Discover Top 15 Companies in Special Mission Aircraft Market: Global Share, Market Size, Revenue Report (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

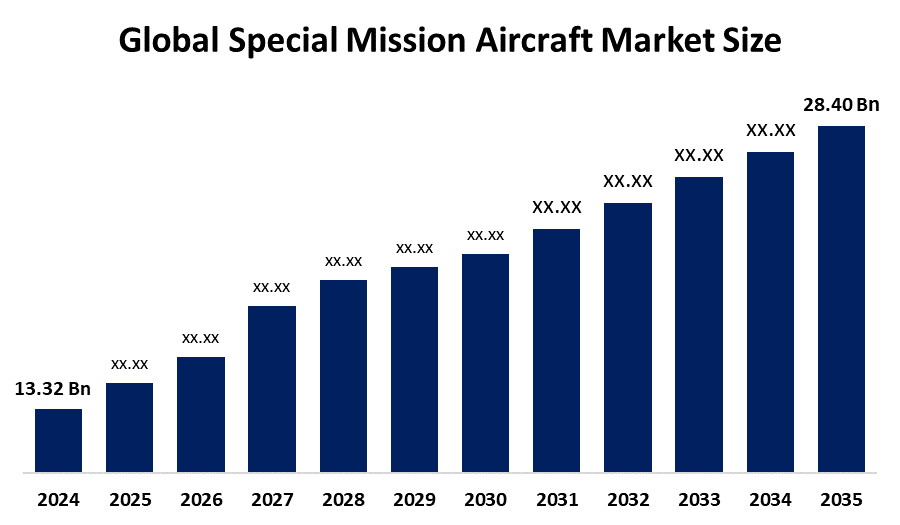

According to a research report published by Spherical Insights & Consulting, The Global Special Mission Aircraft Market Size is projected to Grow from USD 13.32 Billion in 2024 to USD 28.40 Billion by 2035, at a CAGR of 7.13% during the forecast period 2025–2035. The market for special mission aircraft is seeing consistent growth driven by rising global demand for defense, security, and surveillance. Military and law enforcement agencies are the main users having demand is also increasing in commercial sectors such as environmental monitoring and disaster response. Improvements in avionics, sensors, and artificial intelligence are boosting their functions, rendering them more efficient and adaptable.

Introduction

The Special Mission Aircraft (SMA) Market Size denotes the worldwide industry sector dedicated to aircraft that are either specially designed or adapted for executing non-standard, mission-based tasks in defense, homeland security, and commercial fields. Increasing investments in military and defense sectors are fueling the expansion of the special mission aircraft market. Governments across the globe are raising defense expenditures to improve intelligence, surveillance, and reconnaissance (ISR) abilities, driving the need for modern aircraft featuring state-of-the-art technologies. Countries experiencing geopolitical strains are focusing on modernizing their fleets and obtaining specialized aircraft for border protection, maritime surveillance, and electronic warfare. Moreover, the incorporation of AI, self-governing systems, and advanced avionics is enhancing operational efficiency and mission success.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Special Mission Aircraft Market.

Special Mission Aircraft Market Size & Statistics

- The Market Size for Special Mission Aircraft Was Estimated to be worth USD 13.32 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 7.13% between 2025 and 2035.

- The Global Special Mission Aircraft Market Size is anticipated to reach USD 28.40 Billion by 2035.

- North America is predicted to generate the highest demand during the forecast period in the special mission aircraft market.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period in the special mission aircraft market.

Regional growth and demand

Asia Pacific is anticipated to grow the fastest during the forecast period in the special mission aircraft market.

The Asia-Pacific market for special mission aircraft is rapidly expanding due to rising defense budgets, geopolitical conflicts, and the demand for enhanced surveillance features. Nations such as China, India, Japan, and South Korea are significantly funding intelligence, surveillance, and reconnaissance (ISR) aircraft, maritime patrol planes, and electronic warfare technologies to enhance national security. Increasing border tensions and territorial conflicts in the South China Sea further boost demand. Moreover, developing countries are upgrading their military forces and building local aerospace technologies. Governments are increasing funding for disaster response and environmental monitoring initiatives.

North America is projected to generate the highest demand during the forecast period in the special mission aircraft market.

North America leads the special mission aircraft sector, propelled by substantial defense spending, sophisticated aerospace technologies, and significant public funding in intelligence, surveillance, and reconnaissance (ISR) initiatives. The United States is at the forefront of the region, featuring major companies such as Boeing, Lockheed Martin, and Northrop Grumman that create advanced special mission aircraft for military, homeland security, and law enforcement uses. Canada further supports the market by engaging in defense modernization initiatives and collaborating with American aerospace companies.

Top 10 trends in the Special Mission Aircraft Market

- AI-Driven ISR Automation & Real-Time Data Fusion

- Modular & Multi-Role Payload Flexibility

- Autonomous Mission Planning & Execution

- Enhanced Electronic Warfare (EW) Capabilities

- Growing Use of Unmanned Aerial Systems (UAS)

- Conversions of Business Jets & Leasing Models

- Maritime Surveillance & Border Security Focus

- Shift Toward Service-Based & Integrated Solutions

- Regional Growth in Asia-Pacific

- High Operational Costs & Regulatory Challenges

1. AI-Driven ISR Automation & Real-Time Data Fusion

AI and machine learning are improving onboard systems for immediate intelligence, surveillance, and reconnaissance (ISR). These platforms currently integrate radar, EO/IR, EW, and SIGINT data to provide extensive situational awareness with reduced human involvement.

2. Modular & Multi-Role Payload Flexibility

SMA platforms are progressively being integrated with modular designs that enable swift reconfiguration for diverse missions—like maritime surveillance, SIGINT, or rescue operations—minimizing downtime and enhancing operational preparedness

3. Growing Use of Unmanned Aerial Systems (UAS)

The incorporation of HALE/MALE UAVs into SMA fleets is speeding up. UAVs provide prolonged endurance at reduced costs, serving surveillance and ISR functions traditionally performed by manned aircraft.

4. Autonomous Mission Planning & Execution

AI-driven onboard systems now facilitate autonomous planning, threat evasion, and dynamic rerouting in contested areas—reducing decision times and boosting mission resilience.

5. Maritime Surveillance & Border Security Focus

Countries with long coastlines are making significant investments in maritime patrol and border surveillance SMA. Aircraft such as Leonardo's ATR 72MP and Saab's Swordfish are being utilized for monitoring and surveillance of EEZ.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the special mission aircraft market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 15 Companies Leading the Special Mission Aircraft Market

- The Boeing Company

- Lockheed Martin

- Dassault Aviation SA

- Textron Aviation Inc.

- Northrop Grumman Corporation

- General Dynamics Corporation

- Butler National Corporation

- General Atomics Aeronautical Systems Inc.

- Israel Aerospace Industries Ltd.

- L Harris Technologies Inc.

- Ruag International Holding AG

- Gulfstream Aerospace Corporation

- Elbit Systems Ltd.

- Bombardier Inc.

- Pilatus Aircraft Ltd

- Others

1. Pilatus Aircraft Ltd

Headquarters: Nidwalden, Switzerland

Pilatus Aircraft Ltd is a Swiss aerospace company recognized for creating top-quality, high-performance airplanes tailored for specialized markets, especially business, special mission, and military training aircraft. The firm is an aircraft producer, rather than a creator of general use drone software. Pilatus creates, builds, and produces fixed-wing airplanes. The most well-known products include the PC-12 single-engine turboprop, PC-24 twin-engine business jet, and PC-21 military trainer. The firm is well known for its emphasis on short takeoff and landing (STOL) features and durability. The advanced avionics in planes such as the PC-12 NGX and PC-24, created by collaborators like Honeywell and Garmin, depend on very intricate software. This program oversees flight controls, navigation systems, and cockpit interfaces. the PC-24 is equipped with the Honeywell Primus Epic 2.0 Integrated Avionics System.

2. Bombardier Inc.

Headquarters: Montreal, Quebec, Canada

Bombardier Inc. is a Canadian global producer of business airplanes. It is neither a creator nor a producer of drones or software designed specifically for drones. The firm has divested from its rail and commercial aviation sectors to concentrate solely on business jets. Bombardier has created a program known as Smart Link Plus, which is a connected aircraft initiative. This mechanism features a complimentary data collection box supplied by GE that captures vital aircraft information. This information is subsequently sent instantly to an easy-to-use application known as the myMaintenance App. The association with the term "drone" is probably a misinterpretation of the word's application in another context, like in the video game The Division, where "Bombardier Drone" refers to a category of in-game weapon.

3. Elbit Systems Ltd.

Headquarters: Haifa, Israel

Elbit Systems Ltd. is a prominent Israeli defense contractor and a key supplier of unmanned aerial systems (UAS) and associated technologies. Its function in drone software focuses on creating advanced command, control, and management applications that facilitate military and governmental drone operations, rather than offering consumer-oriented solutions. Elbit Systems is a varied defense contractor with proficiency in numerous areas, such as aerospace, ground systems, maritime systems, and intelligence. It is a top global supplier of unmanned aerial systems (UAS), commonly known as drones or remotely operated vehicles (ROVs). This serves as the main center of Elbit's drone software network. The UGCS is a terrestrial control station capable of managing various unmanned systems, ranging from mini-UAS to medium-altitude, long-endurance (MALE) drones such as the Hermes series. The software offers an extensive view of the battlefield, combining information from various sensors and platforms.

4. Israel Aerospace Industries Ltd

Headquarters: Tel Aviv, Israel

Israel Aerospace Industries (IAI) is a prominent state-owned defense and aerospace company in Israel. It is a worldwide leader in the creation, production, and assistance of a variety of systems, including unmanned aerial systems (UAS), commonly known as drones. IAI is a provider of systems-of-systems, which means it creates both the drone hardware and the advanced software that oversees and manages its complete operation. IAI's drone software is specifically designed for military and security uses, facilitating intricate operations that demand a significant level of autonomy, data integration, and secure communication. Their software is a crucial differentiator for their UAS offerings, enabling them to execute a variety of functions from intelligence collection to target engagement. The software is created to convert unprocessed sensor data into usable insights. It employs algorithms and automation to process and merge data from various sources, delivering an extensive and up-to-the-minute overview for intelligence, surveillance, target acquisition, and reconnaissance (ISTAR) operations.

5. Gulfstream Aerospace Corporation

Headquarters: Georgia, USA

Gulfstream Aerospace Corporation is a prominent U.S. aerospace producer that creates, develops, produces, and services business jet planes. It is a fully-owned subsidiary of General Dynamics. Gulfstream stands as a worldwide frontrunner in business aviation, recognized for its ultra-long-range aircraft such as the G650, G700, and G800. The organization emphasizes efficiency, security, and a luxurious cabin atmosphere. The cockpit of Gulfstream planes, including the Symmetry Flight Deck, is state-of-the-art and utilizes sophisticated software created by avionics collaborators like Honeywell. This program oversees flight controls, navigation, and additional essential systems. Gulfstream's aircraft are equipped with advanced CMS that enable passengers to manage the cabin atmosphere, such as lighting, temperature, entertainment, and window shades, using applications on their personal devices.

Are you ready to discover more about the special mission aircraft market?

The report provides an in-depth analysis of the leading companies operating in the global special mission aircraft market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- The Boeing Company

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Lockheed Martin

- Dassault Aviation SA

- Textron Aviation Inc.

- Northrop Grumman Corporation

- General Dynamics Corporation

- Butler National Corporation

- General Atomics Aeronautical Systems Inc.

- Israel Aerospace Industries Ltd.

- L Harris Technologies Inc.

- Ruag International Holding AG

- Gulfstream Aerospace Corporation

- Elbit Systems Ltd.

- Bombardier Inc.

- Pilatus Aircraft Ltd

- Others

Conclusion

The market for special mission aircraft is projected to experience significant growth by 2035, with worldwide revenues more than doubling as military, security, and civilian organizations seek enhanced surveillance, ISR, and versatile platforms. This vibrant industry is supported by key players—such as Boeing, Lockheed Martin, Northrop Grumman, Dassault Aviation, Textron Aviation, General Dynamics, Bombardier, Gulfstream, Pilatus, Elbit Systems, Israel Aerospace Industries, General Atomics, L3Harris Technologies, Ruag International, and Embraer—who are adept at implementing advanced avionics, AI-based automation, modular payloads, and quick UAS integration for various missions. North America dominates the global market share, supported by cutting-edge R&D, defense expenditures, and fleet upgrades, whereas Asia-Pacific experiences the quickest growth, propelled by emerging security needs, border surveillance, and rising technological autonomy.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?