream weddings without immediate financial strain. These loans cover expenses like venues, catering, attire, photography, and destination weddings, offering customizable repayment options. Driven by rising wedding costs, the growing popularity of lavish celebrations, and digital lending platforms, this market is expanding rapidly. Financial institutions and FinTechs companies are offering innovative, accessible solutions, making wedding financing more convenient and appealing to modern couples worldwide.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Wedding Loans market.

Wedding Loans Market Size & Statistics

- The Market Size for Wedding Loans Was Estimated to be Worth USD 4.01 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 6.33 % Between 2025 and 2035.

- The Global Wedding Loans Market is Anticipated to Reach USD 7.41 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Wedding Loans Market.

- Asia Pacific is expected to grow the fastest during the forecast period in the Wedding Loans Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the Wedding Loans market. The wedding loan market in the region has expanded due to the convenience, speed, and tailored options offered by lenders. Due to the flexibility in loan amounts and terms, couples now find it easier to secure the funds necessary for their dream weddings. Stretch loans have become increasingly favored as an alternative to conventional wedding financing because they offer a fresh perspective on this timeless dilemma that can be tailored to various financial goals and attitudes. Analysis conducted by LenDenClub reveals that the need for wedding loans in India surged by 40% from 2020 to 2021.

North America is expected to generate the highest demand during the forecast period in the Wedding Loans market. Currently, increasing wedding costs are fueling the North American wedding loan sector and heightening many couples' aspirations for a perfect wedding. The expense of weddings has risen as a significant number of couples in North America are searching for brides and appropriate venues for the event. Consequently, there has been a significant increase in the amount of North Americans pursuing loans to pay for these expenses.

Top 5 Trends in the Wedding Loans Market

1. Growth of Digital Lending Platforms

Online and app-based lending platforms are simplifying access to wedding loans. With instant approvals, minimal paperwork, and competitive rates, fintech companies are making wedding financing faster, more convenient, and highly appealing to tech-savvy couples planning their celebrations.

2. Customized and Flexible Loan Products

Lenders are offering personalized loan options, including “marry now, pay later” schemes and flexible EMI plans. These tailored solutions allow couples to manage budgets effectively, aligning financing with their income flow while minimizing financial stress during and after the wedding.

3. Destination and Themed Wedding Financing

The rising demand for destination and luxury weddings is driving specialized loan products. Lenders are catering to couples looking to host unique, extravagant events, offering larger loan amounts and curated packages for travel, accommodation, and premium services.

4. Partnerships with Vendors and Planners

Financial institutions are collaborating with wedding planners, venues, and vendors to offer bundled financing options. This creates seamless solutions where couples can manage bookings and loans together, enhancing convenience and ensuring smooth planning and execution of wedding events.

5. Increasing Demand from Millennials and Gen Z

Millennials and Gen Z, valuing memorable experiences over traditional savings, are embracing wedding loans. Digital-first approaches, easy approvals, and flexible repayment schedules are making financing attractive to younger generations seeking dream weddings without immediate financial constraints.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Wedding Loans market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 14 Companies Leading the Wedding Loans Market

- LightStream

- Lending Club

- Discover Personal Loans

- Earnest

- SunTrust

- Prosper Marketplace

- Oportun

- Finance of America

- Marcus by Goldman Sachs

- American Express

- SoFi

- Upstart

- Avant

- Others

1. LightStream

Headquarters: Charlotte, North Carolina, USA

LightStream, a division of Truist Financial, specializes in providing low-interest, unsecured personal loans for various purposes, including weddings, home improvements, and debt consolidation. Known for its fully digital platform, LightStream offers quick approvals, same-day funding, and no fees, making it a preferred choice for borrowers seeking a smooth, paperless experience. The company emphasizes competitive fixed rates and flexible repayment terms to meet diverse customer needs. Its customer-centric approach and commitment to transparency have made it one of the most trusted names in the personal lending market, particularly among individuals looking for hassle-free and efficient financing solutions.

2. LendingClub

Headquarters: San Francisco, California, USA

LendingClub is a leading financial services platform known for its innovative peer-to-peer lending model. It offers personal loans for purposes such as weddings, debt consolidation, and medical expenses. The company has evolved into a full-spectrum digital bank, combining technology and financial expertise to deliver quick and transparent lending solutions. Borrowers benefit from competitive rates, easy applications, and flexible repayment terms, making it ideal for those seeking cost-effective financing. With its data-driven approach and customer-focused innovations, LendingClub continues to disrupt traditional lending, providing millions of users with reliable and accessible credit solutions tailored to modern financial needs.

3. Discover Personal Loans

Headquarters: Riverwoods, Illinois, USA

Discover Personal Loans, a division of Discover Financial Services, provides versatile personal loan solutions for expenses like weddings, debt consolidation, or major purchases. The platform is recognized for its transparent pricing, fixed interest rates, and no origination fees. Borrowers benefit from flexible repayment terms and quick disbursement of funds, ensuring seamless financial planning. Discover’s strong reputation, backed by its extensive financial services network, ensures reliability and customer trust. With an emphasis on user-friendly online applications and excellent customer support, Discover Personal Loans continues to be a top choice for individuals seeking secure and efficient personal financing solutions.

4. Earnest

Headquarters: San Francisco, California, USA

Earnest is a modern financial technology company offering personal loans, refinancing, and lending products tailored to individual financial goals. Known for its flexible terms and competitive interest rates, Earnest provides borrowers with a transparent and straightforward lending experience. Its wedding loan offerings cater to couples seeking budget-friendly financing options with manageable repayment plans. Earnest’s innovative underwriting process evaluates more than just credit scores, considering factors like income and financial habits to deliver fair, personalized rates. With its digital-first approach and strong commitment to customer empowerment, Earnest has emerged as a trusted name in the fintech lending industry.

5. SunTrust (now Truist)

Headquarters: Charlotte, North Carolina, USA

SunTrust, now part of Truist Financial Corporation, offers a comprehensive suite of personal loan products designed to meet a variety of financial needs, including weddings, home improvements, and debt management. Known for its competitive rates and excellent customer service, SunTrust provides both secured and unsecured loan options. Its streamlined application process and flexible repayment terms make it accessible for a wide range of borrowers. By integrating traditional banking expertise with modern digital solutions, SunTrust ensures a reliable and convenient borrowing experience, positioning itself as a trusted financial partner for individuals seeking dependable and flexible lending options.

Are you ready to discover more about the Wedding Loans market?

The report provides an in-depth analysis of the leading companies operating in the global Wedding Loans market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- LightStream.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis.

- Lending Club

- Discover Personal Loans

- Earnest

- SunTrust

- Prosper Marketplace

- Oportun

- Finance of America

- Marcus by Goldman Sachs

- American Express

Conclusion

The Wedding Loans Market Size is transforming as digital lending, FinTechs innovation, and changing consumer attitudes reshape financing for ceremonies. Lenders and platforms that offer tailored products flexible EMIs, marry now, pay later, vendor partnerships, and destination-wedding packages will capture demand from experience focused millennials and Gen Z. Strategic alliances with planners, marketplaces, and payment providers enhance customer journeys while data-driven underwriting reduces risk. Regulatory clarity, responsible lending practices, and transparent fees will be critical to sustain growth. Geographic diversification toward fast-growing Asia Pacific and sustained North American demand present scale opportunities for lenders that balance agility, credit discipline, and excellent digital UX experiences.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?