Global Food Flavors Market Size, Share, and COVID-19 Impact Analysis, By Type (Fruit & Nut, Chocolate & Brown, Vanilla, Spices & Savory, Dairy, and Others), By Source (Natural, Artificial), By Form (Dry, Liquid & Gel), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Food & BeveragesGlobal Food Flavors Market Insights Forecasts to 2032

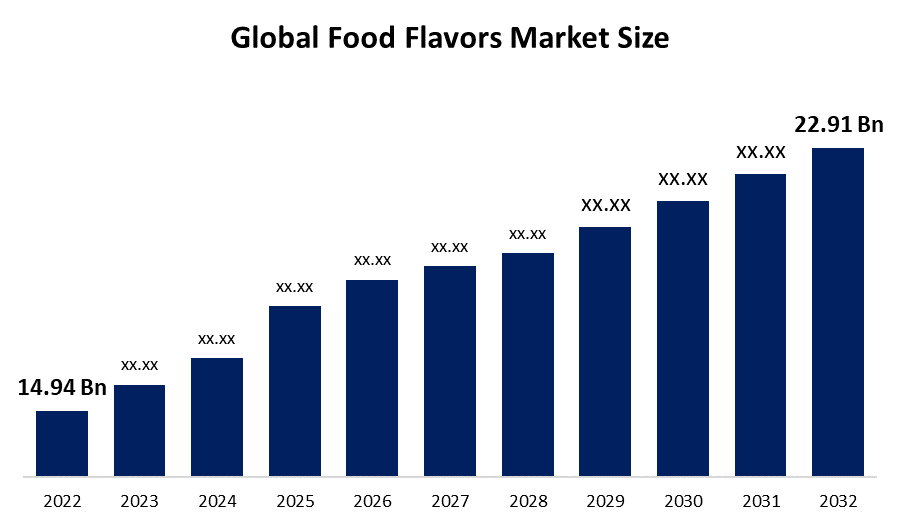

- The Global Food Flavors Market Size was valued at USD 14.94 billion in 2022

- The market is growing at a CAGR of 4.3% from 2022 to 2032

- The Worldwide Food Flavors Market size is expected to reach USD 22.91 billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Food Flavors Market Size is anticipated to reach USD 22.91 billion by 2032, at a CAGR of 4.3% during the forecast period from 2022 to 2032. The Global Food Flavors Market is expanding due to an increase in demand for ready-to-eat meals and fast food. Furthermore, innovative technologies, the development of novel flavors, and a large inflow of assets in R&D activities all contribute to the expansion of the food flavors market. Consumer preference for plant-based products and flavors is growing rapidly. This is additionally fueling the food flavors market growth.

Market Overview

Flavorings are additives that are added to foods in very small quantities to give a product a specific flavor, such as a soft drink, boiled sweet, or yogurt, or to enhance or replace the flavor lost during processing. Flavorings can be created by extracting aromatic compounds from foods or by creating new compounds to excite our taste buds. Perishable foods lose flavor over time after processing and preserving, necessitating the use of flavoring products to help maintain the flavor. Flavors are required in the food and beverage industry for a variety of reasons, including new product development, the introduction of new products, and changing the taste of existing products.

The global food flavors market is a rapidly growing industry that involves the production, sale, and distribution of various flavorings used in food and beverages. Flavors are essential components of the food industry as they enhance the taste, aroma, and appearance of food and beverages. The global food flavors market is expected to continue growing due to various factors such as increasing demand for processed and packaged food products, growing population, and changing consumer preferences. The market is also driven by factors such as innovation in flavor technology, increasing disposable income, and growth in the food service industry.

Report Coverage

This research report categorizes the market for global food flavors market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the food flavors market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the food flavors market.

Global Food Flavors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 14.94 billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 4.3% |

| 2032 Value Projection: | USD 22.91 billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Type, By Source, By Form, By Region |

| Companies covered:: | Firmenich, Givaudan, Mane, International Flavors and Fragrances, Symrise, ADM, Kerry Group, Taiyo International, T. Hasegawa USA Inc, Robertet SA, Synergy Flavors, Inc., Corbion N.V., DSM, Takasago International Corporation, Huabao Flavours & Fragrances Co., Ltd., The Flavor Factory, Besmoke Limited |

Get more details on this report -

Driving Factors

The development of new technologies, such as encapsulation and flavor mapping, is allowing manufacturers to create more complex and nuanced flavors that can be used in a wider range of applications. Consumers are increasingly seeking out unique and authentic flavors in their food and beverages. As a result, manufacturers are investing in research and development to create new and innovative flavors to meet these changing preferences. The increasing popularity of convenience foods such as ready-to-eat meals, snacks, and beverages is driving growth in the food flavors market. These products often rely heavily on flavors to enhance their taste and appeal to consumers. The increase in disposable income among consumers in emerging markets is driving demand for premium food products, including those with unique and high-quality flavors. These are the major factors which will boost the food flavors market in the coming period.

Restraining Factors

The use of food flavors is regulated by various government bodies, such as the US Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). These regulations can be complex and may require extensive testing and documentation before a flavor can be approved for use in food products.

There is increasing concern among consumers about the potential health effects of artificial flavors and additives. This has led to a growing demand for natural and organic flavors, which can limit the use of artificial flavors in certain products.

Food flavors face competition from substitute products such as herbs, spices, and other natural ingredients that can be used to enhance the taste of food. These substitutes may be cheaper or more readily available than food flavors, which can limit the market for food flavors.

Market Segmentation

The Global Food Flavors Market share is classified into type, source, and form.

- The fruit and nut segment is expected to hold the largest share of the Global Food Flavors Market during the forecast period.

Based on the type, the global food flavors market is differentiated into fruit & nut, chocolate & brown, vanilla, spices & savory, and dairy. Among these, the largest segment of the food flavor market is currently the fruit and nut segment. This segment includes flavors such as strawberry, raspberry, almond, and hazelnut, which are used in a wide range of food and beverage products. This segment is driven by increasing demand for natural and authentic fruit and nut flavors, which are perceived as healthier and more appealing to consumers.

The chocolate and the brown segment also have a significant share of the food flavor market. This segment includes flavors such as chocolate, caramel, and toffee, which are used in a wide range of bakery and confectionery products. The popularity of chocolate and other sweet flavors has driven growth in this segment, as consumers continue to seek out indulgent and satisfying treats.

- The natural segment is expected to hold the largest share of the Global Food Flavors Market over the prediction period.

Based on the source, the global food flavors market is classified into natural and artificial. Among these, the natural flavor segment holds the largest market share in the food flavor market. This is driven by increasing consumer demand for natural and organic products, as well as growing concerns about the health and environmental impacts of artificial flavors. Natural flavors are perceived as healthier and more sustainable than artificial flavors, which has driven growth in this segment.

However, the artificial flavor segment is expected to grow at the highest CAGR in the food flavor market during the study period. This segment includes flavors that are created through chemical processes, such as synthetic or nature-identical flavors. Artificial flavors are often less expensive than natural flavors, which can make them a more attractive option for manufacturers, especially in cost-sensitive markets.

- The liquid & gel segment is expected to hold the largest share of the Global Food Flavors Market over the projected period.

Based on the form, the global food flavors market is classified into dry, liquid & gel. Among these, the liquid segment holds the largest market share in the food flavor market. This is because liquid & gel flavors are versatile and can be easily incorporated into a wide range of food and beverage applications. Liquid & gel flavors can be added to everything from beverages to baked goods to processed foods, and are often preferred because they are easy to mix and distribute evenly. The dry flavor segment is also significant, particularly in applications where moisture can be an issue, such as snack foods and dry mixes. Dry flavors are typically more stable than liquid flavors and can have a longer shelf life, which can be an advantage in certain applications.

Regional Segment Analysis of the Food Flavors Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is expected to hold the largest share of the market during the projected period.

Get more details on this report -

The North American food flavor market is expected to hold the largest market share due to the high demand for convenience food products, particularly in the United States. The growth of the food and beverage industry in the region and the rising demand for natural and organic flavors are also driving market growth. The presence of a large number of food processing units in North America, as well as increased demand for convenience and functional foods influenced by the region's dynamic lifestyle and changing eating habits, provides many opportunities for expansion for the food flavors market.

The Asia-Pacific food flavor market is expected to grow rapidly due to the increasing population and rising disposable incomes in countries like China and India. The region's growing food and beverage industry and the demand for healthy and natural flavors are also driving market growth. The region's food flavor market is being driven by the food and beverage industry's high production and sales, the general public's rising purchasing power, and the growing presence of significant regional players. Furthermore, the China food flavors market had the largest market share, while the Indian food flavors market was the region's fastest-growing market.

The food flavor market in Europe is driven by the increasing demand for processed foods and beverages, particularly in Western Europe. The region's strong food and beverage industry and high consumer awareness of natural and organic flavors are also contributing to market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global food flavors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Firmenich

- Givaudan

- Mane

- International Flavors and Fragrances

- Symrise

- ADM

- Kerry Group

- Taiyo International

- T. Hasegawa USA Inc

- Robertet SA

- Synergy Flavors, Inc.

- Corbion N.V.

- DSM

- Takasago International Corporation

- Huabao Flavours & Fragrances Co., Ltd.

- The Flavor Factory

- Besmoke Limited

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Reliance Consumer Products Limited (RCPL), the FMCG arm of Reliance Retail Ventures Limited (RRVL), has announced the launch of Campa, the iconic beverage brand.

- In March 2023, ADM has introduced the Knwble Grwn brand to provide consumers with sustainably sourced, plant-based food ingredients.

- In March 2023, Firmenich has announced its 2023 Flavor of the Year, dragon fruit, celebrating consumers’ desire for exciting new ingredients and bold, adventurous flavor creation.

- In May 2022, Symega Food Ingredients Limited launched 'CUISINARY,' a range of premium quality food solutions for professional kitchens, including seasonings, sauces, coatings, and flavour enhancers, in New Delhi.

- In August 2021, Taiyo International collaborated with ITO EN, a supplier of authentic, flavorful, and highly nutritious tea, with the goal of supplying high-quality matcha to the North American food, beverage, and supplement industries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Food Flavors Market based on the below-mentioned segments:

Global Food Flavors Market, By Type

- Fruit & Nut

- Chocolate & Brown

- Vanilla

- Spices & Savory

- Dairy

Global Food Flavors Market, By Source

- Natural

- Artificial

Global Food Flavors Market, By Form

- Dry

- Liquid & Gel

Global Food Flavors Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?