Discover Top 100 Companies in Duty-Free Retail Market: Global Share, Market Size, Revenue Report (2024–2035)

RELEASE DATE: Oct 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

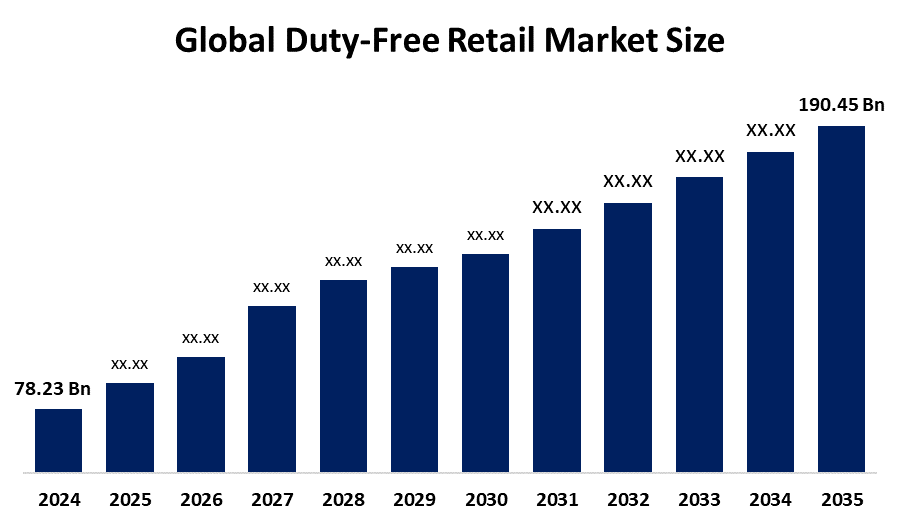

According to a research report published by Spherical Insights & Consulting, The Global Duty-Free Retail Market Size is projected to Grow from USD 78.23 Billion in 2024 to USD 190.45 Billion by 2035, at a CAGR of 8.42% during the forecast period of 2025–2035. The market is driven by rebounding international passenger volumes, a shift toward premiumization that drives up average transaction values, and operators' quick adoption of omnichannel services that track spending before, during, and after the trip

Introduction

Retail establishments that sell items to foreign customers without imposing local import taxes or charges are known as duty-free retail. They can be found at border crossings, seaports, airports, and on foreign flights or cruises. Unique products like luxury goods, limited-edition fragrances, specialty electronics, and high-end fashion accessories are available at duty-free stores.

One of the top duty-free retailers in the world, LAREDO, Texas, is pleased to announce the official opening of its worldwide online marketplace in June 2025. This will provide consumers and wholesale purchasers with never-before-seen access to duty-free goods from all over the world. Exclusive brand partnerships are introduced by duty-free stores in Korea in an effort to increase sales and draw VIPs. In September 2025, PIF announced the launch of the first Saudi-owned duty-free operator, Al Waha Duty-Free Company (Al Waha), a travel store. PIF-owned Al Waha will rise to prominence in the travel retail industry and increase its portion of passenger spending for the Saudi economy. In May 2025, in Mumbai, Ospree Duty Free opened the country's first in-lounge duty-free store.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions. The increased propensity for online shopping and rising internet penetration worldwide are likely to fuel significant growth in the online stores/e-commerce market in the upcoming years.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Duty-Free Retail Market.

Duty-Free Retail Market Size & Statistics

- The Market Size for duty-free retail was estimated to be worth USD 78.23 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 8.42% between 2025 and 2035.

- The Global Duty-Free Retail Market Size is anticipated to reach USD 190.45 Billion by 2035.

- Asia Pacific is expected to generate the highest demand during the forecast period in the Duty-Free Retail Market

- North America is expected to grow the fastest during the forecast period in the Duty-Free Retail Market.

Regional growth and demand

Asia Pacific is expected to grow the largest during the forecast period in the Duty-Free Retail Market.

In 2024, the Asia-Pacific region accounted for a dominant 53.60% of all travel. While Japan and Korea concentrate on sophisticated merchandising to sustain spending per capita, India and Southeast Asian countries increase passenger volume through new terminals and growing disposable incomes. spurred by the growing middle-class population's wealth, which is growing the duty-free market. The market's growth is shaped by regulatory regulations and collaborations among airports, merchants, and global brands. These partnerships optimize product offers and regulatory conditions.

North America is expected to generate the fastest demand during the forecast period in the duty-free retail market.

Developments in technology, the broad use of exclusive goods, and the prominence of major duty-free solution suppliers are what propel North America. A sizeable amount of the market is held by the United States, thanks to investments in upscale shopping and unique product offers in sectors like seaports and airports.

Top 10 Trends in the Duty-Free Retail Market

- Technological Advancement to provide growth opportunities for market players.

- Expansion of Offshore Duty-Free Zones and Free-Trade Islands Boosting Shopper Footfall

- Airport Privatization and Non-Aeronautical revenue Focus Expanding Retail Floor Plates.

- Recovery of long-haul Leisure Travel Reviving Fragrance and beauty spend.

- Rise of Omnichannel Pre-order/Click and collect: Elevating Conversion Rates.

- Strategic Airport Expansions and Renovations

- Rising Disposable incomes and preference for premium products

- Rebounding International Travel

- Growing focus on Brand collaboration

- Luxury and Premium Goods demand

1. Technological Advancement to provide growth opportunities for market players

Key industry players use artificial intelligence and big data to enhance personalization and the customer shopping experience at stores. For instance, in March 2023, Lotte Duty Free, a South Korea-based travel retail company, announced plans to unveil its hyper-personalized marketing strategy using artificial intelligence and big data.

2. Expansion of Offshore Duty-Free Zones and Free-Trade Islands Boosting Shopper Footfall

Customers were able to interact with companies more thoroughly and make higher-value purchases as a result of the extended shopping hours, which also relieved the strain of flight-connection scheduling. A similar tactic was used by Saudi Arabia's Public Investment Fund, which established a state-owned duty-free business that is anticipated to act as a foundation for the creation of future free-trade zones.

3. Airport Privatization and Non-Aeronautical revenue Focus Expanding Retail Floor Plates.

According to Dubai Airports' "Al Maktoum International Expansion Overview 2024" zawya.com, this development shows a strategic approach to increasing the airport's total profitability by utilizing high-value retail spaces. An important change in balancing the financial interests of airports and shops is the implementation of the single-till model, which combines aeronautical and retail revenue.

4. Recovery of long-haul Leisure Travel Reviving Fragrance and beauty spend.

This expansion shows how firms have strategically adapted to changing consumer tastes, especially by launching product lines that are only available for travel. In order to appeal to affluent customers, Dufry took advantage of this premiumization trend by opening haute-parfumerie counters with scents that cost up to USD 800.

5. Rise of Omnichannel Pre-order/Click and collect: Elevating Conversion Rates

The reserve-and-collect concept provides a convenient pre-travel shopping experience by allowing travelers to secure items up to 30 days before their departure. Through programs like Dufry's Red program and Gatwick's World Duty Free, this strategy has been successfully expanded globally, demonstrating its market adaptability.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Duty-Free Retail Market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 15 Companies Leading the Duty-Free Retail Market

- Avolta

- DFS Group

- Gebr. Heinemann SE& Co. KG

- Lagardere Group

- Dubai Duty Free

- China Duty Free

- Lotte Duty Free

- Shilla Duty Free

- Shinsegae Duty Free Inc.

- Duty Free Americas

- Ever Rich Duty Free Shop

- James Richardson Group

- King Power Group

- Lotte Corp.

- Mumbai Duty Free

- Qatar Airways Group

- Hyundai Department Store group

- Flemingo International

- Delhi Duty Free Services Pvt. Ltd

- Aer Rianta International

- Others

1. Avolta

Headquarters: Basel, Switzerland

Avolta is headquartered in Basel, Switzerland. It is a Swiss-based travel retailer that operates duty-free and duty-paid shops and convenience stores in airports, cruise lines, seaports, railway stations, and central tourist areas. The company has almost 75000 people and operates in over 75 countries worldwide. The company’s retail brands are Hudson, World Duty Free, Autogrill, etc. In 2023, the Name changed to Avolta AG after buying the Italian-based restaurant chain Autogrill.

2. DFS Group

Headquarters: Hong Kong, China

DFS Group headquarters in Hong Kong, China. It is a global travel retailer of luxury products based in Hong Kong. Its global network includes outlets with over 750 brands spread throughout major international airports and downtown areas. DFS's departure from Oceania was announced in July 2025 as part of a restructure. The branding for DFS's mid- to large-sized stores that are not found in airports is T Galleria.

3. Gebr. Heinemann SE& Co. KG

Headquarters: Hamburg, Germany

Gebr. Heinemann SE & Co. KG, headquarters in Hamburg, Germany. It is a Hamburg-based distributor and retailer in the international travel market. This travel company was started in 1879 as a ship chandler in Hamburg. Today’s Heinemann is a globally positioned group of companies. It also represented the subsidiaries, affiliates, and partnerships. It’s a human-centric company in the global travel retail. Heinemann also includes special sales in diplomatic missions, military stores, and free trade zones.

4. Lagardere Group

Headquarters: Paris, France

Lagardere Travel Retail is headquartered in Paris, France, and is an international group with operations in over 40 countries. Lagardere Travel Retail is proud to announce the launch of new duty-free and dining operations at two airports in the Kingdom of Saudi Arabia, reinforcing its commitment to delivering a world-class travel experience. Lagardere Publishing, operating mainly under the Hachette Livre Imprint, is the world's third largest consumer publishing group in the Trade and Education Markets. It brings together more than 200 publishing brands and releases over 15000 new titles each year in a dozen languages, mainly in French, English, and Spanish.

5. Dubai Duty Free

Headquarters: Dubai

Dubai Duty Free, now in its 41 year of operations, has grown into one of the biggest single travel retail operators in the world. Employing over 6000 people, the operation has consistently raised the benchmark for airport retailing, and it continues to grow. DDF is the company responsible for the duty-free selling operations at Dubai International Airport and Al Maktoum International Airport. DDF is a subsidiary of the government-owned Investment Corporation of Dubai.

Are you ready to discover more about the Duty-Free Retail Market?

The report provides an in-depth analysis of the leading companies operating in the Duty-Free Retail Market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

1. Avolta

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

2. DFS Group

3. Gebr. Heinemann SE& Co. KG

4. Lagardere Group

5. Dubai Duty Free

6. China Duty Free

7. Lotte Duty Free

8. Shilla Duty Free

9. Shinsegae Duty Free Inc.

10. Duty Free Americas

11. Ever Rich Duty Free Shop

12. James Richardson Group

13. King Power Group

14. Lotte Corp.

15. Mumbai Duty Free

16. Qatar Airways Group

17. Hyundai Department Store group

18. Flemingo International

19. Delhi Duty Free Services Pvt. Ltd

20. Aer Rianta International

21. Others

Conclusion

The Duty-Free Retail Market is driven by the rebound in foreign travel, the growing demand for high-end goods by consumers, and the use of omnichannel tactics by merchants to improve customer satisfaction and collect revenue from many touchpoints. In the Asia-Pacific area, exclusive brand alliances have been introduced, retailers have launched global online marketplaces, and new Saudi-owned duty-free operators and in-lounge duty-free outlets have been established in India. Asia Pacific holds the largest growing market, and North America is the fastest growing market in duty-free retail market.

Browse Related Reports:

Global Data Center Chip Market Size to worth USD 41.5 Billion by 2033: Market Statistics Report

Global Betavoltaic Device Market Size to worth USD 547.5 Million by 2033: Market Insight Repor

Global Interdental Cleaning Products Market Size To Exceed USD 2.15 Billion By 2033: Industry Report

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?