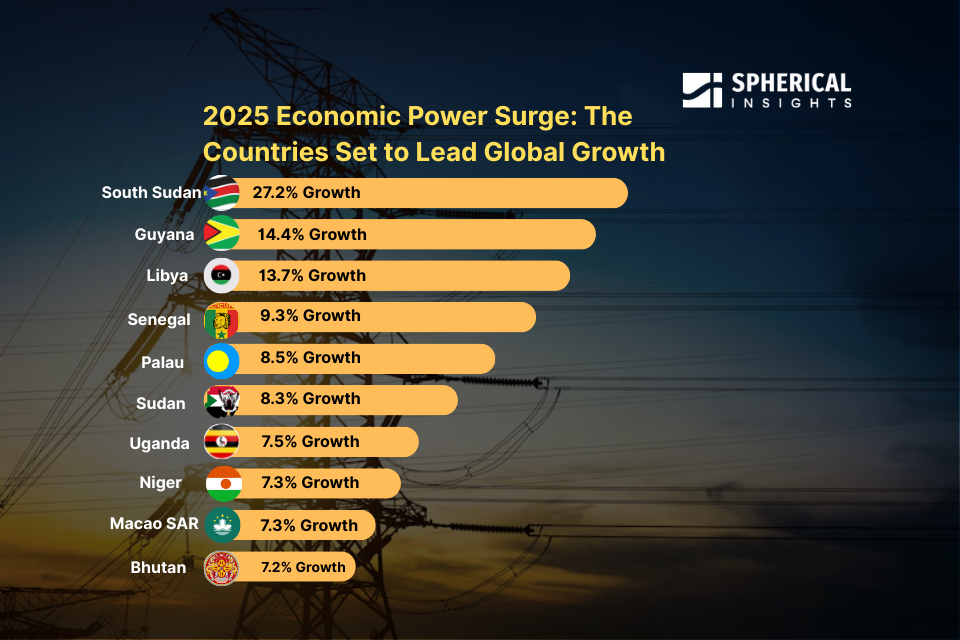

2025 Economic Power Surge: The Countries Set to Lead Global Growth

RELEASE DATE: May 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Top Growth Rate Countries in 2025: Overview

In the Financial and Economic Research Market, accurate and forward-looking insights are critical for guiding investment, policy, and business decisions. As global economies recalibrate post-pandemic, identifying high-growth nations becomes essential for stakeholders across finance, government, and industry. This blog provides an in-depth analysis of the world’s fastest-growing economies in 2025, based on data from leading financial institutions. By highlighting key drivers such as energy, infrastructure, and reform initiatives, this content offers valuable intelligence for economic analysts, investors, and policymakers seeking to capitalize on emerging trends and forecast shifts in the global economic landscape. As the global economy navigates post-pandemic recovery, certain nations are poised to lead with remarkable growth trajectories. Based on the latest projections from the International Monetary Fund (IMF) and the World Bank, here are the top 10 fastest-growing economies in 2025.

Top Growth Rate Countries in 2025: Statitsics & Facts

1. South Sudan – 27.2% Growth

In 2025, South Sudan is projected to lead global economic growth with an astonishing 27.2% increase in GDP. This forecast marks a significant turnaround for a nation long plagued by civil conflict, economic instability, and humanitarian crises. Central to this resurgence is the revival of South Sudan’s oil industry, which accounts for over 90% of government revenue and exports. Peace agreements and international diplomatic efforts have helped create a relatively more stable political climate, allowing for oil production to ramp up and new investment to flow in. Beyond oil, South Sudan is beginning to attract attention for its potential in agriculture, infrastructure, and renewable energy. International donors and development banks are supporting projects that aim to improve road networks, power generation, and access to basic services such as healthcare and education. The government is also attempting to implement structural reforms, strengthen fiscal governance, and create a more investment-friendly environment. However, the country remains at risk of political relapse, corruption, and limited institutional capacity. Continued peace and international cooperation can be essential to turning short-term economic gains into long-term sustainable development. If successful, South Sudan could set a precedent for post-conflict economic recovery across Africa.

2. Guyana – 14.4% Growth

Guyana is on track to maintain its status as one of the world’s most rapidly expanding economies, with a projected GDP growth of 14.4% in 2025. This growth continues the momentum generated by the discovery of vast offshore oil reserves, which have transformed the small South American nation into a global energy hotspot. ExxonMobil and its partners have led oil production projects that are now bringing in billions in revenue. As a result, government income has surged, enabling major investments in infrastructure, healthcare, education, and public services. Guyana’s strategy is not solely reliant on oil. The government is actively working to diversify the economy to avoid overdependence on hydrocarbons. Key sectors targeted include agriculture, tourism, renewable energy, and information technology. With a population of fewer than one million, Guyana is positioned to achieve one of the highest per capita growth rates globally. However, the nation faces challenges in managing its resource windfall. Ensuring transparency, curbing corruption, and maintaining sound macroeconomic policies will be essential for long-term prosperity.

3. Libya – 13.7% Growth

Libya is projected to post a robust 13.7% GDP growth in 2025, driven primarily by the recovery and expansion of its oil industry. As home to Africa’s largest proven oil reserves, the nation’s economic outlook remains heavily tied to the global energy market and its internal political landscape. After years of civil war and instability following the fall of the Gaddafi regime, Libya is slowly stabilizing through ongoing peace efforts and a transitional government backed by international partners. The resumption of oil exports, restoration of production facilities, and rehabilitation of critical infrastructure are expected to fuel economic momentum. Increased foreign investment in the energy, construction, and telecommunications sectors is also contributing to GDP gains. Additionally, Libya’s geographic location offers strategic potential as a trade and energy hub between Europe, Africa, and the Middle East. Despite its growth prospects, Libya’s recovery is fragile. The political situation remains fluid, and institutional capacity is weak. Long-term development depends on achieving political reconciliation, establishing the rule of law, and diversifying the economy beyond oil.

4. Senegal – 9.3% Growth

Senegal is forecast to achieve an impressive 9.3% GDP growth in 2025, making it one of the fastest-growing economies in West Africa. This growth is being propelled by major developments in energy, agriculture, telecommunications, and infrastructure. Key to this economic surge is the commencement of oil and gas production from offshore reserves discovered in recent years, which are expected to transform Senegal into a significant hydrocarbon producer. Beyond natural resources, the government’s Plan for an Emerging Senegal (PSE) continues to attract international investment in transport, logistics, education, and health. Massive infrastructure projects like the Blaise Diagne International Airport, the Dakar Regional Express Train, and expanded port facilities in Dakar are improving connectivity and regional trade. Senegal also benefits from a stable democratic political system, a growing middle class, and a vibrant entrepreneurial culture. Digital transformation and fintech adoption are creating opportunities in the services sector, while agricultural modernization is improving food security and rural livelihoods.

5. Palau – 8.5% Growth

Palau, a Pacific Island nation with a population of around 18,000, is projected to grow by 8.5% in 2025. This remarkable rebound reflects the country’s recovery from the deep economic contractions caused by the COVID-19 pandemic, which devastated its tourism-dependent economy. With international borders open again, tourist arrivals, particularly from Japan, Taiwan, and the United States, are increasing steadily, reviving the hotel, transport, and service industries. In addition to tourism, Palau’s economy is supported by international aid, especially from the United States under the Compact of Free Association. This funding is being directed toward infrastructure improvements, healthcare, and climate adaptation projects. Palau is also prioritizing environmental sustainability, with a strong focus on marine conservation, renewable energy, and eco-tourism. The government is working on economic diversification by exploring opportunities in digital technology and the “blue economy,” which includes sustainable fishing and marine biodiversity projects. Despite its small scale, Palau is often recognized for its leadership in environmental diplomacy and resilience-building. Risks remain, including external shocks from climate change and global market volatility.

6. Sudan – 8.3% Growth

Sudan is expected to record a GDP growth rate of 8.3% in 2025, signaling a strong economic rebound after years of political instability, conflict, and isolation. The country is undergoing significant economic reforms under the guidance of international institutions such as the International Monetary Fund (IMF) and the World Bank. These reforms aim to curb inflation, stabilize the currency, reduce subsidies, and attract foreign investment. Key sectors contributing to Sudan’s growth include agriculture, gold mining, and infrastructure development. Sudan is Africa’s third-largest gold producer, and recent initiatives to regulate artisanal mining and improve transparency are beginning to pay off. Meanwhile, agricultural reforms are improving productivity and food security, with focus on irrigation and export-oriented crops. Sudan’s reintegration into the global economy, following its removal from the U.S. list of state sponsors of terrorism, has opened new avenues for trade and international aid. Major debt relief agreements have also reduced the country’s financial burden, enabling it to reallocate resources toward development.

7. Uganda – 7.5% Growth

Uganda is projected to achieve a robust 7.5% GDP growth in 2025, driven by its emerging oil industry, large-scale infrastructure investments, and a dynamic services sector. A key milestone is the development of the East African Crude Oil Pipeline (EACOP) and related oil production infrastructure in the Albertine Graben. These projects are expected to create thousands of jobs, increase export revenues, and attract substantial foreign direct investment. The government has also prioritized upgrading roads, energy facilities, and transport networks, which is improving domestic connectivity and regional trade. The services sector particularly ICT, financial services, and tourism continues to expand, bolstered by digital transformation initiatives and a youthful, tech-savvy population. Uganda’s demographics offer a long-term advantage, with a median age of just 16. However, this also creates pressure on job creation, education, and healthcare systems. Reforms to improve the business climate, such as streamlined licensing and tax incentives, are enhancing the country’s appeal to investors.

8. Niger – 7.3% Growth

Niger is forecast to achieve a GDP growth of 7.3% in 2025, reflecting its rising economic potential despite persistent challenges such as security threats and infrastructure deficits. The country’s economy is primarily supported by agriculture, mining, and energy, with notable reserves of uranium and oil that are increasingly attracting foreign investment. Recent projects in oil refining and transportation are enhancing Niger’s export capacity and domestic energy independence. In agriculture, which uses the majority of the population, government and international donor programs are focused on improving irrigation, food security, and climate resilience. Meanwhile, investments in solar energy and rural electrification projects are gradually reducing energy poverty and fostering development in remote areas. Niger benefits from its membership in the West African Economic and Monetary Union (WAEMU), which provides macroeconomic stability, access to regional markets, and support from the Central Bank of West African States (BCEAO). Continued improvements in regional integration and trade facilitation are helping drive growth.

9. Macao SAR – 7.3% Growth

Macao Special Administrative Region (SAR) of China is projected to register a strong 7.3% GDP growth in 2025, continuing its post-pandemic recovery. The region’s economy, heavily dependent on tourism and gaming, is rebounding as international travel resumes and visitor numbers from mainland China and beyond return to pre-COVID levels. The reopening of borders and relaxation of restrictions have significantly boosted revenues in the hospitality, entertainment, and retail sectors. While the gaming industry remains Macao’s primary economic engine, contributing more than 50% of GDP, the government is actively pursuing diversification. New policies aim to strengthen financial services, technology innovation, MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism, and cultural industries. Macao’s integration into China’s Greater Bay Area initiative further supports long-term economic prospects by improving connectivity with regional hubs like Hong Kong and Shenzhen. Despite its recovery, Macao faces structural challenges, including overreliance on gambling, a narrow economic base, and limited land resources. Diversification and workforce upskilling are therefore central to its strategic plans.

10. Bhutan – 7.2% Growth

Bhutan is projected to grow by 7.2% in 2025, reflecting a strong rebound led by hydropower exports, tourism, and a resilient development model rooted in sustainability. As a landlocked Himalayan kingdom, Bhutan’s economy is small but stable, supported by decades of hydropower cooperation with India, its largest trading partner. Hydropower remains the backbone of the economy, generating both electricity and export revenue. Tourism, which was severely impacted by the COVID-19 pandemic, is recovering due to Bhutan’s unique “High Value, Low Volume” tourism strategy. This model prioritizes environmental preservation and cultural integrity while ensuring economic benefit through high-end tourism services. As international travelers return, the hospitality and transportation sectors are seeing renewed growth. Bhutan’s approach to development, centered around Gross National Happiness (GNH) rather than purely GDP continues to attract global attention. The government is investing in digital transformation, education, healthcare, and green technology. International donors and financial institutions are supporting projects in climate resilience, sustainable agriculture, and infrastructure.

Comparative Table: Key Economic Indicators

|

Country |

Projected GDP Growth (%) |

Main Growth Drivers |

|

South Sudan |

27.2 |

Oil exports, post-conflict recovery |

|

Guyana |

14.4 |

Offshore oil production |

|

Libya |

13.7 |

Oil industry revitalization |

|

Senegal |

9.3 |

Energy, agriculture, infrastructure |

|

Palau |

8.5 |

Tourism, foreign aid |

|

Sudan |

8.3 |

Economic reforms, debt relief |

|

Uganda |

7.5 |

Oil production, infrastructure |

|

Niger |

7.3 |

Agriculture, mining, energy |

|

Macao SAR |

7.3 |

Tourism, gaming industry |

|

Bhutan |

7.2 |

Hydropower exports, tourism |

Several other countries are also exhibiting strong economic growth in 2025:

- India: Projected to grow by 6.5%, driven by a young population, technological advancements, and manufacturing investments.

- Ethiopia: Expected growth of 6.7%, supported by structural reforms and international aid.

- Rwanda: Anticipated growth of 6.9%, focusing on services and infrastructure development.

- Saudi Arabia: Forecasted to grow by 4.7%, leveraging oil revenues and economic diversification efforts.

- China: Projected growth of 4.5%, with a focus on domestic consumption and technological innovation.

- Egypt: Expected to grow by 4.2%, driven by infrastructure projects and economic reforms.

- Japan: Anticipated growth of 1.1%, focusing on technological advancements and export-oriented industries.

- Canada: Projected growth of 2.0%, supported by natural resources and a strong services sector.

- Democratic Republic of Congo (DR Congo): Expected to grow by 6.5%, leveraging mining and infrastructure development.

- Mexico: Forecasted growth of 1.6%, focusing on manufacturing and trade.

- Russia: Anticipated growth of 1.5%, driven by energy exports and domestic consumption.

- South Korea: Projected growth of 2.2%, focusing on technology and exports.

- United States of America: Expected growth of 2.7%, supported by consumer spending and technological innovation.

- Uzbekistan: Anticipated growth of 6.0%, driven by reforms and investments in various sectors.

- Bangladesh: Projected growth of 6.0%, focusing on textiles and remittances.

- Fiji: Expected growth of 7.0%, supported by tourism and infrastructure projects.

- France: Forecasted growth of 0.8%, focusing on services and industrial production.

Conclusion

The global economic landscape in 2025 showcases a dynamic shift, with emerging economies leading the charge in growth. Factors such as natural resource exploitation, structural reforms, and strategic investments are pivotal in shaping these trajectories. As these nations continue to evolve, they offer valuable insights into the future of global economic development.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?