Discover Top 10 Commercial Real Estate Market Companies Driving Innovation and Market Growth: Report 2024-2035

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

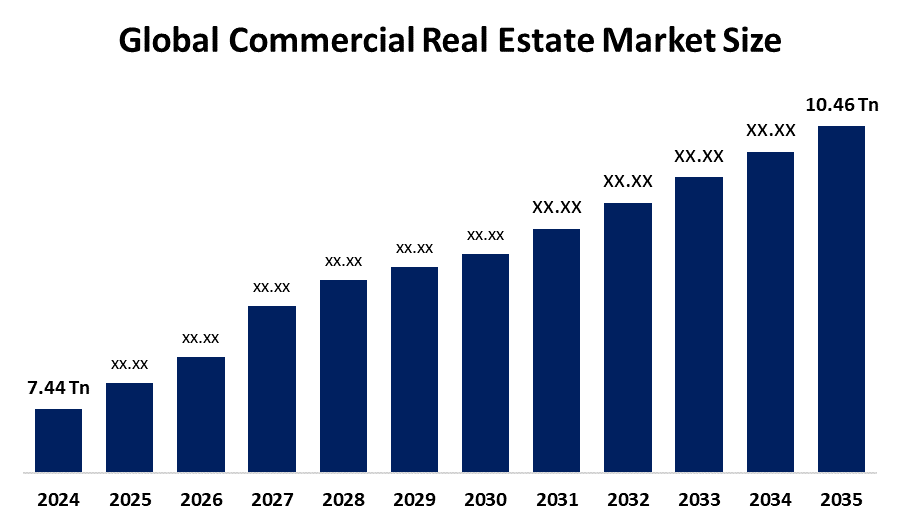

According to a research report published by Spherical Insights & Consulting, The Global Commercial Real Estate Market Size is projected To Grow from USD 7.44 Trillion in 2024 to USD 10.46 Trillion by 2035, at a CAGR of 3.15% during the forecast period 2025-2035. The commercial real estate market is increasingly driven by the rise of secondary cities, where strategic investments in smart infrastructure and digital connectivity are transforming once-overlooked areas into thriving business hubs.

Introduction

The global commercial real estate market includes properties used for business activities such as offices, retail centers, industrial warehouses, and hotels. It is a crucial part of the economy, supporting commerce and investment worldwide. Growth is driven by urbanization, increasing corporate expansions, and the rising demand for logistics and e-commerce facilities. Governments play a key role by promoting CRE through infrastructure development, tax incentives, and regulatory reforms that attract foreign investment and stimulate economic growth. Initiatives like special economic zones and public-private partnerships further encourage commercial real estate projects. Technological advancements, including smart building systems and sustainable construction, are shaping the market to meet modern business needs and environmental standards. Overall, the CRE sector remains essential for economic development, adapting continuously to evolving market trends and government policies across regions, ensuring its ongoing relevance and expansion globally.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights- Download The Brochure now and dive deeper into the future of the Commercial Real Estate Market.

Commercial Real Estate Market Size & Statistics

- The Market Size for Commercial Real Estate Market Was Estimated to be worth USD 7.44 Trillion in 2024.

- The Market Size is Going to Expand at a CAGR of 3.15% between 2025 and 2035.

- The Global Commercial Real Estate Market Size is anticipated to reach USD 10.46 Trillion by 2035.

- Asia Pacific is anticipated to hold the largest share of the global commercial real estate market over the predicted timeframe.

- North America is expected to grow the fastest during the forecast period in the global commercial Real Estate Market.

Regional growth and demand

Asia Pacific is anticipated to hold the largest share of the global commercial real estate market over the predicted timeframe. The region benefits from strong economic growth, expanding middle-class populations, and government initiatives to attract foreign direct investment (FDI), all of which contribute to increased commercial real estate activity. Additionally, the rise of e-commerce, smart city projects, and large-scale logistics developments are further fueling demand for commercial spaces.

North America is expected to grow the fastest during the forecast period in the global commercial real estate market. The region’s strong economic fundamentals, coupled with a rebound in business activity post-pandemic, are contributing to increased investments in office spaces, industrial properties, data centers, and mixed-use developments. Additionally, sustainability trends and the adoption of smart building technologies are reshaping the commercial real estate landscape in the U.S. and Canada, encouraging both domestic and foreign investment.

Top 10 trends in the Commercial Real Estate Market

- Rise of hybrid work and flexible office spaces

- E-commerce driving industrial and logistics demand

- Sustainability and ESG integration

- Technology and smart building integration

- Growth of mixed-use developments

- Expansion of data centers and life sciences facilities

- Increased institutional investment and global capital inflows

- Geographic diversification and rise of secondary cities

- Adaptive reuse and redevelopment of properties

- Interest rate volatility and financing challenges

1. Rise of hybrid work and flexible office spaces

The widespread adoption of hybrid and remote work models has reduced the demand for traditional office leases. Companies are seeking flexible workspace solutions to accommodate fluctuating headcounts and changing employee preferences. As a result, co-working spaces and short-term leasing models are gaining traction. Landlords are redesigning office spaces to include collaborative areas and wellness features. This trend is reshaping how office buildings are designed, leased, and utilized.

2. E-Commerce Driving Industrial and Logistics Demand

The growth of e-commerce is fueling unprecedented demand for warehouses and distribution centers. Retailers and logistics companies are investing heavily in last-mile delivery hubs to ensure fast shipping times. Urban logistics facilities near city centers are especially in demand. This has made industrial real estate one of the top-performing CRE sectors. Developers are responding by building vertically and using automation to optimize space.

3. Sustainability and ESG Integration

Environmental, Social, and Governance (ESG) criteria are becoming essential in CRE development and investment. Tenants and investors now prefer energy-efficient buildings with green certifications like LEED or WELL. Governments are also imposing stricter sustainability regulations. Sustainable design, waste reduction, and carbon-neutral goals are driving how buildings are planned and operated. ESG compliance is now a key factor in property valuation and investment appeal.

4. Technology and Smart Building Integration

Commercial properties are increasingly integrating smart technologies such as IoT sensors, AI systems, and automation tools. These enhance operational efficiency, tenant comfort, and energy management. Predictive maintenance, real-time occupancy tracking, and touchless access are becoming standard. PropTech (property technology) startups are driving innovation in CRE. Smart buildings are also more attractive to tech-savvy tenants and investors.

5. Growth of Mixed-Use Developments

Developers are focusing on mixed-use projects that combine residential, commercial, retail, and entertainment spaces in one location. These developments promote walkability, reduce commute times, and create vibrant communities. Urban areas are especially seeing a surge in such integrated projects. They offer convenience for residents and a steady footfall for businesses. Mixed-use spaces are also more resilient to market fluctuations, as they cater to diverse needs.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the warehouse management system market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Commercial Real Estate Market

- CBRE Group

- JLL (Jones Lang LaSalle)

- Cushman & Wakefield

- Colliers International

- Newmark

- NAI Global

- Avison Young

- Lee & Associates

- TCN Worldwide

- SVN International

- Marcus & Millichap

- Transwestern

- Savills

- Knight Frank

- Eastdil Secured

- Blackstone

- Brookfield Asset Management

- Prologis

- MetLife Investment Management

- PIMCO

- PGIM Real Estate

- UBS Asset Management

- CBRE Investment Management

- ESR

- Nuveen Real Estate

1. CBRE Group

Headquarters: Los Angeles, California, USA

Blue Yonder is a top innovator in warehouse management systems, recognized for its AI-powered platform that increases productivity and operational resilience. Its Warehouse Management solution streamlines every function, from inventory control to outbound logistics, providing 100% inventory visibility, faster throughput, and significant reductions in storage and handling costs. Blue Yonder leverages advanced analytics and decades of supply chain expertise to deliver scalable, cloud-native solutions for complex enterprise operations. Retailers, manufacturers, and 3PLs trust Blue Yonder to support automation, optimize labor, and improve decision-making, all aligning with leading WMS market trends like automation, predictive analytics, and sustainability.

2. JLL (Jones Lang LaSalle)

Headquarters: Chicago, Illinois, USA

JLL is a leading professional services firm specializing in real estate and investment management. The company provides integrated real estate solutions, including advisory, leasing, property management, and capital markets services. JLL is recognized for its commitment to sustainability and smart building technologies, helping clients improve operational efficiency and reduce carbon footprints. Its global presence spans major markets, supporting institutional investors and occupiers alike.

3. Cushman & Wakefield

Headquarters: Chicago, Illinois, USA

Cushman & Wakefield is a global leader in commercial real estate services, offering expertise in brokerage, property management, valuation, and consulting. The firm emphasizes innovation and data-driven insights to enhance asset value and tenant experiences. Cushman & Wakefield’s services cover a broad spectrum of property types including office, retail, industrial, and multifamily. The company is also heavily involved in ESG initiatives and smart building practices.

4. Colliers International

Headquarters: Toronto, Ontario, Canada

Colliers International is a global real estate services and investment management company known for its entrepreneurial culture and client-centric approach. It offers brokerage, property management, project management, and capital markets advisory. Colliers focuses on leveraging technology and market intelligence to deliver tailored solutions. The company’s broad expertise spans office, industrial, retail, and specialized sectors like healthcare and data centers.

5. Newmark

Headquarters: New York City, New York, USA

Newmark is a leading commercial real estate advisory firm offering a full spectrum of services including leasing, capital markets, valuation, and property management. The firm emphasizes innovation and technology to improve client outcomes, leveraging proprietary platforms to enhance market research and transaction efficiency. Newmark serves a diverse client base including occupiers, investors, and developers, with a focus on major urban markets worldwide.

Are you ready to discover more about the Commercial Real Estate Market?

The report provides an in-depth analysis of the leading companies operating in the global commercial real estate market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- CBRE Group

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- JLL (Jones Lang LaSalle)

- Cushman & Wakefield

- Colliers International

- Newmark

- NAI Global

- Avison Young

- Lee & Associates

- TCN Worldwide

- SVN International

- Others

Conclusion

The commercial real estate market is shaped and driven by major global players who combine extensive market expertise with innovative technologies and sustainable practices. Leading firms like CBRE, JLL, Cushman & Wakefield, Colliers International, and Newmark set industry standards by delivering comprehensive services that address evolving client needs across diverse sectors. Their global presence, commitment to ESG principles, and integration of PropTech solutions position them at the forefront of the dynamic and rapidly changing commercial real estate landscape. As the market continues to evolve, these companies will remain key influencers in shaping its future growth and innovation.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?